In an era where financial instability has become a looming specter for many, the quest for financial literacy has never been more critical. Enter “Rich Dad Poor Dad,” Robert T. Kiyosaki’s groundbreaking work that has captivated millions around the globe with its unconventional wisdom and eye-opening insights into the world of money. This isn’t just a book; it’s a beacon, illuminating the nuanced landscape of wealth creation and financial independence. It’s an age-old debate of tradition versus innovation, prudence versus risk. As we delve into the powerful lessons embedded in this transformative narrative, prepare to challenge your preconceived notions and reimagine the role that financial education plays in your life. Welcome to a journey where rich ambitions meet practical wisdom, and where your financial potential is limited only by the boundaries of your imagination.

Table of Contents

- Why Understanding Assets and Liabilities Can Transform Your Financial Life

- The Crucial Role of Financial Literacy in Achieving Wealth

- How to Shift Your Mindset from an Employee to an Investor

- Strategies for Growing Passive Income and Attaining Financial Freedom

- Q&A

- Concluding Remarks

Why Understanding Assets and Liabilities Can Transform Your Financial Life

To truly revolutionize your financial landscape, you must grasp the importance of discerning assets from liabilities. This core principle, vividly explored in Robert Kiyosaki’s “Rich Dad Poor Dad,” lays down the blueprint for achieving lasting financial stability and growth.

Assets are defined as resources that put money into your pocket. This could range from real estate properties earning you rental income, stocks giving dividends, to a well-established business generating stable profits. The key feature is positive cash flow.

In contrast, liabilities are items that take money out of your pocket. This can include mortgages, car loans, credit card debt, or even that luxury vacation you’ve just booked, which might seem harmless but adds to your financial burden.

- Assets: Investments, real estate, business, savings/investment accounts.

- Liabilities: Loans, mortgages, credit card debt, non-earning consumer goods.

Understanding the difference isn’t just about terminology; it’s about redefining how you see potential financial opportunities and pitfalls. By prioritizing the accumulation of assets and minimizing liabilities, you can improve your financial health significantly.

Surprisingly, the traditional educational system does little to educate people on this basic but profound financial principle. This gap leads many to accumulate liabilities, disguised as assets, driven by the misconception that they are creating wealth. For example, a high-end car depreciates over time and costs money to maintain—labeling it a real asset is financially inaccurate.

| Item | Classification |

|---|---|

| Rental Property | Asset |

| Credit Card Debt | Liability |

| Stocks | Asset |

| Car Loan | Liability |

One of the vital lessons from “Rich Dad Poor Dad” is seeing your primary residence differently. While culturally viewed as an asset, your home might actually be a liability if it isn’t generating income and only piling up maintenance costs, mortgage interest, and taxes. This paradigm shift can free up significant capital for investing in true, income-generating assets.

Financial freedom comes from consistently using your resources to purchase assets, generating continuous passive income that can ultimately replace your earned income. Consider starting with small, manageable investments and gradating to larger ventures as you grow more knowledgeable and experienced.

So, begin today. Rethink what you own, reassess your financial statements, and start investing in real assets. This shift is not just intellectual but profoundly practical, setting you on the path to financial autonomy and peace of mind.

The Crucial Role of Financial Literacy in Achieving Wealth

Kiyosaki's Portrayal of Assets and Liabilities

<p>Kiyosaki emphasizes distinguishing assets from liabilities. Assets are things that put money in your pocket, while liabilities take money out. This seemingly simple concept is fundamental but often misunderstood. He urges that acquiring assets such as rental properties, stocks, and businesses should be a priority, as they generate income over time.</p>

Key Elements of Financial Statements

<p>Understanding financial statements can help you manage your personal finances more effectively. Here’s a simplified table inspired by the book:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Financial Statement</th>

<th>Key Component</th>

<th>Importance</th>

</tr>

</thead>

<tbody>

<tr>

<td>Income Statement</td>

<td>Profit & Loss</td>

<td>Tracks revenue and expenses</td>

</tr>

<tr>

<td>Balance Sheet</td>

<td>Assets vs. Liabilities</td>

<td>Net Worth Calculation</td>

</tr>

<tr>

<td>Cash Flow Statement</td>

<td>Cash Inflows & Outflows</td>

<td>Financial Health Check</td>

</tr>

</tbody>

</table>

The Power of Passive Income

<p>Kiyosaki champions the pursuit of passive income over earned income. He explains that passive income, generated from investments like real estate or dividends from stocks, allows your money to work for you instead of you working for money. This shift in mindset is crucial for achieving financial independence.</p>

