In the ever-evolving landscape of business operations, where efficiency and cost-effectiveness dictate success, understanding the true cost of acquiring new equipment is paramount. Enter the Equipment Finance Calculator—a seemingly simple yet powerful tool designed to peel back the financial layers of equipment purchases, leases, and loans. As businesses strive to outmaneuver competitors and stay ahead in their respective industries, the Equipment Finance Calculator emerges as a digital ally, transforming complex financial considerations into clear, actionable insights. Join us as we delve into the mechanics of this indispensable instrument, exploring how it shapes smarter financial decisions and fuels the engines of growth and innovation.

Table of Contents

- Understanding the Basics of Equipment Finance Calculators

- Key Features to Look for in an Equipment Finance Calculator

- How to Use an Equipment Finance Calculator for Accurate Projections

- Expert Tips on Choosing the Right Equipment Finance Calculator

- Q&A

- In Conclusion

Understanding the Basics of Equipment Finance Calculators

In the realm of acquiring new equipment for your business, understanding the importance and functionality of equipment finance calculators can be a game-changer. These tools are designed to give you foresight into your financial commitments, allowing you to make more informed decisions. Equipment finance calculators take into account various factors that affect the overall cost and help you plan accordingly.

An equipment finance calculator typically helps you in estimating the monthly payments you’ll need to make on a loan or lease for equipment. The calculation revolves around several key inputs such as loan amount, interest rate, term length, and residual value. By adjusting these variables, you can get a clear picture of different financial scenarios.

Key Variables:

- Loan Amount: The principal amount you intend to borrow.

- Interest Rate: The percentage of the loan amount charged as interest by the lender.

- Term Length: The duration over which the loan needs to be repaid.

- Residual Value: The estimated value of the equipment at the end of the loan term.

Understanding each of these variables can significantly impact your financing strategy. For instance, a longer term might reduce your monthly payments but could result in paying more interest over time. On the other hand, a higher residual value can lower your monthly payments if you’re leasing equipment, as the final amount to be financed is reduced.

| Variable Name | Description | Impact on Monthly Payment |

|---|---|---|

| Loan Amount | The total amount borrowed for equipment. | Higher loan amount increases monthly payments. |

| Interest Rate | The percentage charged on the borrowed amount. | Higher interest rates increase monthly payments. |

| Term Length | Duration of the financing agreement. | Longer terms decrease monthly payments but may increase total interest paid. |

| Residual Value | Value of the equipment at the end of the financing term. | Higher residual value decreases monthly payments in a lease scenario. |

Another important aspect to consider when using an equipment finance calculator is the type of financing—loan or lease. Loans often come with the benefit of full ownership at the end of the term, whereas leases might offer lower monthly payments and options for upgrading equipment at the end of the term. Tailoring the calculator to reflect these differences can lead to a more accurate financial assessment.

Additionally, equipment finance calculators often include options for different types of equipment. Machinery, vehicles, technology, and medical devices all come with various costs and depreciation rates. Therefore, selecting the right category within the calculator can render more relevant financial projections.

Modern equipment finance calculators are not just confined to simple calculations. Many advanced tools integrate options for down payments, variable interest rates, and even the possibility of tax advantages. Exploring these features can provide you with a comprehensive understanding of your financing situation.

an equipment finance calculator is an invaluable tool that aids in decision-making by considering various financial variables and scenarios. Whether you’re a small business owner looking to lease office equipment or a large enterprise planning to invest in new machinery, using such a calculator can help you navigate the complexities of equipment financing with greater ease and precision.

Key Features to Look for in an Equipment Finance Calculator

When it comes to evaluating your options for financing new equipment, an effective tool to have at your disposal is an equipment finance calculator. Knowing exactly what features to look for can make a world of difference in your decision-making process. Here’s what you should consider:

- User-Friendly Interface: An intuitive layout can save you time and reduce the learning curve. Look for a calculator with a clear, concise design that doesn’t bury critical information under multiple menus.

