Picture this: you’re standing at the entrance of a grand library, each book representing a different aspect of personal finance. Your eyes scan the shelves until they rest on one particular volume, its spine embossed with golden letters: “Credit Scores: The Key to Your Financial Future.” With curiosity piqued, you carefully open the book to a chapter titled, “What Is Considered A Fair Credit Score?”

As you begin to read, you’re transported into a world where numbers tell a story about responsibility, opportunity, and trust. The narrative unfolds, shedding light on what it means to possess a fair credit score and its significance in the grand tapestry of your financial life. We embark on this journey not as mere spectators but as participants, eager to understand the nuances of creditworthiness and its impact on our dreams and ambitions. So, turn the page with us as we unravel the mysteries of what constitutes a fair credit score, setting the stage for wise financial decisions and a brighter fiscal horizon.

Table of Contents

- Understanding the Credit Score Spectrum

- The Importance of a Fair Credit Score

- How to Identify If Your Credit Score is Fair

- Steps to Improve Your Fair Credit Score

- Q&A

- Future Outlook

Understanding the Credit Score Spectrum

In the vast landscape of credit scores, a “fair” credit score often sits somewhere between good and unfavorable credit. It’s a transitional zone that can significantly impact your financial wellbeing. But what exactly does this mean, and how does it affect your financial opportunities?

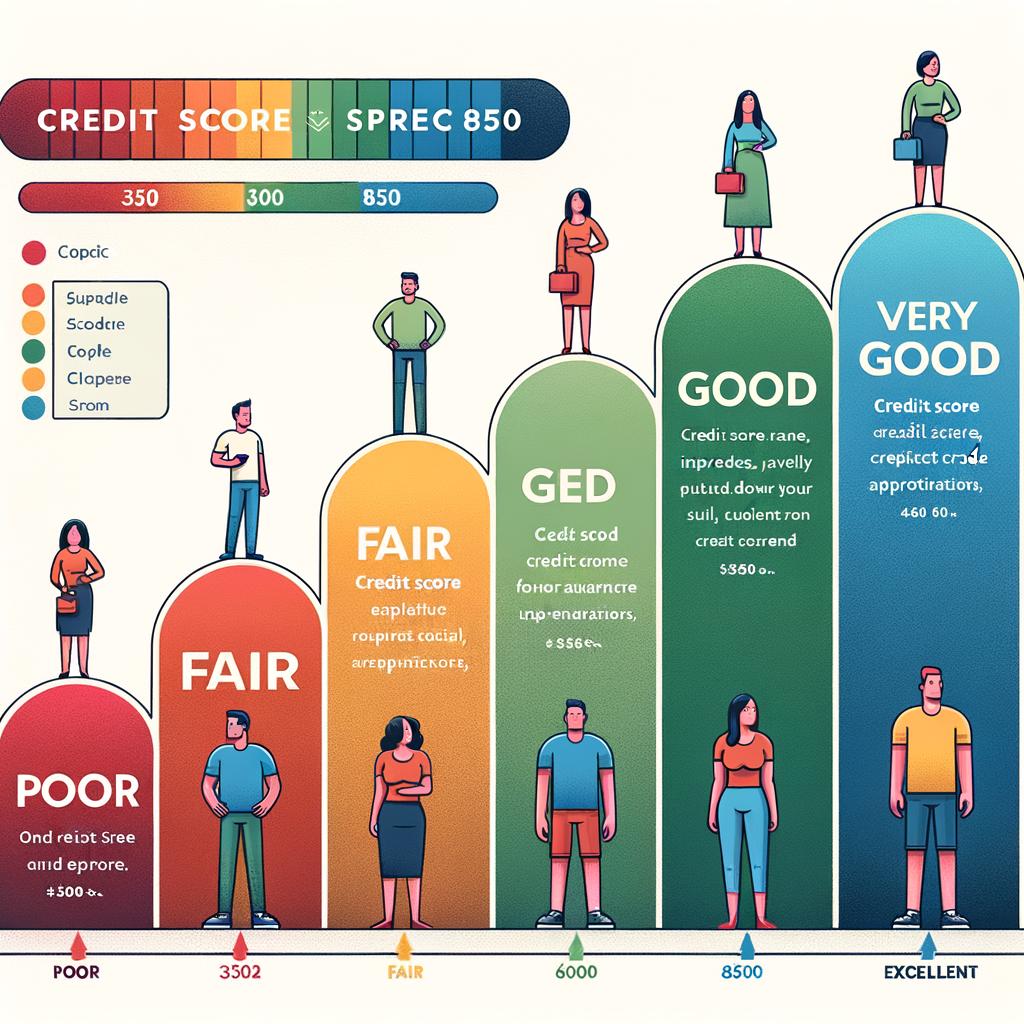

To understand this better, let’s break down the credit score spectrum. Typically, credit scores are categorized by five key ranges:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

A fair credit score, often considered to be between 580 and 669, indicates that while you have had some credit mishaps, you’re still managing to pay back most of your debts. You might not qualify for the best credit offers, but you’re not at the bottom of the barrel either.

