In the vast tapestry of financial products, the realm of loans occupies a significant and varied section. Here, money is neither a mere currency nor a static quantity; it ebbs and flows, navigating through our aspirations and necessities. Among these instruments of financial mobility lies a unique entity—the unsecured loan. Picture it as a trustworthy handshake between lender and borrower, untethered by collateral but anchored in mutual commitment. This article embarks on an exploration of the unsecured loan, unraveling its essence, and revealing why, amidst an ocean of financial strategies, it stands distinct. Whether you are contemplating this option or simply seeking to understand its place within the financial architecture, join us as we decode the nuances of what truly makes an unsecured loan.

Table of Contents

- Understanding the Basics of Unsecured Loans

- How Unsecured Loans Differ from Secured Loans

- Advantages and Drawbacks of Unsecured Loans

- Top Tips for Getting Approved for an Unsecured Loan

- Q&A

- Wrapping Up

Understanding the Basics of Unsecured Loans

A significant aspect of an unsecured loan is that it’s not backed by any collateral. This differentiates it from secured loans, like mortgages or auto loans, where the lender holds an asset as security. Without collateral, lenders rely heavily on the borrower’s creditworthiness to determine loan approval and interest rates.

<strong>Key Characteristics of Unsecured Loans:</strong>

<ul>

<li>No collateral required</li>

<li>Higher interest rates than secured loans</li>

<li>Typically shorter repayment terms</li>

<li>Approval based primarily on credit score and income</li>

</ul>

Lenders mitigate the risk factor associated with unsecured loans by implementing stringent eligibility criteria. Borrowers need to exhibit strong financial health and maintain a good credit score to qualify for favorable terms. Consequently, these loans are accessible to individuals with a reliable credit history but might pose challenges for those with low credit scores.

The diverse range of unsecured loan options includes:

<ul>

<li><strong>Personal Loans:</strong> Often used for debt consolidation, home improvement, or unexpected expenses.</li>

<li><strong>Credit Cards:</strong> Provide a revolving line of credit with variable interest rates.</li>

<li><strong>Student Loans:</strong> Fund education costs without requiring specific assets as security.</li>

</ul>

Interest rates on unsecured loans are typically higher than those on secured loans. The absence of collateral raises the risk for lenders, prompting them to charge more to compensate. Interest rates can be fixed or variable, with fixed rates offering consistent monthly payments and variable rates fluctuating based on market conditions.

<table class="wp-block-table alignwide is-style-stripes">

<thead>

<tr>

<th>Loan Type</th>

<th>Typical Use</th>

<th>Interest Rates</th>

</tr>

</thead>

<tbody>

<tr>

<td>Personal Loan</td>

<td>Debt consolidation, major purchases</td>

<td>Fixed or variable</td>

</tr>

<tr>

<td>Credit Card</td>

<td>Everyday expenses, emergencies</td>

<td>Variable APR</td>

</tr>

<tr>

<td>Student Loan</td>

<td>Educational expenses</td>

<td>Fixed or variable</td>

</tr>

</tbody>

</table>

Securing an unsecured loan often involves significant documentation, including proof of income, employment verification, and a thorough credit check. The approval process can be swift, with some lenders offering same-day funding based on eligibility.

Borrowers should explore various lenders—banks, credit unions, online lenders—to compare terms, interest rates, and fees. Understanding the impact of different fees, such as origination fees or prepayment penalties, is crucial for making an informed choice.

unsecured loans offer flexible borrowing options for many financing needs. Despite higher interest rates, their collateral-free nature provides access to funds without risking personal assets. By maintaining good credit and researching diligently, borrowers can find favorable terms that align with their financial goals.

