In the intricate mosaic of personal finance, credit scores often stand as silent sentinels, guarding the gateways to financial opportunities. Their numerical semblance may appear mundane, but their influence is both profound and pervasive. Among the numerous scenarios where these scores wield their power, personal loans emerge as a significant arena of interest. This article delves into the enigmatic world of credit scores, specifically unraveling the average credit score required for personal loans. As we navigate through a labyrinth of data and industry insights, we aim to illuminate the path for prospective borrowers, shedding light on how their financial histories align with their aspirations of securing a personal loan. Whether you’re a seasoned borrower or a curious onlooker, join us as we embark on a journey to understand where most stand on the credit score spectrum and how it shapes their financial narratives.

Table of Contents

- Understanding the Basics: What Constitutes an Average Credit Score

- Factors Influencing Your Credit Score for Personal Loans

- Analyzing Trends: How Average Credit Scores Vary by Demographics

- Actionable Tips for Improving Your Credit Score Before Applying

- Q&A

- Wrapping Up

Understanding the Basics: What Constitutes an Average Credit Score

Credit scores act as a measure of an individual’s creditworthiness, influencing the likelihood of loan approval and the terms offered by lenders. Understanding what constitutes an average credit score is crucial for personal loan seekers aiming to enhance their financial standing.

In the United States, credit scores generally range from 300 to 850, with 850 being considered a perfect score. The average credit score, according to recent data, hovers around 675-700. However, lenders categorize these scores into different brackets to assess risk:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Scores in the ”Good” range of 670-739 are often deemed the benchmark for average credit scores. Individuals within this range usually have a higher likelihood of securing personal loans with favorable terms. Conversely, those with “Fair” or “Poor” scores might face challenges in obtaining loans or may receive less favorable interest rates and loan conditions.

Several factors contribute to a credit score, and understanding these components can help you maintain or improve your credit level:

- Payment History: Timeliness and regularity of past payments.

- Credit Utilization: The ratio of current debt to total available credit.

- Length of Credit History: How long your credit accounts have been active.

- Types of Credit: Mix of credit accounts like credit cards, mortgages, and loans.

- Recent Credit Inquiries: Number of new accounts and inquiries.

Making sense of this information can help interpret average credit scores more contextually. For instance, an individual with a short credit history might have a lower score even if they have an impeccable payment record. Similarly, high credit utilization can drag down scores, even with no late payments.

Here’s a snapshot comparison for better clarity:

| Factor | High Impact | Moderate Impact | Low Impact |

|---|---|---|---|

| Payment History | Consistent on-time payments | Few late payments | Several late payments |

| Credit Utilization | Less than 30% | 30%-50% | More than 50% |

| Length of Credit History | 15+ years | 7-14 years | 0-6 years |

Maintaining an average credit score offers multiple benefits besides increased loan eligibility. It can also lead to lower insurance premiums and even influence rental and employment opportunities. Regularly monitoring credit reports and scores is essential to ensure accuracy and identify areas needing improvement.

Despite where you fall on the credit score spectrum, there’s always room for enhancement. Simple actions like reducing outstanding debt, avoiding new credit inquiries before applying for a loan, and correcting any errors on your credit report can make a substantial impact over time.

average credit scores are a composite evaluation influenced by multiple factors. Understanding these factors and their impact can empower individuals to make informed decisions and pave the way for better financial health.

