In an age where financial precision can unlock a world of opportunities, Fannie Mae has taken a significant step towards democratizing access to essential mortgage tools. Imagine a future where calculating your income for a mortgage application is no longer a maze of confusion and guesswork, but rather an exercise in clarity and simplicity. This vision is now within reach, as Fannie Mae unveils its new offering: a free access income calculation tool. Designed for aspiring homeowners, financial advisors, and lending professionals alike, this tool promises to transform the landscape of mortgage applications, making financial dreams more attainable than ever. Let’s delve into how this innovative resource aims to streamline the often-daunting process of income calculation, bridging the gap between aspiration and reality.

Table of Contents

- Access Made Simple: Unveiling Fannie Mae’s Free Income Calculation Tool

- Empowering Borrowers: How the Tool Enhances Financial Decision-Making

- Navigating the Interface: A Step-by-Step Guide

- Professional Insights: Leveraging the Tool for Optimal Results

- Q&A

- Insights and Conclusions

Access Made Simple: Unveiling Fannie Mae’s Free Income Calculation Tool

In the mortgage and real estate industry, calculating income accurately is crucial for both lenders and borrowers alike. Recognizing the importance of precision and efficiency, Fannie Mae has launched a groundbreaking free income calculation tool designed to simplify the process. This innovation is bound to become a game changer for many professionals in the field.

<p>The tool offers a user-friendly interface that ensures even those with minimal technical skills can navigate it with ease. It breaks down intricate financial data into digestible segments, enabling users to gain clear insights into income potential and financial health. Whether you're a seasoned lender or a first-time homebuyer, this tool tailors the process to suit your needs.</p>

<p><strong>Key Features of Fannie Mae's Income Calculation Tool:</strong></p>

<ul>

<li><b>Automated Calculations</b> – Automate complex calculations, reducing the potential for human error.</li>

<li><b>User-Friendly Interface</b> – Simplifies data entry and offers intuitive navigation for all users.</li>

<li><b>Comprehensive Data Analysis</b> – Delivers precise income insights through thorough data evaluation.</li>

</ul>

<p>This tool leverages sophisticated algorithms to ensure consistent and reliable results. To illustrate, suppose you're dealing with a borrower who has multiple sources of income. The tool can seamlessly consolidate these diverse income streams into a coherent and comprehensive analysis. This not only saves time but also increases accuracy, making loan approval or rejection decisions clearer than ever.</p>

<p>To make the most of this tool, users can refer to the following examples:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Income Source</th>

<th>Monthly Estimate</th>

<th>Annual Estimate</th>

</tr>

</thead>

<tbody>

<tr>

<td>Salary</td>

<td>$5,000</td>

<td>$60,000</td>

</tr>

<tr>

<td>Rental Income</td>

<td>$1,200</td>

<td>$14,400</td>

</tr>

<tr>

<td>Freelance Projects</td>

<td>$800</td>

<td>$9,600</td>

</tr>

</tbody>

</table>

<p>The inclusion of Fannie Mae's tool can streamline the entire mortgage application process for lenders. Firstly, it reduces the time spent on manual calculations, making it possible to service more clients efficiently. Secondly, the consistent accuracy means lenders can place greater trust in their income assessments, ultimately providing borrowers with quicker and more reliable feedback.</p>

<p>For borrowers, the transparency afforded by this tool empowers them to better understand their financial standing. It allows them to see exactly how their income is calculated, offering a clear projection of their borrowing capacity. This clarity can aid in making informed decisions, thus contributing positively to their home-buying journey.</p>

<p>Ultimately, Fannie Mae’s free income calculation tool sets a new standard in financial assessments, promising to foster trust and efficiency at every step of the mortgage process. Embracing technology’s role in simplifying complex tasks, this tool ensures that income calculations are accessible, accurate, and efficient for all stakeholders.</p>

Empowering Borrowers: How the Tool Enhances Financial Decision-Making

Giving borrowers the tools to understand their financial position with precision can make a significant difference in their decision-making process. Fannie Mae’s free income calculation tool is designed to do just that, providing users with a comprehensive and user-friendly way to evaluate their earning potential and loan eligibility.

One of the standout features of this tool is its ability to break down complex income streams. Traditionally, borrowers have struggled with the intricacies of how different income sources, such as freelance gigs, side businesses, or rental incomes, are assessed. This tool simplifies the procedure by utilizing intuitive algorithms that ensure all income types are correctly identified and calculated.

Furthermore, the tool is integrated with a set of dynamic features that help borrowers cross-verify their data across various financial documents. For instance, you can upload pay stubs, tax returns, and bank statements, allowing the tool to provide a holistic view of income patterns. This feature can help in identifying potential discrepancies early on, ensuring that the information provided to lenders is accurate and reliable.