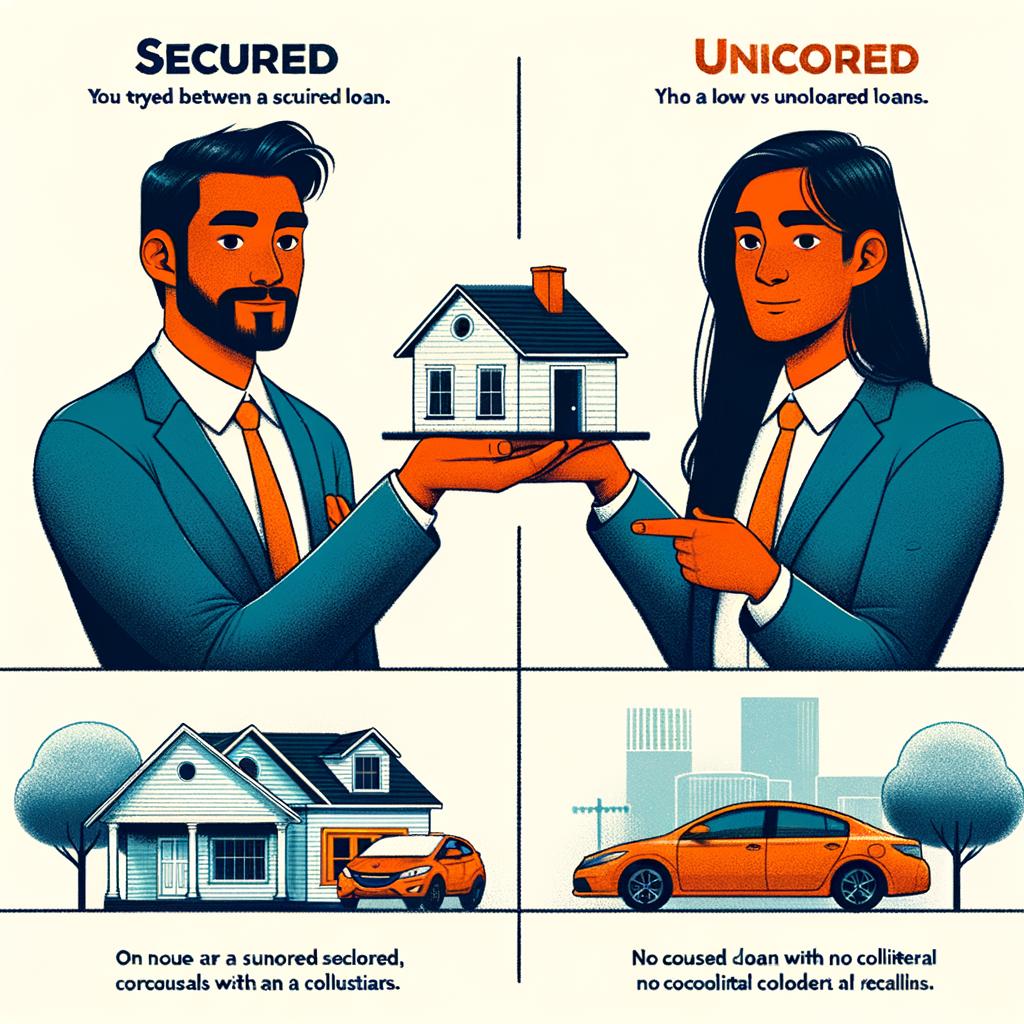

How Unsecured Loans Differ from Secured Loans

When considering a loan, it’s crucial to understand the differences between unsecured and secured loans. The fundamental difference lies in the collateral.

Secured loans require borrowers to pledge an asset as collateral — commonly a house, car, or other high-value possession. This collateral acts as security for the lender, reducing their risk. Consequently, secured loans typically feature lower interest rates and potentially higher borrowing limits.

On the other hand, unsecured loans do not require any collateral. Approval for these loans is primarily based on the borrower’s creditworthiness and financial history. As a result, they can be more accessible for those without significant assets to offer as collateral but may come with higher interest rates to offset the greater risk to the lender.

<table class="wp-block-table">

<thead>

<tr>

<th>Aspect</th>

<th>Secured Loans</th>

<th>Unsecured Loans</th>

</tr>

</thead>

<tbody>

<tr>

<td>Collateral</td>

<td>Required</td>

<td>Not Required</td>

</tr>

<tr>

<td>Interest Rates</td>

<td>Lower</td>

<td>Higher</td>

</tr>

<tr>

<td>Approval Basis</td>

<td>Asset Value</td>

<td>Creditworthiness</td>

</tr>

</tbody>

</table>

With secured loans, the inclusion of collateral means that in the event of non-payment, the lender has the right to seize the pledged asset to recuperate some or all of the loan’s value. This backs the lender's position and reduces their overall risk, permitting them to offer more favorable terms.