<li>Detailed Cost Breakdown: Transparency is key. A high-quality calculator should provide a detailed breakdown of costs, including principal, interest, and additional fees. This will offer you a holistic view of your financial obligations.</li>

<li>Customizable Input Fields: Every business is unique, so the calculator should allow for adjustable inputs such as loan amount, interest rate, and term length. Customization can yield a more accurate financial forecast tailored to your specific needs.</li>

<li>Amortization Schedule: Having access to an amortization schedule is essential. This feature should provide a month-by-month breakdown of how each payment progresses, highlighting the evolving balance over the life of the loan.</li>

<li>Comparative Analysis Tools: The best calculators don’t just show you one scenario—they allow you to compare multiple financing options side by side. Whether it's different loan terms or varying interest rates, comparative analysis tools can illuminate the path to the best decision.</li>

<li>Advanced Calculation Options: Look for calculators that let you account for extra payments, late fees, or changes in the financial structure over time. Flexibility in calculations can provide a more comprehensive financial projection.</li>

An effective equipment finance calculator should also offer multiple output formats. Whether you need a printable report, email summary, or CSV export for further analysis, versatile output options are invaluable for sharing and record-keeping purposes.

When making a decision, it’s also crucial to have access to real-time updates. The ability to input real-time rates and immediately see how they impact your costs can help in making timely and informed choices, especially in volatile markets.

The following table provides a comparison of features you might find in top-rated equipment finance calculators:

| Feature | Basic Calculator | Advanced Calculator |

|---|---|---|

| User-Friendly Interface | ✔️ | ✔️ |

| Detailed Cost Breakdown | ❌ | ✔️ |

| Customizable Input Fields | ✔️ | ✔️ |

| Amortization Schedule | ❌ | ✔️ |

| Comparative Analysis Tools | ❌ | ✔️ |

| Advanced Calculation Options | ❌ | ✔️ |

| Multiple Output Formats | ✔️ | ✔️ |

| Real-Time Updates | ❌ | ✔️ |

How to Use an Equipment Finance Calculator for Accurate Projections

Using an equipment finance calculator allows businesses to make informed decisions by providing a clear projection of costs involved. Here’s a step-by-step guide to utilizing this tool for better financial planning.

<p>First, gather all necessary information. This includes the price of the equipment, expected loan term, interest rate, and any additional fees. Having these details on hand will streamline the process and ensure accuracy in your projections.</p>

<p>Input the equipment cost into the calculator. This is the total amount you're planning to borrow. If you're making a down payment, deduct this from the equipment price before entering the final amount. For instance, if the equipment costs $100,000 and you're making a $20,000 down payment, you should enter $80,000.</p>

<p>Next, specify the loan term. Most calculators allow you to choose between months and years. Consider your business's cash flow and select a duration that balances affordability with loan repayment speed.</p>

<p>Set the interest rate. This is usually expressed as an annual percentage rate (APR). The rate may vary depending on the lender and your creditworthiness. An accurate rate will help you understand the true cost of financing.</p>

<p>Include any additional fees. These might cover loan origination, maintenance, or other related charges. Entering these costs ensures that your projections are comprehensive.</p>

<p>Once all inputs are set, click calculate. The calculator will generate detailed projections, including monthly payments, total interest paid, and overall loan cost.</p>

<p>Results might be displayed as follows:</p>

<table class="wp-block-table">

<tr>

<th>Monthly Payment</th>

<th>Total Interest</th>

<th>Total Loan Cost</th>

</tr>

<tr>

<td>$1,500</td>

<td>$12,000</td>

<td>$92,000</td>

</tr>

</table>

<p>These projections are useful for budgeting and making comparisons. You can also adjust variables to see how different terms or rates impact your finances. This flexibility enables you to craft a financing strategy that aligns with your business goals.</p>

<p>By leveraging an equipment finance calculator, you can gain a clearer picture of future financial commitments, thus making decisions with confidence and foresight.</p>

