In the grand tapestry of adulthood, few threads are as transformative as participating in a general election. It’s a moment of civic duty, a time when voices merge to create the symphony of democracy. But what if casting your ballot—an act fueled by passion and principles—could also tune up your financial scorecard? Imagine the surprise of discovering that registering to vote has the potential to boost your credit score. This article delves into the unexpected connection between these two seemingly disparate worlds, unveiling how a simple act of civic engagement can ripple through the realms of personal finance, knitting together the fabric of responsibility, identity, and trust.

Table of Contents

- Understanding the Link Between Voter Registration and Credit Scores

- How Voter Registration Improves Your Creditworthiness

- Step-by-Step Guide to Registering for the General Election

- Maximizing Your Credit Potential Through Civic Engagement

- Q&A

- To Conclude

Understanding the Link Between Voter Registration and Credit Scores

Did you know that your participation in democratic elections could have a direct, positive impact on your credit score? It’s true! When you register to vote, you’re also contributing to the accuracy and completeness of your credit report. This connection might seem surprising, but let’s explore how it works and why it’s beneficial for you.

Firstly, voter registration often serves as a reliable, verified source of personal identification. Credit reference agencies regularly update their databases and cross-check information with voter rolls to confirm your identity and address. Being listed on the electoral roll ensures that your credit profile remains up-to-date and accurate, reducing the risk of inconsistencies that could harm your credit rating.

Consider this: when lenders evaluate your credit application, they look for stability and reliability. Being registered to vote indicates a stable residence, which signals to lenders that you’re less likely to be a risk. Stability is a key factor that lenders consider, making your voter registration a subtle nod to your trustworthiness and dependability.

Accuracy and completeness of your credit report can be critical when applying for loans or credit cards. If your address history is muddled or incomplete, lenders might view your application with suspicion. By ensuring you are consistently registered to vote at your current address, you enhance the completeness of your address history, positively impacting your creditworthiness.

Additional Benefits of Voter Registration:

- It helps maintain your public record, which credit agencies depend on for updated information.

- It demonstrates responsible citizenship, a trait that lenders value.

- It reduces the risk of identity fraud by regularly updating your details.

Here’s a brief comparison that outlines how being registered (or not) might affect your credit profile:

| Registered to Vote | Not Registered |

|---|---|

| Higher credit score due to verified identity | Potential lower credit score due to unverified identity |

| Stable address history | Incomplete address history |

| Lower risk of identity fraud | Higher risk of identity fraud |

It’s also worth noting that the linkage between voter registration and identity verification can play a crucial role in protecting against identity theft. Regular updates to your voter registration status can act as a safeguard, ensuring that your personal information is current and accurate, thus making it harder for fraudsters to misuse your identity.

if you haven’t already, take the time to register to vote. Not only will you be exercising your democratic rights, but you’ll also be taking an important step towards maintaining a healthy credit score. It’s a win-win situation where your civic duty aligns seamlessly with your financial health.

How Voter Registration Improves Your Creditworthiness

Many people are surprised to learn that their creditworthiness can be enhanced by something as civic-minded as registering to vote. While it may seem unrelated, being on the electoral roll offers several tangible benefits that appeal to both your financial stability and credit rating.

When you register to vote, your name and address are added to the electoral roll, a public record that lenders often use for verification purposes. This linkage builds trust and credibility, signaling to creditors that you have a stable residence and traceable identity. Verification of address helps to speed up the approval process for loans and credit cards, making you a more attractive candidate for credit.

Lenders look at the electoral roll to confirm your identity and place of residence. If your details are easily verifiable through this public record, it adds an extra layer of trust. Being on the electoral roll provides proof that you have a permanent address, which is crucial for lenders assessing your reliability.

- Trust and Credibility: Establishes residency and traceability.

- Identity Verification: Simplifies the process of confirming who you are.

- Speedier Approvals: Can accelerate credit application processes.

Not being on the electoral roll can raise red flags, leading lenders to believe you might be less stable, which can negatively impact your credit score. Conversely, a registered voter status boosts your profile, aligning you with creditors’ criteria for reliability.

Moreover, some credit scoring models integrate your voter registration status as part of their metrics. Being registered can augment your overall credit score, sometimes significantly. Although this component might be just a fraction of your full credit assessment, every bit helps, especially if you are hovering near a critical threshold.

| Benefit | Impact on Credit |

|---|---|

| Verification Ease | High |

| Increased Trust | Medium |

| Address Stability | Crucial |

As well as improving creditworthiness, being on the electoral roll also brings additional financial benefits. Some utility companies and landlords use the electoral roll for background checks. Being registered may smooth out renting processes or getting utility services set up swiftly.

In essence, including your name on the electoral roll is an easy way to signal to various financial bodies that you are accountable and settled. This can lead to a ripple effect of financial opportunities, from lower interest rates to pre-approved credit offers, showcasing the subtle yet significant impact of voting registration on your financial health.