To facilitate ease of use, the tool offers a step-by-step guide that walks borrowers through each stage of the calculation process. For those new to financial documentation, this is particularly beneficial as it highlights what to look for in each document and how to input the data accurately.

Key features include:

- User-friendly interface with easy navigation

- Comprehensive income breakdown

- Document upload and verification process

- Step-by-step input guide

- Real-time error detection

The tool doesn’t just stop at income calculation. It also offers recommendations for improving financial health. For example, based on the calculated income and expense patterns, it might suggest strategies for reducing debt, optimizing savings, or even improving credit scores.

This income calculation tool by Fannie Mae also brings transparency into the borrowing process. Borrowers can have a clear understanding of what lenders see and how decisions are made, thereby minimizing confusion and increasing confidence in the borrowing experience. By giving borrowers direct access to precise income metrics, they can negotiate loan terms more effectively and advocate for themselves in financial discussions.

A notable benefit is the real-time error detection that alerts users to potential issues before they finalize their income report. This helps in avoiding common mistakes that can delay loan approval processes. Below, we’ve summarized the primary benefits of using the tool:

| Feature | Benefit |

|---|---|

| Comprehensive Income Breakdown | Ensures all income types are considered accurately |

| Document Verification | Minimizes errors through cross-document verification |

| Step-by-Step Guide | Makes the tool accessible for users with varied financial knowledge |

| Real-time Error Detection | Avoids common mistakes, speeding up the approval process |

In sum, Fannie Mae’s free income calculation tool empowers borrowers by providing them with the clarity and control needed to make informed financial decisions. It transforms the borrowing experience into a more transparent, efficient, and confident journey.

