In an unexpected twist to the student loan landscape, Navient has unveiled a pioneering private student loan forgiveness program, sending ripples through the financial corridors of higher education. The announcement marks a significant milestone, not just for borrowers, but for an entire industry grappling with a myriad of complexities and evolving policies. Meanwhile, other noteworthy developments in the student loans arena are capturing the attention of borrowers and policymakers alike. Join us as we delve into Navient’s groundbreaking move and explore the broader tapestry of student loan news reshaping the future of education financing.

Table of Contents

- The Dawn of Private Student Loan Forgiveness: Navient Paves the Way

- Examining the Impact: How Private Loan Forgiveness Affects Borrowers

- Navigating the New Landscape: Tips for Students and Graduates

- The Bigger Picture: Other Noteworthy Developments in Student Loans

- Q&A

- Concluding Remarks

The Dawn of Private Student Loan Forgiveness: Navient Paves the Way

The groundbreaking initiative launched by Navient is set to make waves in the realm of private student loans. Historically, private student loans have been notably unforgiving, often leaving borrowers with limited options for relief. However, Navient’s new forgiveness program is poised to change that narrative, offering a lifeline to countless individuals laden with educational debt.

Navient’s plan introduces a series of forgiving measures aimed at easing the financial burden on borrowers. Key features of the program include:

- Partial loan forgiveness based on the borrower’s income and financial hardship

- Enhanced repayment terms for those in public service roles

- Comprehensive financial counseling to help borrowers manage and reduce debt

This move towards offering private student loan forgiveness is significant, particularly considering that private loans often lack the same consumer protections as federal loans. Previously, borrowers with private student loans had little recourse, but now Navient is offering a beacon of hope.

The announcement is a nod to the growing recognition of the student debt crisis and its far-reaching impact. While federal loan forgiveness programs have garnered much attention, private loan borrowers often found themselves left out. Navient’s strategy could set a precedent for other lenders to follow, potentially leading to industry-wide reforms.

Eligibility Criteria

Navient has outlined specific criteria for those eligible for its forgiveness program. The eligibility criteria include:

- Borrowers experiencing financial hardship due to unemployment or underemployment

- Borrowers with a history of consistent payments

- Alumni of qualified institutions with loans originating before a designated date

Table: Navient Forgiveness Eligibility Criteria

| Criteria | Requirement |

|---|---|

| Financial Hardship | Proof of unemployment or underemployment |

| Payment History | Documented consistent payments |

| Loan Origination Date | Before specified cut-off date |

When it comes to implementation, Navient is rolling out its program progressively. Interested borrowers are required to apply via Navient’s online portal, where they can also access detailed information on qualifications and processes. The platform is designed to be user-friendly, ensuring a seamless experience for applicants.

The response from the public has been overwhelmingly positive, as this new initiative provides a much-needed relief valve for those struggling with their educational debt. Private student loan forgiveness has the potential to reshape the financial futures of many, offering both immediate benefits and long-term financial stability.

The ripple effect of Navient’s decision may inspire other private lenders to introduce similar programs, driving a collective shift towards more borrower-friendly policies. As Navient paves the way, the dawn of a new era in private student loan forgiveness seems to be rising on the horizon.

