Navigating the world of credit can often feel like traversing a labyrinth, especially when past financial missteps obscure your path. However, the dawn of June 2024 brings a beacon of hope for those seeking to rebuild their credit. With strategic choices and informed decisions, even the most seemingly insurmountable credit challenges can be overcome. In this article, we journey through the myriad options available, shedding light on the best credit cards tailored specifically for bad credit. Whether you’re seeking to mend a fractured financial history or simply striving to establish a sturdy credit foundation, our carefully curated selection aims to illuminate the way forward, empowering you with the tools to step confidently into a brighter financial future.

Table of Contents

- Top Picks for Rebuilding Your Credit

- Low Interest Rates and No Annual Fees: Ideal Cards for Tight Budgets

- Secured vs. Unsecured: Understanding Your Options

- Maximizing Rewards Even with Bad Credit

- Q&A

- Wrapping Up

Top Picks for Rebuilding Your Credit

Rebuilding your credit can feel like a daunting task, but with the right tools, it becomes significantly more manageable. Here we’ve curated a list of top credit cards tailored specifically for individuals with bad credit, available in June 2024. These cards not only help you rebuild credit but also come with various perks to make the journey smoother and more rewarding.

- Discover it® Secured Credit Card

This card is one of the top choices for those looking to rebuild credit while earning rewards. It requires a security deposit, which serves as your credit line, but offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, plus 1% on all other purchases.

- OpenSky® Secured Visa® Credit Card

OpenSky doesn’t require a credit check, making it an excellent option for those who have faced credit challenges. The card reports to all three major credit bureaus, helping you build or rebuild your credit history over time.

| Credit Card | Annual Fee | Best For |

|---|---|---|

| Discover it® Secured | $0 | Cash Back Rewards |

| OpenSky® Secured Visa® | $35 | No Credit Check |

Credit One Bank® Platinum Visa® for Rebuilding Credit

This unsecured card is another great option, designed specifically for those looking to rebuild their credit. It offers 1% cash back on eligible purchases including gas, groceries, and services like mobile phone, internet, cable and satellite TV. Additionally, this card provides free access to your credit score, making it easier to track your credit-building progress.

Capital One® Platinum Credit Card

With no annual fee, this card is ideal for anyone with fair credit seeking an unsecured option. As a cardholder, you can be automatically considered for a higher credit line in as little as six months, providing a great opportunity to boost your credit score when used responsibly.

Petal® 2 “Cash Back, No Fees” Visa® Credit Card

The Petal® 2 card stands out with its no fees policy – no annual fee, late payment fee, or international fees. It’s an excellent choice for those who want to build their credit without worrying about hidden costs. The card also offers 1% to 1.5% cash back on eligible purchases.

| Credit Card | No Annual Fee | Cash Back |

|---|---|---|

| Credit One Bank® Platinum Visa® | X | 1% |

| Petal® 2 Visa® Credit Card | X | 1% – 1.5% |

Each of these credit cards offers unique benefits tailored to those striving to rebuild their credit. Whether it’s through secured deposits, cash back rewards, or minimal fees, these top picks are designed to support and accelerate your journey toward better credit.

Low Interest Rates and No Annual Fees: Ideal Cards for Tight Budgets

For consumers dealing with bad credit, finding a credit card that doesn’t impose heavy fees or high-interest rates is crucial. Such cards can provide a much-needed financial lifeline while working to rebuild your credit score. Here are some top options you should consider if you’re operating on a tight budget.

<p>One key feature to look for in credit cards suitable for bad credit is a combination of <strong>low interest rates</strong> and <strong>no annual fees</strong>. These features help keep costs down, allowing you to focus on timely repayments and improving your credit standing. Here are some standout cards that tick these essential boxes:</p>

<ul>

<li><b>Card A:</b> Perfect for those who want basic credit-building features without any frills. It offers a surprisingly low APR, making it easier to manage even if you're unable to pay off the full balance each month.</li>

<li><b>Card B:</b> Another excellent option, especially if you’re wary of annual fees. This card provides an introductory period with 0% APR on purchases and balance transfers for six months, giving you room to breathe as you commit to financial recovery.</li>

<li><b>Card C:</b> Known for its user-friendly terms, this card not only waives the annual fee but also comes with minimal charges for late or over-limit fees, helping you stay on track without unexpected costs.</li>

</ul>

<p>Moreover, some of these cards offer additional features that provide extra value. For example, certain cards may include:</p>