So, why does this range exist? Credit bureaus use fair credit scores to signify a moderate level of risk. Lenders see these scores as a sign that the borrower has potential but might need a bit more scrutiny. This often translates to higher interest rates and less favorable loan terms for individuals in this category.

Here’s a quick look at how fair credit scores can impact different financial scenarios:

| Financial Aspect | Impact with Fair Credit Score |

|---|---|

| Credit Card Offers | Higher interest rates, fewer rewards |

| Loan Approval | Stringent terms, higher interest |

| Mortgage Rates | Poor rates, possible special programs |

| Insurance Premiums | Higher premiums |

Managing a fair credit score requires vigilance. Regularly checking your credit report for errors, making timely payments, and reducing your debt-to-income ratio can help you move up the spectrum. Financial institutions often look favorably on small but consistent improvements.

For those in this range, it’s crucial to take proactive steps in credit repair. Consider consolidating high-interest debt, setting up automatic payments, and keeping credit card balances low. These small actions can make a significant difference over time.

Building a better credit score from a fair range doesn’t happen overnight, but with a straightforward plan and consistent effort, you can slowly move towards a more favorable credit bracket. Remember, every financial decision you make either adds or detracts from your creditworthiness.

The journey from fair to good (and even excellent) credit involves understanding and actively managing your finances. Utilize all available resources, be it educational materials or professional advice, to guide you along this path. Your financial future will thank you.

The Importance of a Fair Credit Score

A fair credit score is more than just a number; it’s a crucial component in achieving financial stability and success. This numerical representation of your credit history can significantly impact various aspects of your life.

First and foremost, a fair credit score affects your ability to secure loans. Whether it’s for a car, a home, or education, lenders closely examine this score to determine your creditworthiness. A fair score means you might not get the best interest rates, but you’ll still have access to essential financial products.

Beyond loans, your credit score also influences the terms of your credit cards. With a fair score, you may face higher interest rates and reduced credit limits compared to those with excellent scores. It’s essential to manage credit responsibly to avoid falling into a cycle of debt.

Housing is another critical area impacted by your credit score. Many landlords and property management companies use credit scores to assess potential tenants. A fair score may not disqualify you from renting, but it could result in a more thorough background check or a higher security deposit.

Employment opportunities can also be affected. Certain employers review credit reports as part of the hiring process, especially for roles that involve financial responsibilities. While a fair score isn’t necessarily a deal-breaker, it could influence their final decision.

Key Factors Influencing Your Credit Score:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit

- Recent credit inquiries

| Credit Score | Description |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Financial emergencies are unavoidable, and a fair credit score can be incredibly beneficial in such situations. Whether it’s an unforeseen medical expense or an urgent home repair, having a fair credit score ensures you have more options and can access funds more quickly.

a fair credit score empowers you to build a foundation for future financial goals. It paves the way for improvement, allowing you to work toward a better score and, subsequently, better financial terms and opportunities.

How to Identify If Your Credit Score is Fair

Determining whether your credit score falls into the “fair” category can be a straightforward process once you know what to look for. Credit scores are typically measured on a scale from 300 to 850, with several factors influencing the final number. By examining various indicators and benchmarks, you can get a good idea of where you stand.

One of the first steps is to check the numerical range of your score. Credit scores are often categorized as follows:

- 300-499: Poor

- 500-649: Fair

- 650-749: Good

- 750-850: Excellent

If your score falls between 500 and 649, you’re in the fair range. This typically means that while you may have had some credit challenges in the past, you are more likely to be approved for credit than someone with a poor score.

Another important factor is your credit utilization ratio. This ratio compares your current credit card balances to your credit limits and is a crucial part of your credit score calculation. A higher ratio can negatively impact your score, while a lower ratio is generally better. Aim to keep your credit utilization below 30%.

Your payment history also plays a significant role. Late or missed payments can drag down your score, while a consistent payment history can help improve it. Make sure you frequently pay your bills on time to maintain or boost your credit score.

Length of credit history is another critical factor. The longer you have had credit accounts open, the better it is for your score. If you’re relatively new to credit, having fewer accounts with longer histories can be beneficial for stabilizing and potentially raising your score.

Mix of credit types is something that is often overlooked but certainly relevant. Lenders look for a variety of accounts on your credit report, such as credit cards, car loans, and mortgages. A diverse credit profile can positively impact your score, indicating that you can manage different types of credit responsibly.

Lastly, keep an eye on the number of recent credit inquiries. Frequent applications for credit can lower your score temporarily. Hard inquiries stay on your credit report for about two years and can make lenders wary. Space out your credit applications to minimize the impact on your credit score.

| Category | Credit Score Range |

|---|---|

| Poor | 300-499 |

| Fair | 500-649 |

| Good | 650-749 |

| Excellent | 750-850 |

Steps to Improve Your Fair Credit Score

First and foremost, it’s crucial to check your credit report regularly. This ensures that you are aware of the state of your credit and can quickly identify any discrepancies or errors. By law, you can receive a free copy of your credit report from each of the major credit reporting agencies once per year via AnnualCreditReport.com. If you spot any errors, dispute them immediately to prevent potential pitfalls.