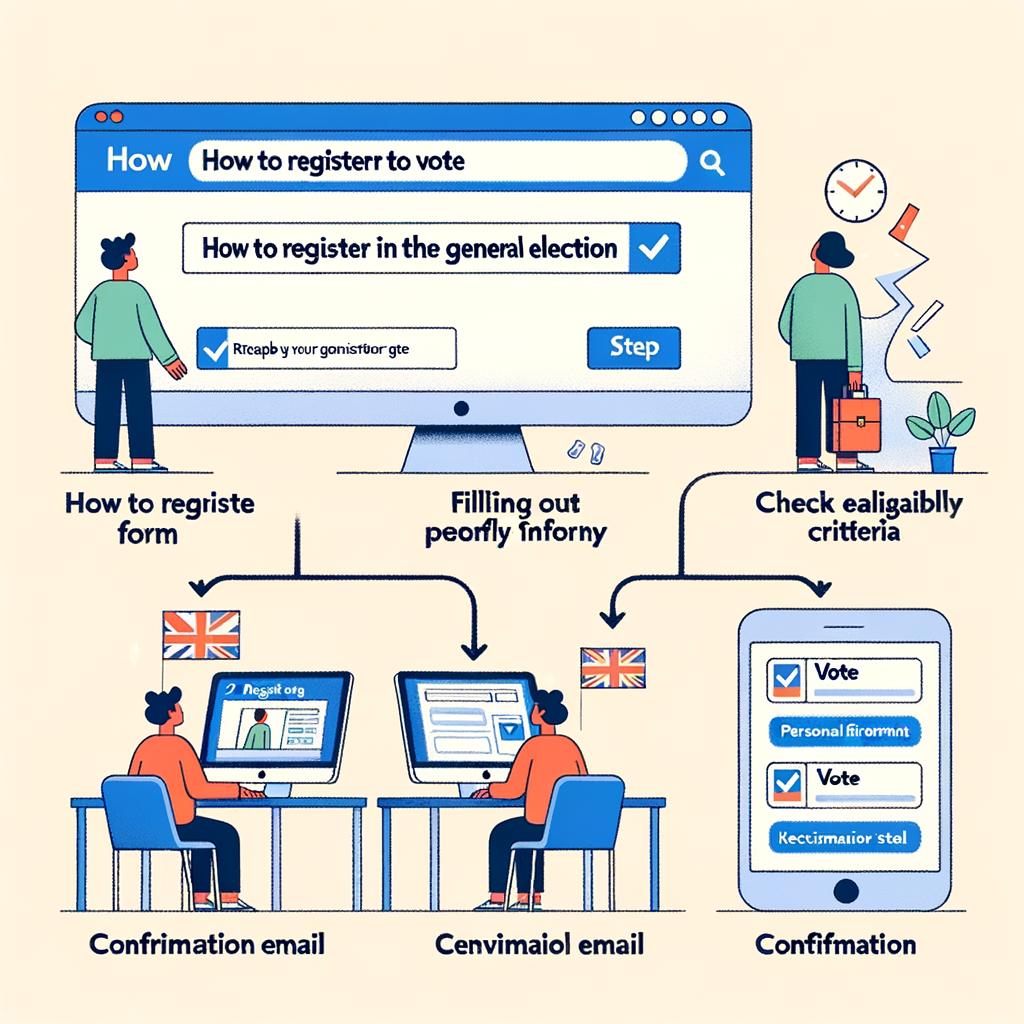

Step-by-Step Guide to Registering for the General Election

First, visit the official government website dedicated to voter registration. The website is your entry point to making sure you’re part of the democratic process. Look for the registration section, usually prominently displayed on the homepage.

Once you’re on the registration page, you’ll need to gather some essential documents. Make sure you have the following items at hand:

- A government-issued ID (passport, driver’s license, etc.)

- Proof of residence (utility bill, lease agreement, etc.)

- Social Security number or another unique identifier

Next, you must fill out the online registration form. This form typically requires personal information such as your full name, date of birth, address, and contact details. Double-check to ensure all information is accurate. Typos or inaccuracies could delay your registration process.

After submitting your online application, you will receive a confirmation email. Check your email for a message that includes:

- Confirmation of your submitted application

- A reference number to track your application status

- Instructions on what to do next if additional documents are required

If your jurisdiction requires a physical document submission, mail the required forms to the provided address. Make sure to use tracking services to confirm your documents arrive safely. The following table outlines some common submission addresses for a few states:

| State | Submission Address |

|---|---|

| California | California Secretary of State, Elections Division, Sacramento, CA |

| New York | New York State Board of Elections, Albany, NY |

| Texas | Texas Secretary of State, Elections Division, Austin, TX |

Await approval from your local election office. This step can take a few days to a couple of weeks depending on your location and the volume of requests. Meanwhile, make sure your contact information remains up-to-date to receive any necessary communication promptly.

Once your application is approved, you will receive a voter registration card in the mail. Keep this card safe, as you will need it on election day. This card confirms your registration status and provides important information such as your polling location.

Engage with community education sessions if you have any uncertainties about the voting process. Attend local events, join informational webinars, or reach out to civic groups offering guidance. Taking these steps will help you:

- Understand voter ID requirements

- Locate your nearest polling station

- Stay informed about crucial dates and deadlines

Maximizing Your Credit Potential Through Civic Engagement

Engaging in your community does more than just enrich your civic life; it also has the potential to elevate your financial health. While it may seem far-fetched, registering to vote and participating in elections can significantly influence your credit score.