<ul>

<li>Cashback rewards on essential purchases</li>

<li>Fraud protection services to safeguard your account</li>

<li>Free credit score monitoring tools to help you track your progress</li>

</ul>

<p>Here’s a comparative overview of these cards to help you decide:

</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Card</th>

<th>Annual Fee</th>

<th>APR</th>

<th>Bonus Features</th>

</tr>

</thead>

<tbody>

<tr>

<td><b>Card A</b></td>

<td>$0</td>

<td>15.24%</td>

<td>Low Foreign Transaction Fees</td>

</tr>

<tr>

<td><b>Card B</b></td>

<td>$0</td>

<td>Intro 0% for 6 Months</td>

<td>Balance Transfer Option</td>

</tr>

<tr>

<td><b>Card C</b></td>

<td>$0</td>

<td>16.99%</td>

<td>Free Credit Monitoring</td>

</tr>

</tbody>

</table>

<p>Focusing on low-interest rates and no annual fees doesn't mean you have to sacrifice security. Many of these cards also come with robust protection features like fraud liability protections and real-time alerts for any suspicious activity. This ensures you are not only building your credit but also doing so safely.</p>

<p>Whether you're just starting to rebuild your credit or looking to sustain your financial recovery, the right card can make all the difference. By opting for credit cards with low interest rates and no annual fees, you'll minimize your financial risks and create a smoother path toward a better credit score.</p>

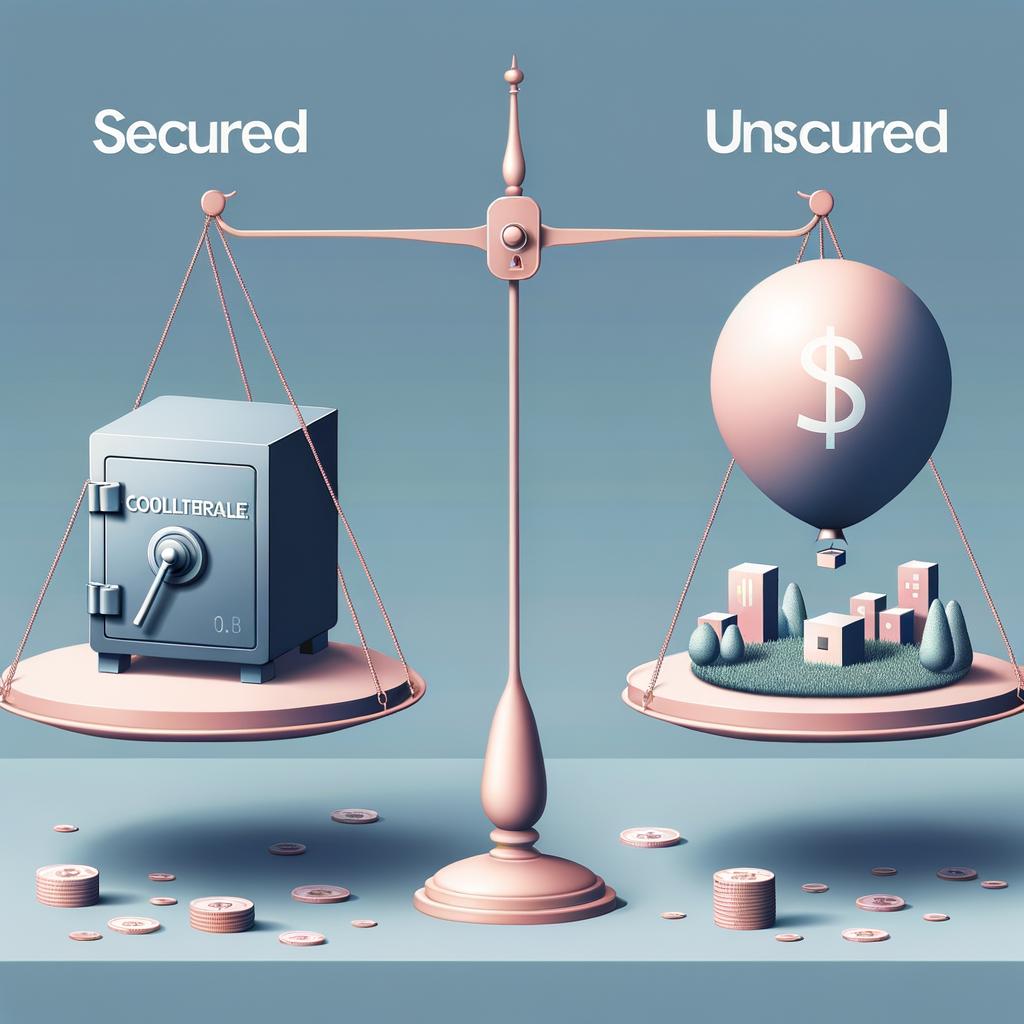

Secured vs. Unsecured: Understanding Your Options

Choosing the right type of credit card when you have bad credit can be daunting, especially when faced with the decision between secured and unsecured options. Each has its own set of benefits and potential drawbacks, and understanding these can help you make a more informed decision.