Factors Influencing Your Credit Score for Personal Loans

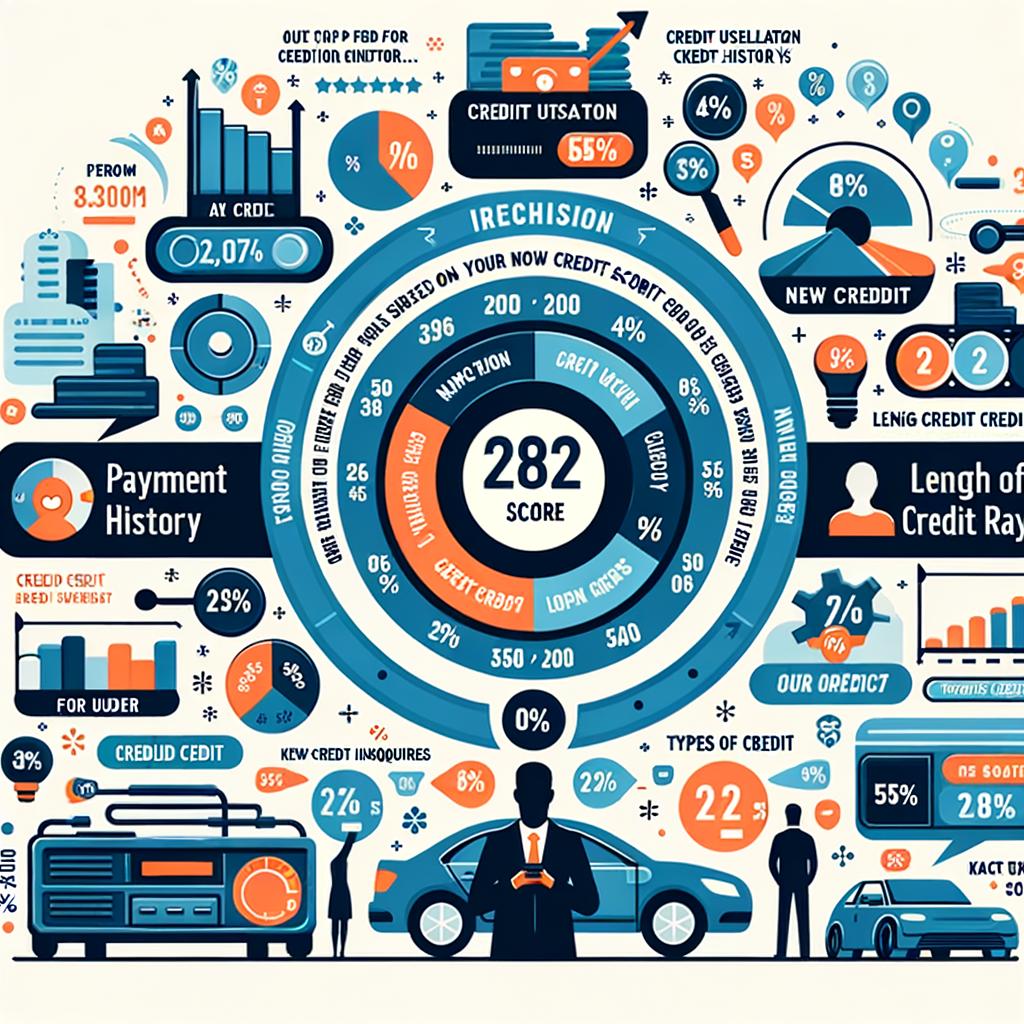

One of the primary elements impacting your credit score is your payment history. Lenders want to be assured that you can make timely payments, so they give significant weight to your track record. Missed payments, late payments, and delinquencies can drastically pull your score down, making it harder to secure a personal loan.

Another vital factor is the amounts owed. This refers to your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A lower credit utilization rate can be beneficial. So, if you have several credit cards, it’s wise to keep your balances low to maintain a healthier score.

Length of credit history also plays a critical role. The longer you’ve managed your credit responsibly, the better. This factor considers your oldest account’s age, the average age of all your accounts, and the age of your newest account. Opening too many new accounts in a short period could reduce the average age of your accounts, possibly negatively impacting your credit score.

Diversification in credit types can positively influence your score. Under credit mix, possessing a combination of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans can be beneficial. However, it’s advisable not to open accounts you don’t need just to influence your credit mix, as this could do more harm than good.

Another consideration is new credit. Several hard inquiries—credit checks by lenders—within a short period can lower your score. Each of these inquiries slightly impacts your credit score, so it’s wise to avoid applying for too many credit accounts too quickly.

Your debt-to-income (DTI) ratio may not directly affect your credit score, but it’s often considered by lenders when deciding whether to approve your loan. This ratio measures your monthly debt obligations compared to your gross income. A lower DTI ratio indicates better financial health and can enhance your attractiveness to lenders.