Examining the Impact: How Private Loan Forgiveness Affects Borrowers

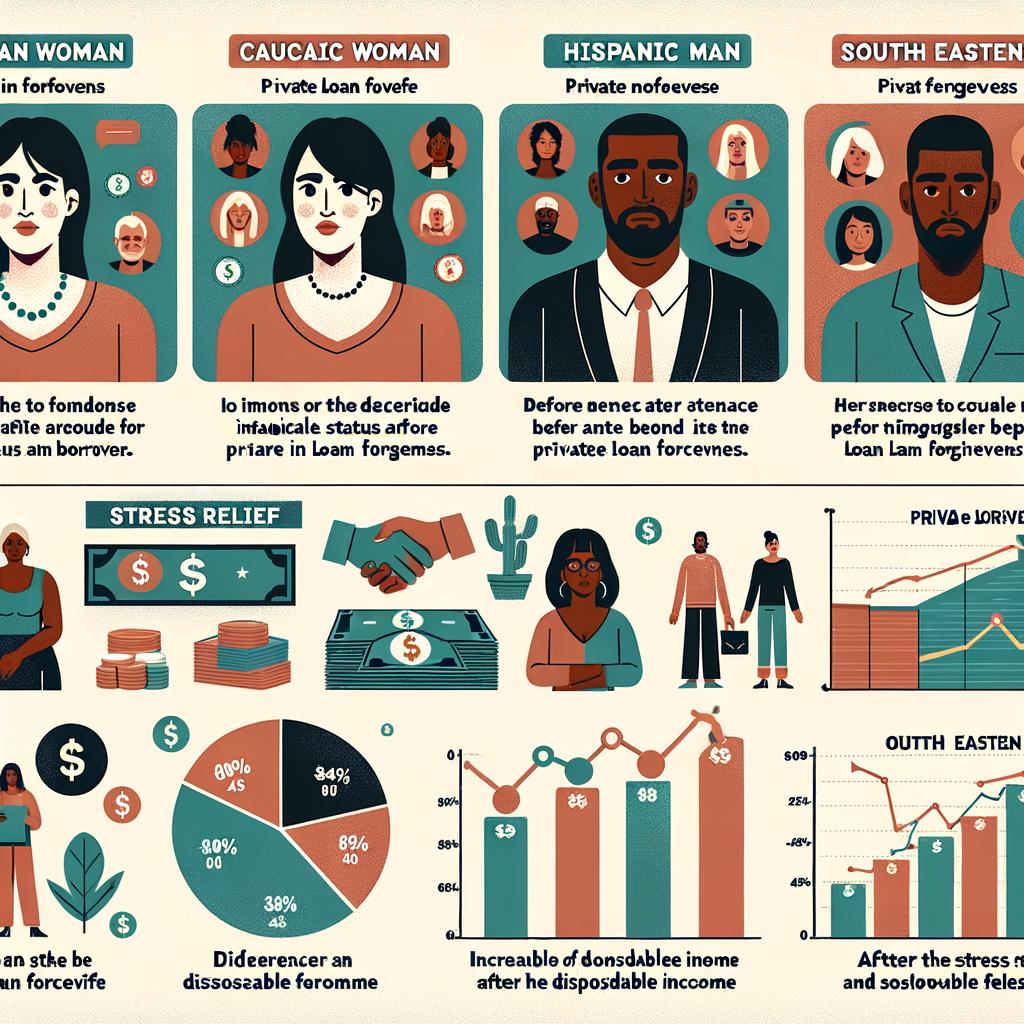

Navient’s recent announcement about private student loan forgiveness marks a significant development in the student loan landscape. This initiative has the potential to bring relief to thousands of borrowers, but it also raises questions about the broader implications on personal finances, credit scores, and future borrowing capabilities.

Forgiveness of private loans can lead to immediate financial relief. Borrowers often juggle multiple loans with varying interest rates, leading to substantial monthly payments. By eliminating a portion of this debt, individuals can free up disposable income, allowing them to invest in other goals such as homeownership, savings, or retirement plans.

This kind of debt relief can also positively impact mental health. The constant burden of student loans can induce stress and anxiety. Knowing that part of the debt has been forgiven can bring a sense of peace and financial security, significantly improving overall well-being.

However, it’s important to analyze how this move might affect credit scores. While loan forgiveness can reduce debt-to-income ratio, closing accounts that were previously in good standing might temporarily dip credit scores. Conversely, for those who struggled with repayments, having a loan forgiven can remove negative entries from their credit history, potentially boosting their credit score over time.

Another consideration is the potential tax consequences. In some jurisdictions, forgiven debt is considered taxable income. Borrowers could face a hefty tax bill in the following year, which might come as an unwelcome surprise.

| Pros | Cons |

|---|---|

| Financial relief | Possible tax implications |

| Improved mental health | Temporary credit score dip |

| Better debt-to-income ratio | Closing of good standing accounts |

As borrowers navigate this new terrain, they should also consider the economic ripple effects. Widespread loan forgiveness could lead to changes in how private lenders operate. Lenders may tighten borrowing criteria or adjust interest rates to mitigate their risks, potentially making it more challenging for future students to obtain loans.

The introduction of private student loan forgiveness by Navient might also spark policy changes. This initiative could serve as a framework or catalyst for broader legislative reform, prompting a re-evaluation of federal loan forgiveness programs and inspiring other private lenders to offer similar relief.

As always, staying informed and understanding the nuances of these changes is vital. Borrowers should consult financial advisors to fully comprehend the benefits and potential drawbacks of loan forgiveness and to devise strategies that align with their long-term financial goals.

Navigating the New Landscape: Tips for Students and Graduates

The student loan landscape has experienced significant shifts recently, especially with Navient introducing private student loan forgiveness. This change brings a wave of hope for many students and graduates struggling with their financial burdens. Understanding the nuances of these new financial opportunities is crucial for anyone navigating their way through higher education or entering the job market with student debt.