Unsecured loans, conversely, lean heavily on trust in the borrower's ability to repay based on their financial record. This absence of a fallback option for the lender generally results in higher interest rates to compensate for the elevated risk. If the borrower defaults, the lender must rely on legal avenues, which typically involve debt collection efforts and potentially negative impacts on the borrower's credit score.

It's worth noting that unsecured loans often come with shorter repayment terms. Borrowers facing unexpected financial challenges typically find more flexibility with secured loans, including potential loan restructuring options and term extensions offered by lenders to prevent the liquidation of collateral.

Both secured and unsecured loans have their place in personal and business finance. Secured loans might be preferable for large purchases or substantial capital needs where longer repayment terms and lower interest rates can make the costs more manageable. Unsecured loans are often favored for smaller amounts or for borrowers who prefer not to risk losing personal assets.

the choice between a secured and an unsecured loan will depend significantly on each borrower's individual circumstances, including their financial stability, credit history, and asset base. Knowing the distinct characteristics of each loan type can guide borrowers in making informed financial decisions.

Advantages and Drawbacks of Unsecured Loans

Unsecured loans offer a unique set of advantages and drawbacks that potential borrowers should consider carefully before applying. Let’s break down the key aspects:

Advantages of Unsecured Loans

- No Collateral Required: One of the most appealing aspects of unsecured loans is that they do not require any form of collateral. This means that you do not have to risk your personal assets, such as a home or a car, to get the loan.

- Quick Approval Process: Since there’s no need for asset evaluation, the approval process for unsecured loans is typically faster compared to secured loans. This makes it an ideal choice for those needing funds urgently.

- Flexibility of Use: Borrowers have the freedom to use the funds from an unsecured loan for various purposes, be it consolidating debt, covering medical expenses, or funding a major purchase.

- Fixed Interest Rates: Many unsecured loans come with fixed interest rates, which means your monthly payments remain consistent throughout the loan term. This can make budgeting easier.

- Avoid Potential Asset Loss: Since you are not putting up any collateral, there is no risk of losing your assets if you default on the loan.

Drawbacks of Unsecured Loans

- Higher Interest Rates: To compensate for the lack of collateral, lenders often charge higher interest rates on unsecured loans compared to secured ones. This can lead to higher overall repayment amounts.

- Stringent Qualification Criteria: Lenders may impose stricter credit score and income requirements for unsecured loans to mitigate the risk of default. Borrowers with poor credit histories might find it challenging to qualify.

- Lower Loan Amounts: Due to the increased risk, unsecured loans generally come with lower borrowing limits than their secured counterparts. This might not be suitable for those needing large sums of money.

- Shorter Repayment Terms: Unsecured loans often have shorter repayment periods, which may result in higher monthly payments. This could be a strain on your monthly budget.

- Potential Impact on Credit Score: Missing payments on an unsecured loan can negatively affect your credit score, making it harder to obtain credit in the future.

| Factor | Unsecured Loan |

|---|---|

| Collateral Requirement | None |

| Interest Rates | Higher |

| Approval Speed | Faster |

| Loan Amount | Lower |

| Repayment Terms | Shorter |

Understanding these pros and cons is essential when considering an unsecured loan. Evaluate your financial situation, your need for quick funds, and your ability to handle potentially higher interest rates before making a decision.

Top Tips for Getting Approved for an Unsecured Loan

When you’re aiming to get approved for an unsecured loan, preparation and smart financial strategies can make all the difference. Here are some top tips to boost your chances of success:

1. Know Your Credit Score

Your credit score is a critical factor in determining your eligibility for an unsecured loan. Regularly check your credit report for errors and take steps to improve your score. Lenders are more likely to approve applicants with higher scores since it indicates responsible financial behavior.

2. Manage Your Debt-to-Income Ratio

This ratio measures your monthly debt payments against your monthly income. A lower ratio is favorable as it shows lenders that you have sufficient income to cover new debt. Aim to pay off existing loans and avoid taking on new debt before applying.

3. Prepare Key Documents

Lenders require various documents to assess your loan application. Ensure you have recent pay stubs, tax returns, and bank statements ready. Organized documentation can streamline the approval process and demonstrate your preparedness.

4. Compare Lenders

Lending criteria can vary significantly. It’s wise to research and compare different lenders to find the best fit for your situation. Look at interest rates, terms, and customer reviews to make an informed decision.

