In the bustling marketplace of the modern financial world, your credit score acts as a silent yet powerful navigator, charting the course toward your financial goals—or steering you away from them. Nestled within this numeric spectrum is the score of 700, often regarded with curiosity and cautious optimism. But is 700 truly a beacon of fiscal health? What does it unlock, and where might it still fall short? This article delves into the enigmatic realm of credit scores, peeling back the layers to understand what having a score of 700 really means for your financial journey. Join us as we explore how this three-digit number influences everything from securing a loan to the interest rates on your credit card, and what steps you can take to harness its full potential.

Table of Contents

- Unlocking the Mysteries of a 700 Credit Score

- The Real Benefits and Disadvantages of a 700 Credit Score

- Factors Influencing Your Credit Score’s Strength

- Practical Steps to Improve a 700 Credit Score

- Q&A

- In Conclusion

Unlocking the Mysteries of a 700 Credit Score

A credit score of 700 often sits at the tipping point between average and excellent. But what does this number really signify, and how does it unlock financial opportunities? To unravel the enigma, let’s delve deep into the factors that shape this pivotal score, and what it means for your financial journey.

Firstly, a score of 700 is often considered a solid benchmark for healthy credit. Holding steady in the “good” range, it opens doors to more favorable interest rates and loan approvals, yet it stops short of the elite tier scores of 750 and above. Understanding this can be critical in leveraging your financial strategy.

So, what influences your credit score? Here are some of the key contributing factors:

- Payment History: Timely payments account for about 35% of your score. Consistent payment behavior showcases reliability.

- Credit Utilization: This refers to the percentage of your credit limit that you’re using. Ideal utilization should be below 30%.

- Credit History Length: Older accounts contribute positively, demonstrating longstanding credit management.

- New Credit Inquiries: Frequent credit checks can signify high-risk behavior. Limit your hard inquiries.

- Credit Mix: A diverse mix of credit types, such as credit cards, mortgages, and personal loans, can enhance your score.

To put these factors in perspective, consider the following table:

| Factor | Impact on Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit History Length | 15% |

| New Credit Inquiries | 10% |

| Credit Mix | 10% |

Armed with this understanding, navigating the financial landscape becomes more intuitive. For instance, knowing that credit utilization plays a significant role empowers you to keep balances low. In parallel, maintaining punctual payments and refraining from frequent credit checks are crucial steps to sustaining a healthy score.

Moreover, a score of 700 offers a gateway to better financial products. You might find more attractive credit card offers with rewards and perks, lower interest rates on loans, and a stronger negotiating position for renting apartments or getting utility services.

For those aspiring to elevate their score from 700 to the excellent range, a few actionable tips can make all the difference. Regularly checking your credit report for inaccuracies, keeping old accounts open to lengthen your credit history, and considering a secured credit card for building credit can be transformative strategies.

Ultimately, understanding the anatomy of a 700 credit score and its implications can empower you to make savvy financial decisions. It’s not just about the number; it’s about the doors it can open and the opportunities it can unlock.

The Real Benefits and Disadvantages of a 700 Credit Score

A credit score of 700 can be seen as a pivotal point in the financial world. Falling within the “good” range, it opens doors to various financial opportunities, but it comes with its own set of trade-offs.

Advantages of a 700 Credit Score:

- Competitive Interest Rates: With a score of 700, you’re likely to receive comparatively lower interest rates for loans and credit cards.

- Better Loan Approval Chances: Lenders see a 700 credit score as reliable, improving your chances of getting approved for both small and large loans.

- Rental Approval: Landlords often check credit scores during rental applications, and a score of 700 can make securing a rental home or apartment easier.

- Credit Card Offers: You’ll have access to a wider range of credit card options, including those with better rewards and benefits.

- Insurance Premiums: Many insurance companies consider credit scores when determining policy rates, and a higher score can potentially lower your premiums.

While a 700 credit score brings multiple advantages, it’s essential to be aware of its limitations.

Downsides of a 700 Credit Score:

- Limited Access to Best Rates: While good, a score of 700 doesn’t offer the most competitive rates and terms that higher scores (750 and up) can unlock.

- Not Immune to Rejections: Some premium financial products still require higher scores, which means you might face rejections for elite cards or loans.