1. New Opportunities

Navient’s initiative to forgive private student loans can be a game-changer. It’s essential to keep abreast of the eligibility requirements and the application process. The forgiveness program typically targets those experiencing extreme financial hardship or those who have been in repayment for an extended period.

2. Assess Your Eligibility

To maximize these opportunities, reviewing your loan agreements and contacting your loan servicer to discuss your eligibility is crucial. Keep detailed records of your repayment history, income, and any correspondence with your loan provider. This documentation can be vital in supporting your application for loan forgiveness.

3. Alternative Repayment Plans

If you find yourself ineligible for Navient’s forgiveness program, exploring alternative repayment plans, such as income-driven repayment or consolidation, can provide significant relief. These plans often adjust your monthly payments based on your earnings and family size.

4. Staying Informed

Continuous changes in the student loan sector mean you must stay informed about new regulations and programs. Regularly checking financial news sources, attending webinars, and engaging with community forums can help you stay updated on relevant developments. Consider setting up alerts or subscriptions from reliable financial news platforms.

5. Employment Benefits

Some employers offer student loan repayment assistance as part of their benefits package. When seeking new job opportunities, prioritize employers who provide such perks. This benefit can significantly reduce your financial burden and truncate your loan repayment period.

6. Budgeting and Financial Planning

Budgeting plays a critical role in managing student loans. Establish a detailed monthly budget that accommodates your loan payments while ensuring you meet other financial obligations. Financial apps and software can help track your spending and savings goals efficiently.

7. Seek Professional Guidance

Professional financial advisors can offer tailored advice and strategies for your specific situation. Their guidance can illuminate the best paths for loan repayment, consolidation, and forgiveness options. Don’t hesitate to seek their expertise, especially when dealing with complex financial matters.

| Action | Potential Impact |

|---|---|

| Apply for Loan Forgiveness | Reduce total owed amount significantly |

| Enroll in Income-Driven Repayment | Lower monthly payments based on earnings |

| Explore Employer Assistance | Possible repayment help |

| Engage a Financial Advisor | Customized financial strategy |

The Bigger Picture: Other Noteworthy Developments in Student Loans

While Navient’s new initiative in private student loan forgiveness is making waves, several other developments in the realm of student loans are also worthy of attention. Let’s explore these significant trends.

<p><strong>1. Refinancing Rates Hit Historic Lows</strong></p>

<p>Amidst fluctuating economic conditions, student loan refinancing rates have plummeted to some of the lowest points in recent history. This offers a unique opportunity for borrowers to refinance their student loans at a much more favorable rate, potentially saving thousands. Key financial institutions have reported a marked increase in refinancing applications as students and parents alike seek to capitalize on these benefits.</p>

<ul>

<li>Rate reductions as low as 2.5%</li>

<li>Extended terms for greater flexibility</li>

<li>Increased competition among lenders for better offers</li>

</ul>

<p><strong>2. Expansion of Income-Driven Repayment Plans</strong></p>

<p>The federal government has recently expanded eligibility criteria for several income-driven repayment (IDR) plans. This shift aims to support a broader range of individuals, from recent graduates to mid-career professionals struggling with debt. The new criteria take into account family size and discretionary income, allowing for more manageable monthly payments. Affected borrowers are now navigating a more forgiving landscape, potentially easing long-term financial burdens.</p>

<table class="wp-block-table is-style-stripes">

<thead>

<tr>

<th>Plan Name</th>

<th>Eligibility</th>

<th>Payment Calculation</th>

</tr>

</thead>

<tbody>

<tr>

<td>REPAYE</td>

<td>All borrowers</td>

<td>10% of discretionary income</td>

</tr>

<tr>

<td>PAYE</td>

<td>New borrowers</td>

<td>10% of discretionary income</td>

</tr>

<tr>

<td>IBR</td>

<td>Any borrower</td>

<td>10-15% of discretionary income</td>

</tr>

</tbody>

</table>

<p><strong>3. Automation in Loan Servicing</strong></p>

<p>Technological advancements have significantly influenced loan servicing, introducing more automation into the process. Automated repayment systems, proactive reminders, and enhanced customer service bots are designed to streamline the management of student debts. Borrowers now experience reduced administrative burdens, allowing them to focus more on strategic repayment plans, rather than wrestling with bureaucratic processes.</p>

