As we step into 2024, the financial landscape continues to evolve, offering individuals new and exciting opportunities to secure the funds they need for life’s various ventures. Whether you’re planning a home renovation, consolidating debt, or simply seeking to cushion your savings for a rainy day, personal loans remain a trusted resource. But with an array of options at your disposal, how can you uncover the hidden gems that offer the lowest rates? And what exactly does it take to qualify for these financial boons? Join us on an insightful journey as we explore the intricate world of personal loans in 2024, unraveling the secrets to securing the best possible rates and demystifying the qualifications required to unlock these golden opportunities. Dive in and discover how you can make the most of what this year has to offer.

Table of Contents

- Understanding 2024’s Competitive Personal Loan Landscape

- Crucial Criteria for Qualifying for the Best Rates

- Expert Tips for Maximizing Your Eligibility

- Comparing Top Lenders: Who Offers the Lowest APR

- Q&A

- In Conclusion

Understanding 2024’s Competitive Personal Loan Landscape

2024 is shaping up to be an enlightening year for personal loans, with unprecedented competition driving interest rates to exceptional lows. For the savvy borrower, this environment presents an opportunity to secure more affordable financing, but it’s important to stay informed about the qualifications needed to access the best rates.

The key to unlocking these favorable terms lies in understanding what lenders require. Credit scores remain the cornerstone of loan eligibility. The higher your score, the more likely you are to receive a lower interest rate. For example, a FICO score of 750 or above could open doors to APRs as low as 3.5%, while scores between 700 and 749 might see slightly higher rates around 4.5%.

Beyond the credit score, lenders are increasingly looking at your debt-to-income (DTI) ratio. Maintaining a DTI ratio of below 35% can significantly enhance your chances of securing a low-rate loan. This figure represents the percentage of your monthly income that goes towards paying debts. Keeping this ratio in check can be as important as maintaining a high credit score.

Another critical factor is your employment history. Lenders prefer borrowers who have a stable job with steady income. A minimum of two years in the same position or within the same industry can boost your credibility. Consistent earnings provide lenders with the assurance that you can handle the loan repayments without difficulty.

Some lenders may also consider your savings and liquid assets. Having a savings cushion can be an indicator of financial responsibility, potentially leading to more favorable loan terms. A well-funded emergency savings account not only fortifies your financial stability but also signals to lenders your ability to manage your finances prudently.

Additionally, being proactive in paying down existing debts can significantly improve your loan prospects. Each debt paid off reduces your DTI ratio and can have a positive impact on your credit score. Prioritize high-interest debts first, as eliminating these can have the most immediate benefit.

Here’s a table summarizing key factors for qualifying for the lowest personal loan rates in 2024:

| Qualification Factor | Ideal Criterion |

|---|---|

| Credit Score | 750+ for best rates |

| Debt-to-Income (DTI) Ratio | Below 35% |

| Employment History | 2+ years in the same industry |

| Liquid Assets | Significant savings |

consider getting pre-approved for personal loans from multiple lenders. Pre-approval can give you a clearer picture of the rates you might qualify for without affecting your credit score. It allows you to compare offers and select the best option tailored to your financial situation.

the competitive landscape of 2024’s personal loan market offers significant opportunities for consumers. However, to fully benefit from these low rates, it’s essential to meet and ideally exceed lenders’ qualifying criteria. Preparation and financial discipline will be your best allies in securing the most advantageous loan terms.

Crucial Criteria for Qualifying for the Best Rates

When seeking the lowest personal loan rates in 2024, there are several key factors that lenders will scrutinize to determine your eligibility. Knowing these criteria can position you for the best possible rates and save you a significant amount of money over the life of the loan. Here are some crucial aspects you should focus on:

- Credit Score: This is one of the primary factors lenders evaluate. A high credit score indicates that you have been responsible with past credit obligations, making you a low-risk borrower. Generally, a score above 720 will qualify you for the best rates, while scores below 600 might not even meet the minimum requirements for some lenders.