The Importance of Entrepreneurship and Investing

<p>Another significant lesson is the value of entrepreneurship and investing. Owning your business or being an investor offers greater financial rewards than being an employee due to the potential for higher returns and tax advantages. Kiyosaki suggests starting small, but emphasizes the importance of continuous learning and risk-taking.</p>

<ul>

<li><strong>Real Estate:</strong> Buying properties can provide steady rental income and potential appreciation.</li>

<li><strong>Stocks and Bonds:</strong> Diversified investments can yield passive income through dividends or interest.</li>

<li><strong>Starting a Business:</strong> Owning a business can lead to significant financial growth.</li>

</ul>

Financial Education in Practice

<p>To embody Kiyosaki's principles, one must consistently educate oneself on financial matters. This includes reading books, attending seminars, and seeking mentors. Continuous learning serves not only to build knowledge but also to stay updated with evolving financial landscapes, regulations, and opportunities.</p>

Tax Knowledge and Legal Entities

<p>Kiyosaki also highlights the importance of tax knowledge and using legal entities, like corporations and limited liability companies (LLCs), to your advantage. He explains that understanding tax laws can minimize tax liabilities and protect your assets, which is a critical component of financial literacy.</p>

Mindset Transformation

<p>A recurring theme in 'Rich Dad Poor Dad' is how beliefs about money shape financial reality. Adopting a mindset that views money as a tool for creating wealth and opportunities rather than a mere means of survival can profoundly impact one's financial journey. By embracing a proactive and educated approach to finances, you can transform your economic future.</p>

How to Shift Your Mindset from an Employee to an Investor

Understanding the fundamental difference between employees and investors is crucial. Employees work for money, whereas investors make their money work for them. This starts with recognizing that financial education is your most powerful tool. Knowledge about assets, liabilities, and how money flows through the economy will set the foundation for your investment journey.

Focus on acquiring income-generating assets. While employees are often trapped in the cycle of working for a steady income, investors invest in stocks, real estate, businesses, and intellectual property. Explore avenues where your money can grow passively rather than actively trading your hours for dollars.

| Employee Mindset | Investor Mindset |

|---|---|

| Works for money | Makes money work |

| Seeks job security | Seeks financial freedom |

| Focuses on earning | Focuses on wealth generation |

One of the most profound changes is to start seeing opportunities rather than obstacles. “Rich Dad Poor Dad” suggests that the source of financial troubles is often our own inability to spot chances to invest. Cultivate a mindset that always looks for investment potential in everyday scenarios.

Embrace the concept of risk management rather than risk avoidance. Employees may prioritize job stability, often shying away from investments due to the fear of losing money. Investors, however, understand that taking calculated risks is a part of growing their wealth. Learn to assess risks and seek financial education to manage them wisely.

Building a robust network of mentors and like-minded individuals is indispensable for this journey. Surround yourself with people who inspire and challenge you to think like an investor. Attend seminars, join investment clubs, and participate in online forums to widen your perspective and gain valuable insights.

Shift your focus from linear income (salary) to passive income (investments and side businesses). Consider creating multiple streams of income to not only safeguard against financial downturns but also accelerate your journey towards financial independence.

adopt the habit of continuous learning. The financial world is ever-evolving and staying updated can provide you with the best opportunities. Whether it’s reading more books like “Rich Dad Poor Dad”, taking online courses, or simply following market trends, keep feeding your financial intellect.