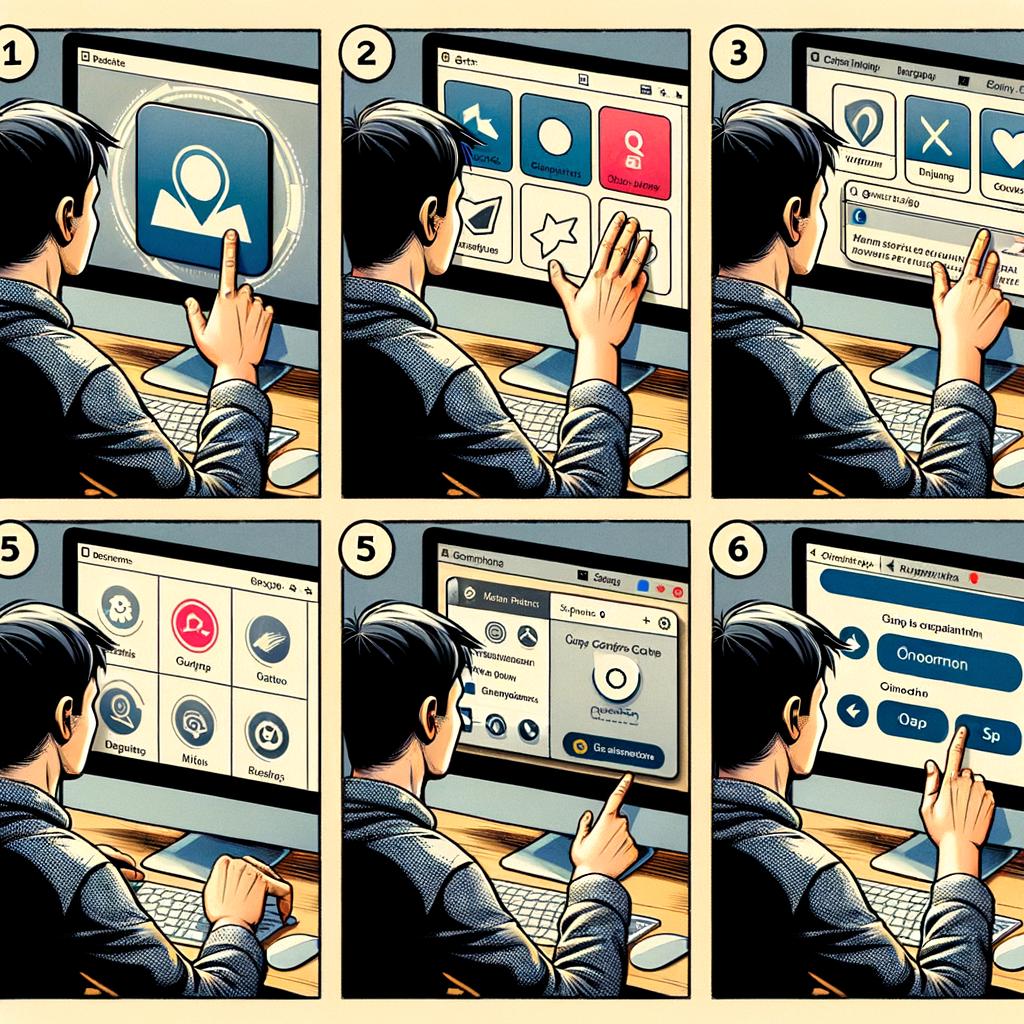

Navigating the Interface: A Step-by-Step Guide

Discovering how to make the most out of Fannie Mae’s free income calculation tool can greatly simplify your workflow. This intuitive tool empowers users by streamlining the income evaluation process, fundamental for mortgage professionals. To help you master this resource, follow our comprehensive guide.

Start by familiarizing yourself with the dashboard. The clean, user-friendly interface divides major functions into clearly labeled sections. Upon logging in, you’ll find a menu bar at the top, featuring options such as “Home”, “Income Calculation”, “Resources”, and “Support”. Hovering over each menu item will display additional sub-options.

To access the income calculation feature, click on the “Income Calculation” tab. This section provides tools for inputting various income types. Easily navigate through different income categories like salary, self-employment income, and rental income. Each category has its own form, ensuring that all necessary details are captured comprehensively.

Your next step is entering *financial data*. The forms are pre-populated with common income fields to guide you effortlessly. For instance, if you’re entering salary information, fill in fields such as “Employer Name”, “Pay Period”, and “Gross Annual Income”. The intuitive design facilitates quick entry while minimizing errors.

Special scenarios often call for more specific details. For self-employed borrowers, the tool enables you to add “Business Income and Expenses” directly from tax returns. Toggle between different fiscal years to account for income variability. The smart automation factors in deductions and adjustments, presenting an accurate output promptly.

A standout feature is the real-time analysis table. As data is input, the tool instantly calculates and displays the results. This table summarizes significant elements such as total income, deductions, and net qualifying income. Here’s a glimpse:

| Category | Details |

|---|---|

| Total Income | $75,000 |

| Deductions | $15,000 |

| Net Qualifying Income | $60,000 |

Enhanced by the intelligent validation system, the tool cross-references entered data against standard qualifying criteria. Any inconsistencies or missing fields trigger a prompt, ensuring all data is accurate and complete before submission. This reduces the likelihood of rework and speeds up the overall process.

Support is readily available under the “Resources” and “Support” tabs. Here, you’ll find user guides, detailed FAQs, and a direct contact form for more personalized assistance. Leveraging these resources can enhance your problem-solving capabilities and deepen your understanding of the tool.

Mastering Fannie Mae’s income calculation tool means you save time, increase accuracy, and enhance customer experiences. Dive in with confidence, equipped with our step-by-step guide, you’ll transform a once tedious process into a seamless, highly efficient task.

Professional Insights: Leveraging the Tool for Optimal Results

With Fannie Mae’s newly available income calculation tool, financial professionals can now harness a powerful resource to streamline and enhance their workflow. The tool, designed to simplify income assessments, promises to add precision and reliability to calculations, a crucial aspect in the loan approval process. Understanding the tool’s capabilities and applications can lead to optimal results.

Maximize Accuracy in Income Calculations

Correctly calculating income is critical for both loan officers and underwriters. Fannie Mae’s tool helps ensure that computations are consistent and accurate, reducing the risk of errors that can occur with manual calculations. With built-in guidelines, the tool automatically flags discrepancies, ensuring that all income sources are properly documented and verified.

- Automated data entry

- Standardized calculation methods

- Real-time validation

Streamlined Data Management

Managing multiple income sources and documentation can be complicated and time-consuming. The tool centralizes data collection and management, enabling users to upload, store, and retrieve documents efficiently. This functionality significantly reduces the time spent on administrative tasks, allowing users to focus on analysis and decision-making.

Enhanced Client Communication

Clear and accurate income calculations improve client communication. The tool generates professional, easy-to-understand reports that can be shared with clients. By providing detailed breakdowns and visual aids, clients can better comprehend their financial status, leading to more informed decisions and smoother loan processes.