- Higher Standards: As you move closer to excellent credit tiers (800+), the standards for maintaining or improving your score become more stringent, with any slip-ups potentially having a larger negative impact.

To provide a clearer view, consider the following comparison of how a 700 credit score stacks up against other ranges:

| Credit Score Range | Approval Chances | Interest Rates |

|---|---|---|

| 300-579 | Very Low | Very High |

| 580-669 | Fair | High |

| 670-739 | Good | Moderate |

| 740-799 | Very Good | Low |

| 800-850 | Excellent | Very Low |

Just as a 700 credit score provides multiple benefits, maintaining or improving it requires continuous responsibility. Staying on top of payment schedules, keeping debt levels manageable, and regularly reviewing your credit reports can ensure that you not only maintain but potentially elevate your score.

Ultimately, a 700 credit score offers more positives than negatives, positioning you favorably in various financial scenarios. However, striving for higher scores can unlock even greater benefits, all while being mindful of the pitfalls that can accompany even a “good” credit rating.

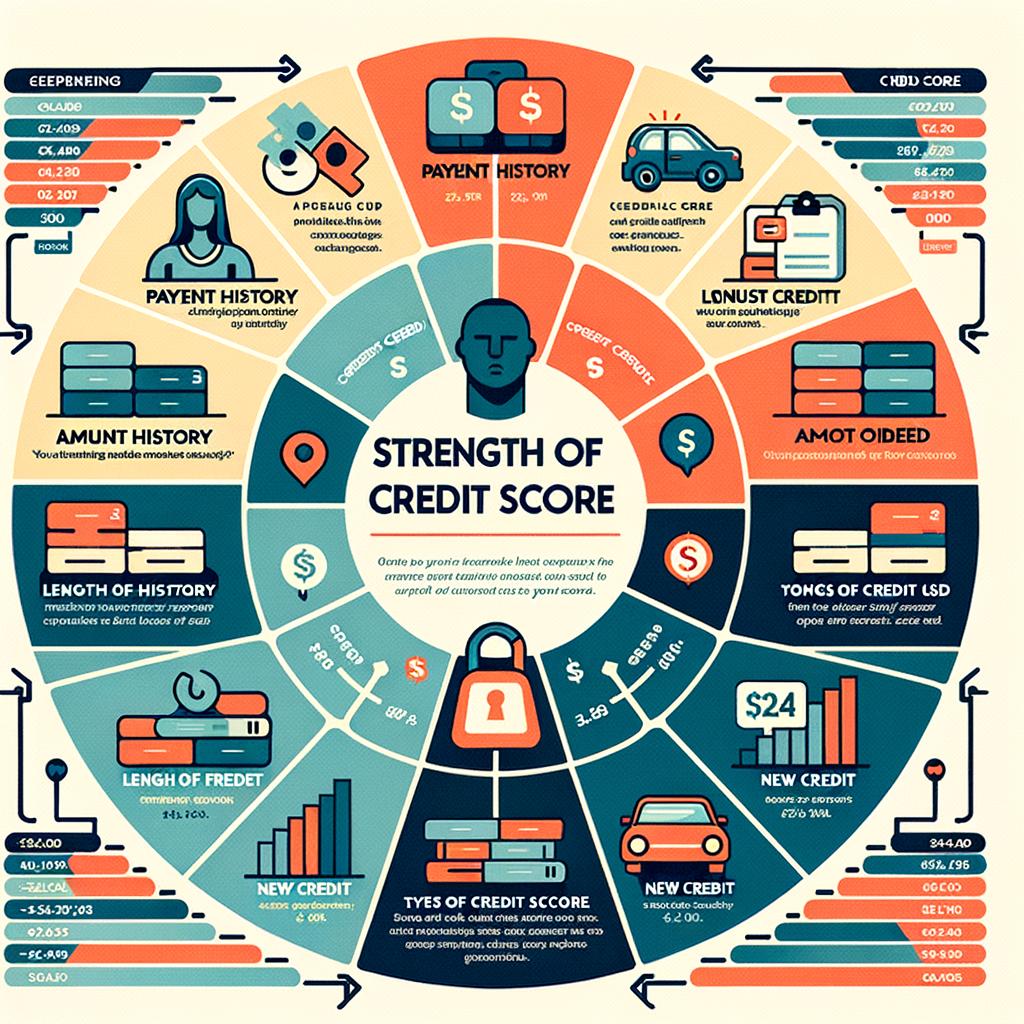

Factors Influencing Your Credit Score’s Strength

Understanding what elements contribute to your credit score is crucial for maintaining or improving your financial health. While it’s easy to get caught up in the numbers, focusing on the contributory factors will give you better control over your credit score’s fortitude.