Additionally, derogatory marks like bankruptcies, collections, or tax liens can devastate your credit score. These remain on your credit report for several years, reflecting severe financial mismanagement. Maintaining clean credit behavior can help improve your score over time, despite these blemishes.

| Factors | Weight on Score |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

Keeping an eye on these aspects can help you not only comprehend your credit score better but also tweak your financial habits to improve it. Remember, building and maintaining a high credit score is a gradual process; consistency is key.

Analyzing Trends: How Average Credit Scores Vary by Demographics

Credit scores are a significant indicator of financial health and borrowing potential. When it comes to personal loans, these scores can vary dramatically based on demographic factors such as age, income level, gender, and geographical location. Understanding these trends helps lenders make informed decisions and guides borrowers in improving their creditworthiness.

Age plays a pivotal role in average credit scores. Younger individuals, particularly those under 25, often have lower credit scores. This can be attributed to a shorter credit history and potentially higher levels of indebtedness from student loans.

- Individuals under 25: Average score is around 630

- Age 25-34: Average score climbs to around 660

- Ages 35-54: Averages about 695

- 55 and older: Scores average around 720

Income level also heavily influences credit scores. Higher-income individuals generally have higher credit scores thanks to greater financial stability and better debt management strategies. Conversely, those in lower income brackets may struggle more with debt, impacting their scores.

| Income Level | Average Credit Score |

|---|---|

| Less than $30,000 | 600 |

| $30,000 - $50,000 | 650 |

| $50,000 - $75,000 | 700 |

| $75,000 and above | 750 |

There’s also noticeable variation based on gender. While the differences aren’t drastic, trends indicate women tend to have slightly higher average credit scores compared to men. Potential factors include different spending habits and financial behaviors.

Geographical location further influences credit score trends. Urban areas tend to boast higher average scores due to better access to financial education and resources. Rural areas may see lower scores, perhaps due to fewer financial institutions and services available.

| Geographical Location | Average Credit Score |

|---|---|

| Urban | 690 |

| Suburban | 680 |

| Rural | 650 |

Ethnicity can also be a critical factor. Socioeconomic disparities often manifest as differences in credit scores among various racial and ethnic groups. Addressing these disparities requires targeted financial education and support initiatives.

Observing how average credit scores shift and change among different demographic groups provides a clearer picture of broader financial behaviors and trends. This knowledge is invaluable for all stakeholders, including lenders, policymakers, and individuals keen on improving their financial health.

Actionable Tips for Improving Your Credit Score Before Applying

Boosting your credit score can open up better opportunities when seeking a personal loan. Here are some effective strategies that can make a significant difference:

Review Your Credit Report

Your credit report is a critical document. Obtain a free copy from the major credit bureaus and scan it for any errors. Incorrect entries can drag your score down, so ensure you correct any mistakes promptly. Dispute errors and follow up to verify they have been rectified.

Pay Down Credit Card Balances

Credit card utilization—the ratio of your credit card balances to credit limits—plays a significant role in your credit score. Aim to keep your utilization below 30%. If possible, target even lower. Paying down outstanding balances can give your score a noticeable boost.

Set Up Automatic Payments

Missed payments are one of the biggest factors that can hurt your credit score. Set up automatic payments to ensure you never miss a due date. This practice not only avoids penalties but also builds a pattern of consistent, on-time payments, which lenders love.

Keep Old Accounts Open

The length of your credit history accounts for a part of your credit score. Closing older accounts can negatively impact your score by reducing your average account age. Therefore, keep these accounts open, even if they are infrequently used.

Seek Out Different Types of Credit

Having a variety of credit types—credit cards, installment loans, retail accounts—demonstrates responsibility across different financial products. However, do not open new accounts purely for diversification, as hard inquiries can briefly dent your score.

Consider a Secured Credit Card

If you have poor or limited credit history, secured credit cards offer a way to build or improve your score. These cards require a security deposit, which serves as your credit limit. Using a secured card responsibly can help establish a good payment history.

Negotiate “Pay for Delete” Agreements

If you have outstanding debts, reach out to your creditors and negotiate a “pay for delete” arrangement where they remove negative entries in exchange for payment. While not all creditors agree to this, it’s worth attempting; even partial success can be beneficial.