Uniform Standards and Compliance

Adhering to industry standards and regulatory requirements is crucial in the financial sector. Fannie Mae’s tool is crafted to meet these standards, ensuring that all income calculations comply with the latest rules and guidelines. This uniformity helps maintain consistency across the board, mitigating the risk of non-compliance.

| Feature | Benefit |

|---|---|

| Automated Calculations | Enhances Accuracy |

| Centralized Data Management | Improves Efficiency |

| Compliance Assurance | Reduces Risks |

Integration with Existing Systems

One of the best aspects of Fannie Mae’s income calculation tool is its ability to integrate seamlessly with existing systems. Whether you use proprietary software or third-party applications, the tool can be adapted to fit into your current technological ecosystem, enhancing its utility and reducing potential disruptions.

Continuous Improvement and Support

Fannie Mae ensures that the tool remains up-to-date with the latest market trends and technological advancements. Regular updates and dedicated support services mean that users can always rely on the tool to meet their evolving needs. Continuous improvement efforts ensure that the tool not only remains relevant but also continues to provide maximum value to its users.

Empowering Financial Professionals

Ultimately, by leveraging this free, cutting-edge tool, financial professionals can offer better service to their clients, drive efficiency in their operations, and bolster their compliance and accuracy. The ability to streamline processes and deliver precise results reinforces the professional’s role as a reliable expert in the financial landscape.

Q&A

Q: What recent initiative has Fannie Mae launched?

A: Fannie Mae has introduced a new initiative to provide free access to an income calculation tool.

Q: What is the primary feature of this tool?

A: The primary feature of this tool is to assist in the accurate calculation of potential borrowers’ incomes, facilitating more informed and efficient lending decisions.

Q: Who stands to benefit from this tool?

A: Mortgage lenders, housing finance professionals, and ultimately, potential homebuyers are the key beneficiaries of this tool.

Q: Why is accurate income calculation important for lenders?

A: Accurate income calculation is crucial for lenders as it ensures they are making lending decisions based on reliable and verifiable financial information, which helps in reducing the risk of defaults and enhancing the overall stability of the housing market.

Q: How does this initiative align with Fannie Mae’s mission?

A: This initiative aligns with Fannie Mae’s mission by promoting sustainable homeownership opportunities and improving the efficiency of the mortgage process, thereby contributing to a healthy housing market.

Q: Is there any cost associated with accessing this income calculation tool?

A: No, Fannie Mae is providing this income calculation tool free of charge.

Q: Can you provide some insight into how this tool operates?

A: The tool uses sophisticated algorithms and data analytics to accurately assess various income sources, ensuring a comprehensive review of a borrower’s financial status. This includes employment income, rental income, bonuses, and other monetary inflows.

Q: What impact might this tool have on the lending process?

A: By streamlining the income verification process, this tool can reduce the time and effort required by lenders, thereby speeding up the loan approval process and potentially improving the borrower experience.

Q: Does this tool apply to all types of loans?

A: While the primary focus is on mortgage loans, the principles behind accurate income calculation can be beneficial for any lending that requires rigorous income verification.

Q: How might potential homebuyers be affected by this initiative?

A: Potential homebuyers may benefit from a faster, more transparent mortgage approval process, potentially making it easier and quicker to buy a home.

Q: What are the broader implications of this tool for the housing market?

A: Broadly, the tool could contribute to a more robust and transparent housing market by enhancing the accuracy of income assessments, thereby promoting better lending practices and fostering trust among all stakeholders.

Q: Is this tool available nationwide?

A: Yes, Fannie Mae has made this tool available nationwide to support lenders across the United States.

Q: How can lenders access this income calculation tool?

A: Lenders can access this tool through Fannie Mae’s official website, where they will find detailed instructions and support for integrating it into their operations.

Q: What future enhancements or expansions does Fannie Mae envision for this tool?

A: While specific future enhancements have not been detailed, Fannie Mae may explore additional features and capabilities that further improve accuracy and user experience, potentially incorporating new technologies and user feedback.

Q: How has the lending community responded to this initiative so far?

A: Early responses from the lending community indicate a positive reception, with many appreciating the prospect of enhanced efficiency and accuracy in income calculations.

Insights and Conclusions

As we stand on the precipice of a new era in home financing, Fannie Mae’s provision of free access to its income calculation tool is more than just another step forward—it’s a giant leap for aspiring homeowners and financial professionals alike. By demystifying the complexities of income assessment, this innovative tool holds the potential to unlock countless doors, one calculation at a time.

In a world where knowledge truly is power, Fannie Mae’s latest offering invites us all to crunch the numbers with newfound clarity and confidence. So, whether you’re a seasoned mortgage expert or a hopeful homebuyer dreaming of a white-picket future, this is your chance to tap into a wellspring of opportunity. As we navigate this evolving landscape, one thing is certain: with the right tools in hand, there are no limits to what we can achieve.