Payment History

Your payment history is the bedrock of your credit score. Late payments, missed payments, and defaults can significantly drag down your score. Consistently paying your bills on time demonstrates reliability to lenders, making you a lower-risk borrower. Conversely, even a single missed payment can blemish your track record for years.

Credit Utilization

Credit utilization, which is the ratio of your credit card debt to your credit limits, also weighs heavily on your score. Aim to keep your credit utilization below 30% to appear fiscally responsible. Higher utilization rates suggest financial distress, undermining your credit profile.

Length of Credit History

The length and age of your credit history play a role in evaluating your creditworthiness. Long-standing accounts demonstrate stability and provide long-term data for lenders to assess your risk. Younger accounts or frequent closures can introduce instability into your credit report.

Credit Mix

Having a diverse array of credit accounts, such as credit cards, mortgages, and auto loans, can work in your favor. A well-balanced mix of credit types suggests that you can manage different types of credit responsibly. Conversely, relying heavily on just one type of credit can indicate limited financial experience.

New Credit Inquiries

Each time you apply for new credit, it results in a hard inquiry on your credit report. Frequent hard inquiries within a short period can be seen as a red flag, signaling that you may be desperate for credit. On the other hand, soft inquiries, like those for pre-approved offers, don’t affect your score.

Derogatory Marks

Derogatory marks such as bankruptcies, liens, or accounts in collections can have a severe negative impact. These marks stay on your report for several years, making it imperative to avoid actions that might lead to them. Clearing any outstanding debts and ensuring that no accounts go into collections can help you maintain a sound credit profile.

| Factor | Impact on Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit Inquiries | 10% |

Mastering these factors can lead to a robust credit score, paving the way for better loan terms, lower interest rates, and a more secure financial future. Focus on these elements to ensure your credit score reflects your true financial capabilities.

Practical Steps to Improve a 700 Credit Score

Even with a credit score of 700, there is always room for improvement. Enhancing your credit score opens the door to better loan terms, lower interest rates, and more financial opportunities. Here are some practical steps you can take:

Regularly Check Your Credit Report

To start, make it a habit to review your credit report regularly. This ensures that all the information being reported is accurate.

- Dispute Errors: If you find any inaccuracies, dispute them promptly with the credit bureau.

- Look for Fraud: Regular checks can help you spot any signs of identity theft or fraud early.

Timely Bill Payments

Paying bills on time shows lenders that you’re reliable, positively impacting your score. Prioritize paying all your dues, including utility bills, on or before the due date.

- Set Reminders: Use your phone or calendar reminders to notify you of upcoming payments.

- Auto-Pay: Set up automatic payments for recurring bills to ensure they’re always paid on time.

Reduce Credit Card Balances

Having high outstanding balances on your credit cards can bring down your score. Aim to reduce these balances to enhance your credit health.

| Strategy | Action |

|---|---|

| Snowball Method | Pay off the smallest balance first, then move to the next smallest balance. |

| Avalanche Method | Focus on paying off the highest interest rate balances first. |

Avoid Opening Unnecessary New Credit Lines

Each time you apply for new credit, a hard inquiry is conducted, which can temporarily lower your score. Be selective and strategic about opening new credit accounts.

- Research: Before applying, research the terms and conditions of the new credit line.

- Space Out Applications: Avoid applying for multiple credit accounts in a short period.

Increase Your Credit Limits

Requesting a higher credit limit on an existing card can help lower your credit utilization ratio, thus improving your score. However, use this extra credit wisely and avoid increasing your spending.

- Call Your Issuer: Contact your credit card issuer to request a limit increase based on your payment history.

- Maintain Low Utilization: Even with a higher limit, aim to keep your utilization below 30%.

Diversify Your Credit Mix

Having a varied credit mix can positively impact your credit score. If you only have credit card debt, consider adding a different type of credit, such as a personal loan or an auto loan, to your profile.