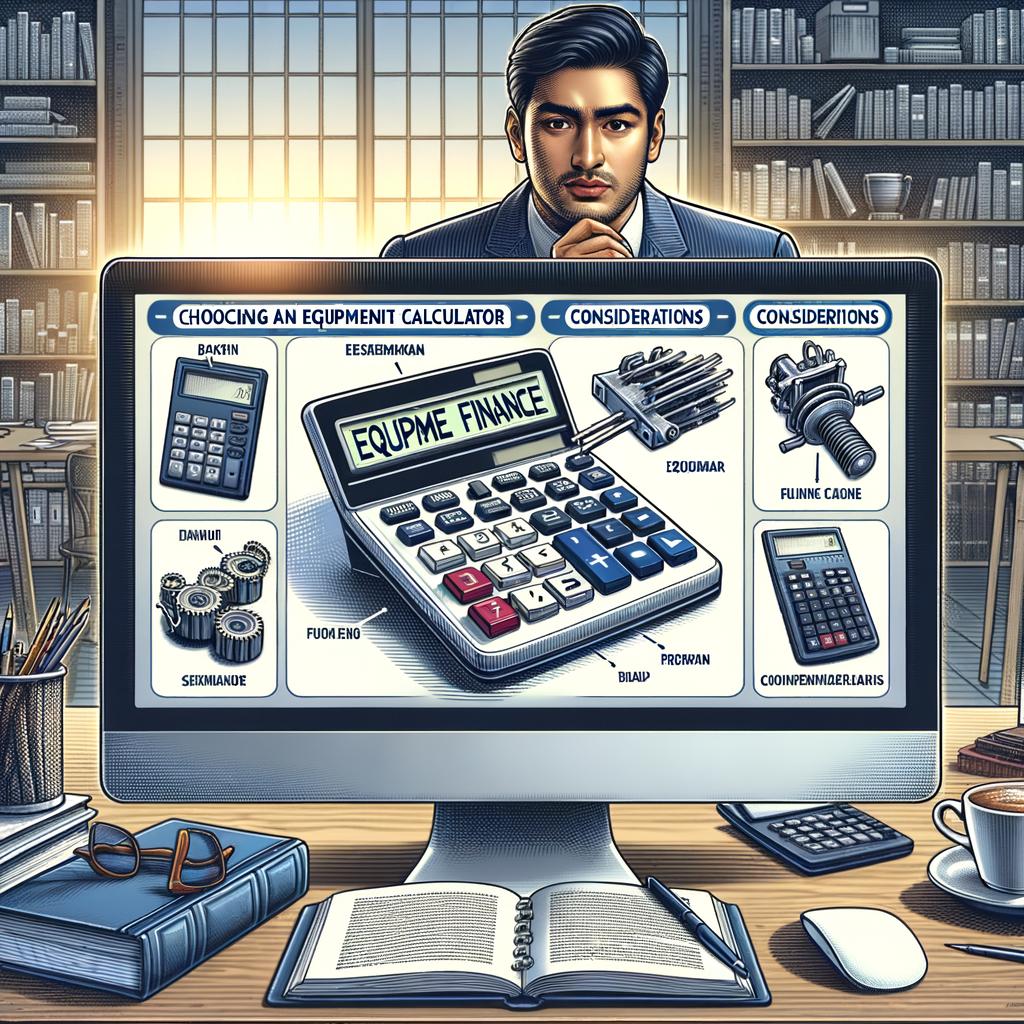

Expert Tips on Choosing the Right Equipment Finance Calculator

Choosing the ideal equipment finance calculator can make the difference between a seamless financing experience and a complicated one. Here are expert tips to guide you through this process:

Understand Your Financial Needs

Before diving into the specifics of calculators, it’s crucial to have a clear understanding of your financial requirements. Different calculators cater to varying needs such as lease vs. loan calculations, down payments, interest rates, and loan terms. Identify what’s most important for your financial decision-making.

Focus on User-friendly Interfaces

A good finance calculator should be easy to use, even for those who might not be financially savvy. Look for calculators that have a simple, intuitive interface with clear instructions. This helps you quickly input data and obtain results without any hassle.

Accuracy and Reliability

Ensure the calculator provides accurate and reliable results. This can often be verified by reading user reviews and expert opinions. An inaccurate calculator could lead to poor financial decisions, so take the time to choose one that’s highly rated for its precision.

Range of Features

While simplicity is key, it’s also helpful to have a calculator with a range of features. Look for options that include:

- Customizable interest rates

- Tax considerations

- Different term lengths

- Early payoff scenarios

Mobile Compatibility

In today’s fast-paced world, having access to financial tools on your mobile device is a necessity. Check if the calculator is mobile-friendly or if there is an app version available. This will allow you to conduct calculations on-the-go, making your life much more convenient.

Integration with Financial Software

If you’re already using financial software or planning to, ensure your equipment finance calculator can integrate with these platforms. This can save time by automatically syncing data, thus minimizing manual input errors. Consider compatibility with software like QuickBooks or Xero.