When you register to vote, your information is entered into public records. Credit bureaus often use these public records to verify your current address and identity, which streamlines the process of determining your financial reliability. An accurate and up-to-date address can expedite credit applications and create a positive impression on lenders.

Aside from the technicalities of address verification, regular civic engagement can also foster a sense of responsibility and consistency. These traits are invaluable when it comes to managing your finances and maintaining a healthy credit score. Once you’re registered to vote, you’re more likely to pay attention to deadlines and commitments, translating to better management of credit obligations.

Interestingly, data security is another realm where voter registration plays a crucial role. By ensuring that your voter information is correctly logged, you minimize the chances of identity theft. Maintaining clean and accurate voter records can be just as critical in preventing fraud as diligently monitoring your credit report.

Furthermore, community involvement, including voting and attending local meetings, can help you stay informed about fiscal policies that impact your financial status. Understanding regional economic shifts can enable you to make knowledgeable decisions that positively influence your spending habits and credit management.

To put this in perspective, consider the table below, which delineates the various benefits of engaging in civic activities on your credit health:

| Activity | Benefit |

|---|---|

| Registering to Vote | Address Verification |

| Voting in Elections | Sense of Responsibility |

| Attending Community Meetings | Informed Fiscal Decisions |

| Following Municipal Policies | Data Security |

It’s also important to highlight that civic engagement can indirectly boost your credit score by enhancing your reputation within the community. Local lenders and financial institutions often take into account a borrower’s community involvement, viewing it as an indicator of reliability and trustworthiness.

If community involvement isn’t yet a part of your routine, now is the perfect time to start. Here are some simple ways to get involved:

- Register to vote if you haven’t already.

- Participate in local and general elections.

- Attend town hall meetings and community forums.

- Engage in local advocacy groups.

- Stay informed about regional economic policies.

By taking these steps, not only will you contribute to the broader community, but you’ll also be actively participating in practices that can lead to a healthier credit score. Civic engagement is indeed a win-win scenario, benefiting both your community and your financial well-being.

Q&A

Q&A: Register to Vote in the General Election to Boost Your Credit Score

Q: How does registering to vote impact my credit score?

A: Registering to vote can positively affect your credit score because it helps credit reference agencies verify your identity and address more easily. Being on the electoral roll makes you appear more stable and reliable, which can lead to better credit ratings.

Q: Is it illegal not to register to vote in the general election?

A: While it is not illegal in most places to refrain from registering to vote, it is strongly encouraged for civic participation and other benefits, such as the potential improvement in your credit score.

Q: How long does it take to see a change in my credit score after registering to vote?

A: Changes to your credit score typically depend on the credit reference agency’s updating cycles, which can vary. It might take a few weeks to a couple of months for the new information to be reflected in your credit score.

Q: What are other benefits of registering to vote besides potentially boosting my credit score?

A: Registering to vote ensures you have a say in the democratic process and can affect the governance of your community and country. It also serves as a proof of address, making it easier to apply for loans, mortgages, and other financial products.

Q: Can I register to vote if I have recently moved to a new address?

A: Yes, you can and should register to vote at your new address. Updating your details ensures the accuracy of the electoral roll and can prevent any negative impacts on your credit score caused by outdated information.

Q: Does registering to vote guarantee a higher credit score?

A: While registering to vote can improve your creditworthiness in the eyes of lenders, it is not a guarantee of a higher credit score. Your overall credit health depends on various factors, including your payment history, credit utilization, and existing debts.

Q: How can I register to vote?

A: You can usually register to vote through your local electoral office or online through government websites. The process typically involves providing some personal details and proof of address. Be sure to check the registration deadlines to ensure your details are updated in time for the upcoming election.

Q: Are there any disadvantages to registering to vote?

A: There are generally no significant disadvantages to registering to vote. Concerns about personal data privacy can be mitigated by opting out of the public version of the electoral roll.

Q: What should I do if my credit score does not improve after registering to vote?

A: If your credit score does not improve after registering to vote, review your overall credit profile for other potential issues. Paying bills on time, reducing debt, and maintaining a low credit utilization ratio are critical steps to enhance your credit score.

By registering to vote, you participate in democracy and may also boost your financial health. It’s a win-win scenario that underscores the interconnectedness of civic responsibility and personal financial management.

To Conclude

As the dust settles on this informative journey, it becomes clear that the act of registering to vote extends beyond the realm of civic duty, intertwining with the complex tapestry of your financial well-being. While the notion that casting a ballot could nudge your credit score might seem unconventional, it underscores the intricate ways in which diverse aspects of our lives are interwoven.

So, as you ponder the significance of your vote in shaping the future, remember that the ripple effects of your actions might just reach farther than you’d ever imagined. Register today, not just for democracy’s sake, but for the subtle ways it could bolster your financial standing. Embrace the power of the vote, and let it be a beacon guiding both your civic and financial journey.