- Research Loan Options: Look into different loan types and their impact on your credit.

- Be Cautious: Only take on new credit if you can manage additional debt responsibly.

Maintain Long-Term Accounts

The age of your credit accounts plays a role in your overall credit score. Keeping long-standing accounts open and active can positively influence your score.

- Don’t Close Old Accounts: Even if you don’t use them frequently, keeping old accounts open can be beneficial.

- Use Sparingly: Make small, regular purchases and pay them off to keep the account active.

Following these steps not only helps improve your financial health but also prepares you for greater financial opportunities in the future. Start taking these actions today and see the positive impact on your credit score!

Q&A

Q: What factors contribute to a credit score of 700?

A: A credit score of 700 is typically achieved through a mix of responsible financial behaviors. This includes timely payments of bills and debts, maintaining a low credit utilization ratio, having a healthy mix of credit types (like credit cards, loans, etc.), and minimizing hard inquiries on your credit report. Longevity of your credit history also plays a role.

Q: How does a credit score of 700 compare to other credit score ranges?

A: A 700 credit score falls in the “good” range, which usually spans from 670 to 739. It’s a step below “very good” (740-799) and “excellent” (800+), but well above the “fair” range (580-669) and the “poor” range (300-579). This means borrowers with a 700 score often qualify for better interest rates and financing options than those in the lower ranges, though not necessarily the very best terms available.

Q: What can someone with a 700 credit score expect when applying for loans?

A: With a 700 credit score, you’re likely to be approved for most loans, including mortgages, auto loans, and personal loans. However, while you might not get the absolute lowest interest rates reserved for those with ”very good” or “excellent” credit, you will still find competitive rates that make borrowing cost-effective. Lenders see a 700 score as a strong indicator of financial responsibility.

Q: Are there specific benefits to having a 700 credit score?

A: Absolutely. Some key benefits include access to better interest rates and loan terms, higher credit limits, and better negotiating power when it comes to mortgages and other forms of credit. Additionally, a good credit score can lead to lower insurance premiums and improved chances of renting properties as it reflects well on your financial reliability.

Q: What steps can be taken to improve a 700 credit score to an excellent rating?

A: To elevate a 700 credit score to an “excellent” rating (800+), you should continue to pay all bills and debts on time, regularly review your credit report to spot and dispute any errors, keep your credit utilization below 30%, and avoid closing old accounts. Additionally, minimizing new credit applications and maintaining a diverse mix of credit types will further bolster your score over time.

Q: How long does it take to move from a 700 to an excellent credit score?

A: Timeframes vary based on individual financial habits and circumstances. For some, it can take as little as a few months to a couple of years if they consistently engage in positive credit behaviors. Persistence and patience are key as consistent, small improvements compound to generate significant credit score boosts over time.

Q: Does having a 700 credit score impact opportunities beyond borrowing?

A: Yes, a 700 credit score can influence various aspects of life beyond borrowing. For instance, insurance companies often use credit scores to set premiums, and employers in some industries may consider credit scores during hiring processes. It can also impact rental applications; landlords frequently review credit scores to assess the reliability of potential tenants.

Q: Is it possible for a 700 credit score to decrease, and what can trigger a drop?

A: Certainly, a 700 credit score can drop if financial management practices decline. Missed or late payments, high credit card balances, closing old accounts, multiple hard inquiries in a short period, and maxing out credit can all negatively impact your score. It’s important to continually monitor and manage your credit to maintain or improve your score.

In Conclusion

As we close our exploration into the realm of credit scores, we find ourselves wiser and more equipped to navigate the labyrinthine pathways of financial prowess. The story of a 700 credit score is one of balance and achievement, straddling the fine line between stability and aspiration. While it opens doors to numerous opportunities, it also leaves room for ambition, for climbing higher on the rungs of the credit ladder.

Understanding the intricate dance of credit scores—where each number tells a tale of trust and responsibility—empowers us to make informed decisions. It is through this lens that we see how our financial choices ripple through our credit reports, shaping our future possibilities.

So, as we bid adieu to this chapter, let it serve as a reminder that no financial narrative is static. With knowledge as our compass and prudent choices as our co-pilot, the journey from good to great is not just a distant dream but an attainable reality. Here’s to the next steps on your financial voyage, where every credit score is yet another plot point in your unfolding story.