Cost and Value

Some high-quality calculators might come with a fee, but don’t be deterred if it provides significant value. Compare the free vs. paid options, evaluating the additional features and support offered in paid versions. Sometimes a small investment in a reliable tool can save you a lot in the long run.

Customer Support

Lastly, top-notch customer support is essential, especially if you run into issues. Opt for calculators from reputable providers who offer robust customer support. Check if they provide various support channels such as email, live chat, or phone support to address your queries promptly.

| Feature | Importance |

|---|---|

| Customizable Interest Rates | High |

| Mobile Compatibility | Medium |

| Integration with Financial Software | Critical |

| User-friendly Interface | High |

| Customer Support | Essential |

Following these expert tips, you can choose an equipment finance calculator that perfectly suits your needs and enhances your financial decision-making process effectively.

Q&A

Q&A: Understanding the Equipment Finance Calculator

Q1: What is an equipment finance calculator, and why should businesses consider using it?

An equipment finance calculator is a specialized online tool designed to help businesses estimate the costs associated with financing new equipment. It takes into account various factors such as loan amount, interest rates, loan terms, and potential monthly payments. Businesses should consider using it to make informed financial decisions, streamline budgeting processes, and ensure their investment aligns with their financial strategy.

Q2: How does an equipment finance calculator work?

An equipment finance calculator typically requires users to input specific details about the loan, including the total amount needed, the interest rate offered, and the desired loan term. Once these details are entered, the calculator processes the information and provides an estimate of monthly payments and the total cost of the loan over its duration. This helps businesses understand their financial commitments before proceeding with a purchase.

Q3: What are the benefits of using an equipment finance calculator for small and medium enterprises (SMEs)?

For SMEs, the primary benefits of using an equipment finance calculator include enhanced financial planning, greater transparency in understanding loan commitments, and the ability to compare different financing options quickly. This tool empowers SMEs to make cost-effective decisions that align with their growth objectives and budget constraints.

Q4: Can an equipment finance calculator be used for any type of equipment?

Generally, yes. An equipment finance calculator is versatile and can be used for a wide range of equipment financing needs, whether it’s for heavy machinery, office technology, medical devices, or manufacturing tools. The key is to input accurate information related to the specific equipment to get the most precise financial estimate.

Q5: What information do businesses need to provide when using an equipment finance calculator?

Businesses will need to provide details such as the total cost of the equipment, the interest rate (if known), the proposed loan term (in months or years), and any down payment amount. Some calculators may also ask for additional details like sales tax or insurance costs to give a more comprehensive financial outlook.

Q6: Are there any limitations to using an equipment finance calculator?

While an equipment finance calculator is a valuable tool, it does have some limitations. It provides estimates based on the inputted data and cannot account for all variables in the real-world financing process, such as fluctuating interest rates or additional fees not initially considered. It should be used as a preliminary guide, with final decisions made in consultation with financial advisors or lenders.

Q7: Where can businesses find reliable equipment finance calculators?

Reliable equipment finance calculators are typically available on financial institutions’ websites, equipment vendors’ sites, and specialized financing companies. For the most accurate and relevant results, businesses should use calculators from providers they are considering for their equipment financing needs.

Q8: How can the results from an equipment finance calculator aid in strategic business planning?

The results from an equipment finance calculator can be pivotal in strategic business planning by providing a clearer picture of financial obligations and cash flow impact. By knowing the anticipated monthly payments and overall loan costs, businesses can better allocate resources, plan for future expenses, and avoid overextending their financial capacity, ensuring a balanced and sustainable growth trajectory.

By leveraging the insights provided by an equipment finance calculator, businesses can confidently move forward with their equipment investments, ensuring they make sound financial decisions that support their long-term objectives.

In Conclusion

In the dynamic realm of business, strategy and precision are your steadfast allies. As you navigate the intricacies of equipment procurement, the equipment finance calculator stands as a beacon, illuminating the path to informed decision-making. With its blend of practicality and insight, this tool empowers you to transform numbers into narratives of growth and efficiency. So, whether you’re breaking new ground or scaling towering heights of success, let the equipment finance calculator be your trusted companion, guiding you toward a future where financial clarity and strategic foresight are the cornerstones of your enterprise. Now, armed with knowledge and the right tool, go forth and build the dream that beckons on the horizon.