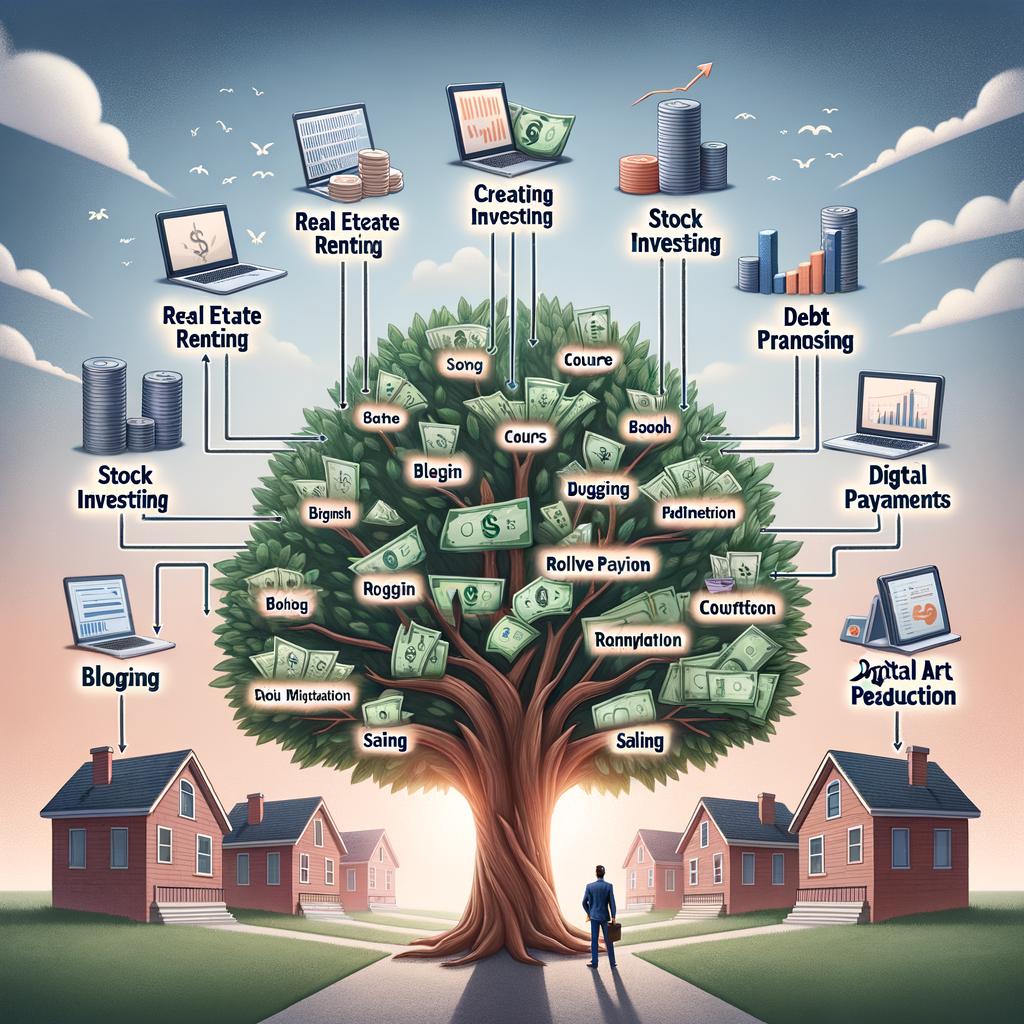

Strategies for Growing Passive Income and Attaining Financial Freedom

Effective strategies for growing passive income hold the promise of not just financial stability but also the ultimate goal of financial freedom. One of the cornerstones of these strategies lies in financial education, which is brilliantly illuminated in Robert Kiyosaki’s classic ‘Rich Dad Poor Dad’. This transformative book distills the principles of wealth accumulation and offers actionable advice to enhance financial literacy.

Embrace the Mindset of an Investor

The first enlightening lesson from the book is to cultivate the mindset of an investor rather than a worker. While earning an income from a job is essential, the book underscores the importance of making your money work for you. This involves understanding various investment vehicles such as:

- Stock Market

- Real Estate

- Businesses

- Mutual Funds

Each has its risk and reward profile, and becoming proficient requires a keen understanding and regular market research.

The Power of Assets vs. Liabilities

Kiyosaki introduces the vital distinction between assets and liabilities, emphasizing that assets are anything that puts money into your pocket, while liabilities take it out. Therefore, the focus should be on acquiring assets such as:

- Rental Properties

- Dividend-Paying Stocks

- Intellectual Property

Each of these plays a pivotal role in building a passive income stream.

Use the Leverage of Real Estate

Real estate remains one of the most favored vehicles for passive income. Rental properties generate monthly income, and the appreciation in property value increases net worth over time. A strategic investment in the real estate market can yield substantial returns by leveraging properties through mortgage financing. Here’s a quick comparison of potential investments:

| Investment Type | Initial Cost | Potential Annual Return |

|---|---|---|

| Rental Property | High | 5%-10% |

| Stocks | Moderate | 7%-15% |

| REITs | Low | 4%-8% |

Engage in Continuous Learning

Another critical lesson from ‘Rich Dad Poor Dad’ is the emphasis on continuous learning. The financial landscape is perpetually evolving, and staying abreast of trends, market conditions, and new investment opportunities is indispensable. Investing in courses, webinars, and books can yield substantial returns down the line.