Secured Credit Cards: A Safety Net

Secured credit cards require a cash deposit as collateral, which typically serves as your credit limit. This deposit reduces the risk for card issuers, making these cards accessible even if your credit history isn’t stellar.

Pros of Secured Credit Cards:

- Easier Approval: With reduced risk for the lender, approval rates are higher for those with poor credit.

- Opportunity to Build Credit: Regular, responsible use and timely payments can help improve your credit score.

- Conversion Options: Many secured cards offer the chance to convert to an unsecured card after a period of on-time payments.

Cons of Secured Credit Cards:

- Initial Deposit Requirement: The need for a cash deposit can be a barrier for some applicants.

- Generally Lower Credit Limits: Credit limits tend to be lower due to the deposit-based structure.

- Possible Fees: Some secured cards come with high fees, which can add up over time.

Unsecured Credit Cards: No Collateral Needed

Unsecured credit cards don’t require an upfront deposit, but qualifying with bad credit can be more challenging. These cards often come with higher interest rates and fees to offset the risk taken by the issuer.

Pros of Unsecured Credit Cards:

- No Deposit Required: You won’t need to tie up your cash in a security deposit.

- Wide Range of Options: More choices are available, from basic cards to those with rewards programs.

- Higher Credit Limits: Typically offer higher credit limits compared to secured cards.

Cons of Unsecured Credit Cards:

- Harder to Qualify: Tougher approval criteria can make these cards harder to obtain with bad credit.

- Higher Interest Rates and Fees: These often come with higher APRs and fees, which can be costly if you carry a balance.

- Potential for More Debt: Easier access to credit increases the risk of accruing more debt if not managed responsibly.

Comparison Table: Secured vs. Unsecured

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Approval Odds | Higher | Lower |

| Initial Deposit | Required | Not Required |

| Credit Limit | Lower | Higher |

| Interest Rates | Generally Lower | Higher |

| Fees | Can be Higher | Typically Higher |

Making the Right Choice

The best choice ultimately depends on your personal financial situation and goals. If you have the funds for a security deposit and aim to rebuild your credit slowly and reliably, a secured card might be your best bet. Conversely, if you prefer no upfront costs and are confident in managing your credit responsibly despite higher fees and interest rates, an unsecured card could be the way to go.

Remember, with either option, responsible use is key to improving your credit score over time. Whichever route you choose, aim for timely payments and keep your balance low relative to your credit limit. This disciplined approach will pave the way to better credit opportunities in the future.

Maximizing Rewards Even with Bad Credit

Even if you have less-than-stellar credit, it doesn’t mean you have to forgo rewards. Many credit card issuers are now offering cards specifically designed for those with poor credit, complete with attractive rewards programs and benefits. Here’s how you can make the most out of them:

First and foremost, look for cards that offer cash back on everyday purchases. Grocery stores, gas stations, and some dining locations are common categories where you can earn rewards. A modest 1-2% return on your expenditures can quickly add up, especially for routine expenses.

Secured Credit Cards form another excellent option. Although these require a security deposit, many of them come with rewards programs that are identical to or closely match those of unsecured cards. Plus, they provide a pathway to improve your credit score with responsible use. Here are some examples of secured cards with decent rewards:

| Card | Rewards | Notes |

|---|---|---|

| OpenSky® Secured Visa® | 1% on all purchases | No credit check required |

| Discover it® Secured | 2% at gas stations and restaurants | Automatic reviews starting at 7 months |

Another strategy is to leverage sign-up bonuses. While these offers might seem less rewarding for bad credit cards, you can still find promotions such as $50-$100 after meeting a modest spending threshold, often within the first three months. Always read the fine print to ensure the benefits outweigh any fees associated with the card.

Utilizing cards with no annual fees is another simple way to maximize your rewards. Some credit cards may offer appealing rewards but charge high annual fees that can eat into any cash back or points you earn. Opt for a card that provides good rewards with zero or minimal fees.