<p><strong>4. Increased Financial Education Initiatives</strong></p>

<p>There is a growing emphasis on financial literacy among students and new graduates. More universities and colleges are incorporating financial education into their curriculum, helping students understand the complexities of student loans, interest rates, and repayment options. These programs aim to empower individuals with the knowledge required to make informed financial decisions from the outset, potentially reducing the likelihood of future financial distress.</p>

<ul>

<li>Workshops and seminars</li>

<li>Online financial literacy courses</li>

<li>One-on-one counseling sessions</li>

</ul>

<p><strong>5. Employer Student Loan Repayment Assistance</strong></p>

<p>An increasing number of employers are recognizing the value of offering student loan repayment assistance as part of their benefits packages. These programs not only alleviate the financial burden on employees but also serve as an attractive incentive for talent acquisition and retention. Noteworthy companies across various industries are participating, with many planning to expand their contributions in the coming years.</p>

<p>Employee benefits now often include:</p>

<ul>

<li>Direct payment contributions</li>

<li>Matching programs</li>

<li>Flexible repayment terms</li>

</ul>

<p><strong>6. Advocacy for Borrower Protections</strong></p>

<p>Advocacy groups are increasingly vocal in their push for stronger borrower protections. This includes calls for more transparent lending practices, stricter regulations on predatory loans, and improved options for loan forgiveness, especially in cases of fraudulent educational institutions. These advocacy efforts are gradually influencing policy changes at both federal and state levels, promising a more equitable and just lending environment for future students.</p>

Q&A

Q&A on “Navient Debuts Private Student Loan Forgiveness, And Other Student Loans News”

Q: What significant new initiative has Navient recently introduced?

A: Navient has recently introduced a groundbreaking initiative: private student loan forgiveness. This marks a notable shift in the private student loan landscape, offering relief options that were traditionally limited to federal student loans.

Q: How does Navient’s private student loan forgiveness program work?

A: The specifics of Navient’s private student loan forgiveness program involve targeted forgiveness for borrowers who meet certain criteria. While the detailed eligibility requirements have been crafted to address specific financial situations, the program aims to ease the burden on borrowers struggling to repay their private student loans.

Q: Why is Navient offering this program now?

A: The timing of Navient’s decision can be attributed to a greater acknowledgment of the financial strain private student loans place on many borrowers. With increasing advocacy and scrutiny surrounding student loan debt, Navient’s forgiveness program may reflect a broader trend towards providing more comprehensive relief options.

Q: How might Navient’s new program impact the broader student loan industry?

A: Navient’s new initiative could have a ripple effect across the student loan industry. Other private lenders might feel pressured to introduce similar forgiveness programs to remain competitive, potentially leading to a market shift that benefits borrowers struggling with private student loan debt.

Q: Beyond Navient’s news, what other updates are there in the realm of student loans?

A: In addition to Navient’s announcement, there have been several noteworthy developments in the student loan sector. Legislative proposals aimed at overhauling federal student loan policies are gaining traction. Enhanced borrower protections and increased scrutiny of loan servicing practices are also in the spotlight, signaling continued evolution and potential reforms on the horizon.

Q: How should current borrowers respond to these new developments?

A: Current borrowers should stay informed about the latest updates and review their own loan terms and obligations. It’s advisable to consult with financial advisors or loan servicers to understand how these changes might affect their specific situations and to explore any new relief options that become available.

Q: Where can borrowers find more information about Navient’s private student loan forgiveness?

A: Borrowers seeking more details on Navient’s private student loan forgiveness program can visit Navient’s official website or contact their customer service representatives. Additionally, keeping an eye on reputable financial news sources and official announcements will provide ongoing information about this and other student loan developments.

Q: What is the overall significance of these student loan updates for borrowers?

A: The recent updates, especially Navient’s introduction of private student loan forgiveness, underscore a pivotal moment for borrowers. These changes potentially offer significant financial relief and signal more borrower-centric reforms in the student loan sector. For many, this could mean a greater degree of financial stability and reduced stress over loan repayments.

Concluding Remarks

As the landscape of student loans continues to evolve, Navient’s pioneering step into private loan forgiveness marks a significant milestone for borrowers and the industry alike. As we navigate these changing tides, staying informed becomes not just beneficial, but essential. With each development, from groundbreaking forgiveness programs to shifts in federal loan regulations, the future of student debt holds promise and complexity in equal measure. So, as we turn the page on today’s news, let us remain vigilant and hopeful, knowing that every new headline brings us one step closer to understanding, and perhaps remedying, the intricate web of student financing.