Diversify to Mitigate Risks

Diversification is the bedrock of a robust passive income strategy. By spreading investments across various asset classes, the risk is mitigated. While some investments may underperform, others could exceed expectations, balancing out the overall performance and ensuring a steady income stream.

Entrepreneurial Ventures

The entrepreneurial spirit is heavily advocated in the book. Launching and owning automated or semi-automated businesses can significantly boost passive income. These businesses could encompass:

- Online Stores

- Franchises

- Affiliate Marketing

- Subscription Services

With the right strategies and frameworks, these ventures can operate with minimal oversight, providing continuous revenue flow.

Smart Tax Strategies

Lastly, understanding and capitalizing on tax benefits can enhance passive income. By investing in tax-advantaged accounts, taking advantage of depreciation in real estate, or utilizing legal tax shelters, individuals can substantially reduce their tax burden, thereby increasing net income.

Q&A

Q: What are the central themes of ‘Rich Dad Poor Dad’ by Robert Kiyosaki?

A: ‘Rich Dad Poor Dad’ delves into the contrasting financial philosophies of Kiyosaki’s two paternal figures – his biological father and the father of his best friend. The book juxtaposes the traditional approach to money – prioritizing job security and saving diligently – with a more entrepreneurial mindset that encourages investing, taking calculated risks, and making money work for you. It stresses the importance of financial education to break the cycle of paycheck dependence.

Q: How does the book redefine the concept of assets and liabilities?

A: Traditional education often defines assets as anything of value owned by an individual. However, Kiyosaki simplifies this by defining assets as items that put money into your pocket and liabilities as those that take money out of your pocket. This redefinition serves to shift focus toward income-generating assets like rental properties, stocks, and businesses, which build wealth over time.

Q: Can you provide an example from the book that illustrates the importance of financial education?

A: One pivotal example in ‘Rich Dad Poor Dad’ is the anecdote about the two fathers’ interpretations of home ownership. The “Poor Dad” sees a house as the most significant investment, while the “Rich Dad” views it as a liability if it does not generate income. This highlights the necessity of financial education for making informed decisions about investments, demonstrating that what is commonly perceived as an asset might actually drain financial resources.

Q: What key lesson does Kiyosaki advocate when it comes to earning and managing money?

A: Kiyosaki emphasizes the lesson of not working for money, but instead having money work for you. He suggests that rather than being confined to wage-based labor, individuals should seek out opportunities to invest in ventures that generate passive income. This shift from earned income to passive income is a cornerstone of achieving financial independence according to Kiyosaki.

Q: How does ‘Rich Dad Poor Dad’ address the topic of risk in financial investments?

A: The book differentiates between educated risk and reckless risk. Kiyosaki argues that with proper financial education, one can make well-informed, strategic investments that, while still carrying some risk, are more likely to yield significant returns. Educated risks involve thorough research, understanding market conditions, and being prepared to manage the potential downsides.

Q: What personal qualities does Kiyosaki suggest nurturing in order to succeed financially?

A: Kiyosaki highlights qualities such as perseverance, adaptability, and a willingness to step out of one’s comfort zone. He champions the idea that financial success often requires continuous learning, self-discipline, and the courage to challenge conventional wisdom about money.

Q: How does ‘Rich Dad Poor Dad’ suggest individuals can begin their journey toward financial education?

A: The book advises starting with small, manageable steps like reading financial books, attending seminars, and seeking mentorship from financially savvy individuals. By gradually building knowledge and confidence, individuals can begin to implement strategies like investing in real estate, stocks, or even starting their own business ventures, ultimately leading to enhanced financial literacy and independence.

Concluding Remarks

As we close the final chapter on our exploration of “Rich Dad Poor Dad,” we’re left with the profound realization that financial education is more than just a tool—it’s a transformative journey. Robert Kiyosaki’s compelling narratives and invaluable insights serve as a beacon for individuals striving for financial freedom. Whether it’s understanding the subtle differences between assets and liabilities or the importance of thinking beyond the conventional, his lessons encourage us to rethink our relationship with money. In a world where the tide of financial responsibilities often threatens to overwhelm, empowering ourselves with knowledge can be our best lifeboat. So, as you set forth on your own fiscal voyage, carry with you the wisdom gleaned from both the Rich Dad and the Poor Dad. For financial education isn’t just about wealth—it’s about creating a future where possibilities are as boundless as the horizons you dare to chase.