Limit Hard Inquiries

Each time you apply for new credit, a hard inquiry is placed on your credit report. Multiple inquiries within a short time frame can lower your score. Therefore, limit new applications and only apply for credit when absolutely necessary.

Keep an Eye on Your Score

Regularly monitoring your credit score helps you keep track of your progress and alerts you to any sudden changes. Many banks and credit card companies offer this service at no charge to their customers.

| Actionable Tip | Potential Score Impact |

|---|---|

| Pay Down Balances | High |

| Set Up Automatic Payments | Moderate |

| Dispute Errors | Variable |

| Use a Secured Credit Card | Moderate |

| Negotiate Pay for Delete | Variable |

| Limit Hard Inquiries | Moderate |

Implementing these actionable tips can significantly enhance your credit score, positioning you better when applying for a personal loan. Regular monitoring and responsible financial habits are key to maintaining a healthy credit profile.

Q&A

Q&A: Understanding the Average Credit Score for Personal Loans

Q: What is the focus of the article “The Average Credit Score for Personal Loans”?

A: The article delves into the typical credit score ranges lenders look for when approving personal loans. It also explores how these scores influence the terms and conditions of the loans.

Q: Why is the average credit score relevant when applying for a personal loan?

A: Your credit score serves as a numerical summary of your creditworthiness. Lenders rely on it to determine the risk involved in lending you money. A higher score generally means better loan terms and lower interest rates.

Q: What is the average credit score needed for a personal loan?

A: While the average can vary, a score between 640 and 680 is typically considered the minimum range for approval. However, scores of 700 or higher often lead to more favorable loan conditions.

Q: How do credit scores influence loan conditions?

A: Lenders use credit scores to set interest rates, loan amounts, and repayment periods. A higher score may result in lower interest rates and higher loan amounts, making borrowing more affordable and accessible.

Q: Are there specific benefits to having a higher credit score for personal loans?

A: Absolutely. A higher credit score can help you secure loans with lower interest rates, reduced fees, and more flexible repayment options, ultimately saving you money over the life of the loan.

Q: What steps can individuals take to improve their credit scores?

A: Improving your credit score involves paying bills on time, reducing debt balances, avoiding new credit inquiries, and correcting any inaccuracies on your credit reports. Consistent positive credit behavior over time will yield the best results.

Q: Can someone with a lower credit score still get a personal loan?

A: Yes, individuals with lower credit scores can still qualify for personal loans, but they may face higher interest rates and stricter terms. Some may need to seek out specialized lenders who cater to those with less-than-ideal credit.

Q: Does the article provide information on the impact of different types of credit scores, like FICO and VantageScore, on personal loans?

A: Yes, the article explains that while FICO scores are more commonly used, some lenders also consider VantageScores. Both scoring models range from 300 to 850, and higher scores favorably impact loan approval and terms.

Q: Are there other factors aside from credit scores that lenders consider for personal loans?

A: Definitely. Besides credit scores, lenders also evaluate income, employment history, existing debts, and overall financial stability to get a comprehensive picture of the applicant’s ability to repay the loan.

Q: How frequently do average credit score requirements for personal loans change?

A: Credit score requirements can fluctuate based on economic conditions, changes in lending practices, and evolving lender policies. It’s wise to stay informed about current trends and maintain a healthy credit profile.

Wrapping Up

In the intricate tapestry of personal finance, the average credit score for personal loans emerges as more than just a number – it’s a gateway to potential possibilities. As we’ve unraveled the threads of data and strategy, it’s clear that knowledge and awareness hold immense power, far beyond the digits on a credit report. Whether you’re tiptoeing through the first steps of your credit journey or refining an already established score, remember that every financial decision you make can influence your path forward.

With your newfound understanding, let this be not the end, but the beginning of your financially empowered future. Embrace the opportunities ahead, wield your credit wisely, and let your journey to securing that personal loan be steered by informed choices rooted in confidence and clarity. So, go forth and let your financial story unfold with purpose, ushered by the wisdom you’ve gathered here.