5. Apply Strategically

- Pre-Approval Checks: Some lenders offer pre-approval that won’t impact your credit score. This can give you an idea of your eligibility.

- Limit Applications: Multiple applications in a short time frame can lower your score. Be selective and apply for one or two loans at a time.

6. Use a Co-Signer

If your credit score is less than ideal, consider a co-signer with a strong financial history. This can increase your chances of approval as it reduces the lender’s risk by involving another responsible party.

7. Highlight Stable Employment and Income

Lenders favor applicants with stable jobs and consistent income. Highlight your long-term employment or regular job changes within the same industry to show reliability. Provide proof of consistent earnings with pay stubs and bank statements.

8. Explain Special Circumstances

If you have any negative marks on your credit report, be ready to explain them. For example, medical emergencies or temporary job loss can be understandable reasons. Providing a written explanation with your application can help lenders see the bigger picture.

9. Keep Your Finances Organized

Demonstrating strong financial management can be a significant advantage. Regularly balancing your accounts, maintaining a savings cushion, and avoiding overdrafts can help paint a picture of financial responsibility.

Q&A

Q&A: What Is An Unsecured Loan?

Q: What exactly is an unsecured loan?

A: An unsecured loan, simply put, is a type of loan where the borrower doesn’t need to provide any collateral or security. Basically, you can borrow the funds based on your creditworthiness and promise to repay, rather than pledging an asset like your car or house.

Q: How does it differ from a secured loan?

A: With a secured loan, you have to offer an asset as collateral, which the lender can seize if you fail to repay the loan. An unsecured loan skips this step, relying instead on your credit score and financial history. Think of it as borrowing money on good faith.

Q: Who can benefit from an unsecured loan?

A: Almost anyone needing quick access to funds can benefit. It’s especially useful for individuals who may not have valuable assets to offer as collateral. If your credit history is solid, lenders are more likely to approve you for an unsecured loan.

Q: Are there any downsides to unsecured loans?

A: Yes, there are a few. Since unsecured loans pose more risk to lenders, they often come with higher interest rates compared to secured loans. Also, approval is more closely tied to your credit score, so those with lower scores might find it hard to get approved.

Q: What can unsecured loans be used for?

A: The versatility of unsecured loans is one of their biggest perks. You can use them for various purposes such as consolidating debt, covering emergency expenses, funding a vacation, or even financing a small business venture.

Q: How does one apply for an unsecured loan?

A: The application process is usually straightforward. Start by researching potential lenders and comparing their offers. Once you choose one, you’ll need to provide financial information and undergo a credit check. Approval times can vary, but some lenders offer quick decisions and funding.

Q: What happens if you can’t repay an unsecured loan?

A: If you default on an unsecured loan, the lender can’t seize your property, but it will seriously damage your credit score. Persistent non-payment can lead to legal action, wage garnishments, and a host of other financial headaches.

Q: Are unsecured loans offered by all lenders?

A: Not all, but many financial institutions, including banks, credit unions, and online lenders, offer unsecured loans. It’s wise to shop around for the best terms and conditions before committing.

Q: Is it possible to get an unsecured loan with bad credit?

A: It’s challenging but not impossible. Some lenders specialize in offering loans to those with less-than-stellar credit, though the terms might not be as favorable, and interest rates will likely be higher.

Q: What should one consider before applying for an unsecured loan?

A: Always assess your financial situation and ensure you can meet the repayment terms. Consider the interest rates, fees, and the total cost of the loan. It’s important to read the fine print and understand all the terms before signing anything.

In essence, unsecured loans can provide a lifeline when you need funds quickly and don’t have assets to offer as security. However, they come with their own set of risks and costs. Weighing the pros and cons carefully can help you make an informed decision.

Wrapping Up

As the curtain falls on our exploration of unsecured loans, it’s evident that these financial instruments hold both potential and responsibility. Unsecured loans present a shell of opportunity for those who seek financial flexibility without collateral. Yet, they demand from us a deep consideration of our capabilities and commitments.

Understanding the fine balance between benefit and obligation is the key. Whether embarking on a dream project or navigating life’s unforeseen cliffs, an unsecured loan could be your silent partner. But remember, in the theater of finance, knowledge and prudence are your best co-stars. As you step offstage and back into your own financial narrative, may your choices be informed and your journey prosperous.