- Capital One QuicksilverOne: Offers 1.5% cash back on every purchase, every day.

- Credit One Bank Platinum Visa: 1% cash back on eligible purchases including gas, groceries, and internet services.

Also, consider credit cards that offer rewards for specific types of spending that you do regularly. Some cards provide extra points or cash back for travel, streaming services, or utility bills. By choosing a card that aligns with your spending habits, you can maximize your rewards without altering your budget.

always remember to build and use your credit wisely. Paying your bills on time and keeping your credit utilization low will not only help you earn rewards but will also steadily improve your credit score. Over time, this opens the door to even better credit card offers and higher rewards potential.

even with bad credit, there are ample opportunities to earn valuable rewards. By choosing the right card and using it responsibly, you can turn everyday spending into tangible benefits while working towards better financial health.

Q&A

Q&A: Best Credit Cards For Bad Credit Of June 2024

Q: What makes a credit card suitable for individuals with bad credit?

A: A credit card tailored for bad credit typically offers accessible approval criteria and features that help in rebuilding credit. These cards often come with lower credit limits and may require a security deposit. They report to major credit bureaus, allowing cardholders to improve their credit scores with responsible use.

Q: Can you highlight some top picks for the best credit cards for bad credit in June 2024?

A: Certainly! Among the top choices for June 2024 are:

-

Rebuild Secure Card: This card requires a refundable security deposit and provides the opportunity to increase your credit limit after consistent on-time payments.

-

FreshStart Platinum: No security deposit is needed, and it comes with rewards for everyday purchases, making it a popular choice for those starting over.

-

SteadyCredit Classic: Known for its flexible credit criteria and educational resources to assist in credit management, it’s ideal for those needing guidance.

Q: Are there any particular benefits of these cards that stand out?

A: Each card offers unique advantages:

- Rebuild Secure Card: Offers graduated credit line increases.

- FreshStart Platinum: Features cashback rewards, which is rare for cards in this category.

- SteadyCredit Classic: Provides free access to your credit score and credit-building tips.

Q: What are the fees associated with these credit cards for bad credit?

A: Fees vary, but here are some typical charges:

- Rebuild Secure Card: Annual fee around $39, security deposit starts at $200.

- FreshStart Platinum: No annual fee, but interest rates can be higher.

- SteadyCredit Classic: Annual fee of $29, competitive interest rates compared to others in the category.

Q: How can using these cards improve one’s credit score?

A: By making regular, on-time payments and keeping balances low, these cards can significantly improve your credit score over time. The key is responsible usage: avoid maxing out the card and aim to pay more than the minimum payment each month. These actions demonstrate good credit habits to credit bureaus.

Q: Are there any potential downsides to consider when choosing a credit card for bad credit?

A: Yes, several potential drawbacks include higher interest rates, lower credit limits, and possible fees for things like late payments or additional cards. However, if managed wisely, the credit-building benefits can outweigh these costs.

Q: What tips can you offer for selecting the right credit card for bad credit?

A: Look for a card with:

- Low Fees: Minimize added costs.

- Credit Reporting: Ensure it reports to all three major bureaus.

- Growth Potential: Options for credit limit increases or transitioning to an unsecured card.

Read the terms carefully and consider your financial habits to find the best fit for your needs.

Q: Any final advice for those looking to rebuild their credit using these cards?

A: Patience and consistency are key. Use the card regularly but wisely, make payments on time, and stay within your limit. Monitor your credit score and understand that rebuilding credit is a marathon, not a sprint. Stay focused, and over time, you’ll likely see significant improvement.

Wrapping Up

As June 2024 unfolds with its myriad opportunities, finding the right credit card for bad credit can be a pivotal step towards rebuilding and reshaping your financial future. Each card we’ve discussed carries its distinct advantages and unique features, tailored to diverse needs and preferences.

Remember, while navigating the credit landscape may seem daunting, it’s a journey marked by perseverance and informed choices. With diligence and responsible use, these credit cards serve not just as tools of recovery, but as stepping stones to a more secure financial horizon.

Whether you’re aiming to rebuild a fractured credit score or seeking to establish a solid financial foundation, the best card for you is out there, waiting to transform challenges into chances for success. Embrace this new chapter with confidence and clarity, as the path to better credit begins with the choices you make today. So, here’s to informed decisions and brighter financial days ahead.

The future of your credit health awaits—step forward and let your journey towards financial empowerment begin.