Paying off outstanding debts is another effective way to enhance your credit score. Prioritize paying down high-interest rate credit card balances and loans. Even making slightly larger payments than the minimum required amount can impact positively over time. If overwhelmed by multiple debts, consider consolidating them to simplify your payments.

Your payment history constitutes a significant part of your credit score calculation. Ensure all your bills and debts are paid on time, every time. Automating payments or setting up reminders can help you avoid late payments. Even a single missed payment can be detrimental to your credit score.

Credit utilization is another critical factor. Try to keep your credit card balances below 30% of your credit limits. For instance, if your credit limit is $10,000, aim to keep your balance below $3,000. This shows creditors that you are managing your credit responsibly and aren’t overly reliant on it.

Here is a simple breakdown:

| Credit Limit | Max Balance |

|---|---|

| $5,000 | $1,500 |

| $10,000 | $3,000 |

| $15,000 | $4,500 |

Consider keeping old accounts open. The length of your credit history impacts your score. Even if you no longer use a particular credit card, keeping the account active can positively influence your credit score. However, ensure that it doesn’t have an annual fee that outweighs the benefits.

Avoid opening multiple new accounts in a short span. Each application leads to a hard inquiry which can temporarily lower your credit score. Space out your credit applications to minimize the impact on your score.

Another worthwhile practice is to diversify your credit mix. A healthy balance between credit cards, installment loans, and other types of credit can improve your score. However, don’t take on new debt unnecessarily; only diversify if it makes financial sense for you.

Lastly, consider credit counseling if you’re struggling to manage your debt. Financial professionals can offer personalized advice and strategies to improve your credit score. They can also negotiate with creditors on your behalf to set up manageable repayment plans.

Q&A

Q&A: Demystifying Fair Credit Scores

Q: What exactly is a “credit score”?

A: A credit score is a numerical representation of your creditworthiness, reflecting how reliably you manage your financial obligations. It’s calculated based on your credit history and ranges typically from 300 to 850.

Q: How is a “fair” credit score defined?

A: A “fair” credit score is generally defined as a score that falls between 580 and 669. It sits in the middle of the scale, signifying that the borrower has some credit history but there is room for improvement.

Q: Who decides what range a fair credit score falls into?

A: The ranges for credit scores are determined by credit reporting agencies, such as FICO and VantageScore. These agencies analyze vast amounts of data to create scoring models that gauge financial behavior.

Q: What factors impact whether a score is considered fair?

A: Factors include payment history, amounts owed, length of credit history, types of credit in use, and new credit inquiries. Scores in the “fair” range might indicate occasional late payments or a higher credit utilization ratio.

Q: Why is having a fair credit score important?

A: A fair credit score can influence your ability to secure loans or credit cards. While you may get approved for some financial products, the terms may not be as favorable—like higher interest rates—compared to those offered to individuals with higher scores.

Q: Can a fair credit score be improved?

A: Absolutely! Improving your credit score involves paying bills on time, reducing outstanding debt, avoiding unnecessary credit inquiries, and responsibly managing your credit mix. With commitment, you can elevate your score to a “good” or even “excellent” range.

Q: Are there misconceptions about fair credit scores?

A: One common misconception is that a fair credit score is akin to having bad credit. In reality, it means you have decent financial habits but there are areas to enhance. Another myth is that once you have a fair score, it’s static—credit scores are dynamic and can change with better financial behavior.

Q: How often should one check their credit score?

A: It’s advisable to check your credit score at least once a year, but monitoring it more frequently, such as quarterly, can be beneficial. Many financial institutions and services offer free credit score access, making it easier to stay informed.

Q: Does a fair credit score have different implications for different types of credit or loans?

A: Yes, different lenders have varying criteria. For example, mortgage lenders may be stricter than credit card issuers. Auto loans, personal loans, and credit cards each have unique approval standards and interest rates that can be influenced by a fair credit score.

Q: Where can individuals get more information or support on improving their credit score?

A: Numerous resources are available. Credit counseling services, financial advisors, and even the websites of credit reporting agencies offer guidance. Additionally, government and nonprofit organizations often provide free educational materials on managing and improving credit.

Whether you’re looking to climb the credit ladder or just maintain a fair standing, understanding and managing your credit score is a key step in achieving financial well-being.

Future Outlook

And there you have it— the intricate world of credit scores, demystified. Navigating the financial landscape can often feel like decoding an enigma, but understanding what comprises a fair credit score is a significant step toward financial literacy. Whether you’re just beginning your credit journey or looking to improve your standing, knowledge is your most valuable asset. Remember, your credit score is more than just a number; it’s a reflection of your financial habits and decisions. Equip yourself with the right information, and you’ll be well on your way to unlocking greater opportunities.

Thank you for joining us on this financial exploration. Here’s to making informed decisions and carving a path toward a secure financial future.