- Income Stability: Lenders want assurance that you have a stable income that allows you to pay back the loan. Consistent employment history and a decent annual income are critical. Some lenders may require you to submit tax returns or pay stubs to verify your earnings.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt obligations to your income. A lower DTI suggests that you effectively manage your debt. Lenders usually prefer a DTI of 36% or less. Higher DTIs may lead to higher interest rates or even disqualification.

| Credit Score Range | Potential Interest Rate |

|---|---|

| 720 – 850 | 3% – 6% |

| 660 – 719 | 6% – 12% |

| 600 – 659 | 12% - 20% |

| Below 600 | 20% and above |

Another crucial element is the loan amount. Borrowing a more specific, smaller amount that’s just what you need can also qualify you for lower rates. Over-borrowing not only increases your financial burden but may also raise red flags for lenders regarding your financial discipline.

Loan term also plays a significant role. Shorter-term loans will generally have lower interest rates compared to longer-term loans. While opting for a shorter-term loan means higher monthly payments, it could save you a sizeable amount in interest over time.

It’s equally important to demonstrate financial stability. This goes beyond just having a steady job. Lenders will consider how long you’ve been employed, your savings, and other assets. The longer you’ve been in a stable financial situation, the more favorably lenders will view your application.

Choosing the right type of lender can also affect your rates. Online-only lenders might offer more competitive rates compared to traditional banks or credit unions. They often have lower overhead costs and more flexible criteria, potentially allowing for better loan terms for qualified borrowers.

Lastly, consider collateral versus non-collateral loans. Secured loans, which require collateral like a car or house, typically come with lower interest rates. Unsecured loans don’t require collateral but generally have higher interest rates. Lenders need to mitigate the risk of default one way or another.

By evaluating and optimizing these criteria, you’ll find yourself in a strong position to secure the lowest personal loan rates available in 2024. Understanding these key factors is crucial to navigating the lending landscape wisely and effectively.

Expert Tips for Maximizing Your Eligibility

Securing the lowest personal loan rates in 2024 takes more than just a good credit score. There are multiple facets to be aware of, and understanding these subtle intricacies can significantly enhance your eligibility. Here are some expert tips that can help unlock those coveted low rates:

<ul>

<li><strong>Maintain a Healthy Credit Score:</strong> While it's well-known that a higher credit score opens doors to better loan rates, consistently monitoring and managing your credit report can make a significant difference. Regularly check for inaccuracies and resolve them promptly. Aim for a credit score above 700 to be in the ideal range for lower rates.</li>

<li><strong>Diversify Your Credit Mix:</strong> The variety of credit on your report can influence your eligibility. Holding different types of credit, like installment loans, revolving credit, and mortgage loans, shows lenders that you can manage multiple credit streams effectively.</li>

</ul>

<p><strong>Pay Attention to Debt-to-Income Ratio (DTI):</strong> Lenders scrutinize your DTI ratio to gauge your ability to repay the loan. Calculated by dividing your monthly debt payments by your gross monthly income, a DTI ratio below 36% is usually considered optimal. If your DTI ratio is higher, paying off some debts could significantly improve your chances of securing a lower rate.</p>

<p><strong>Show Proof of Stable Income:</strong> Having a steady job or consistent income sources reassures lenders of your repayment capability. Demonstrating stable employment over a period of time can also work in your favor. Freelancers and self-employed individuals, ensure you have your income documents well-organized and up-to-date.</p>

<ul>

<li><strong>Build a Strong Financial History:</strong> A history of timely payments on past loans and credit lines speaks volumes. This shows that you are reliable and can handle borrowing responsibly.</li>

<li><strong>Saving for a Larger Down Payment:</strong> For larger personal loans, putting down a significant amount can lower your interest rate. Consider saving up for a few extra months before applying.</li>

</ul>

<p><strong>Avoid Hard Credit Inquiries:</strong> Multiple hard inquiries in a short span can negatively affect your credit score. Instead of applying to several lenders at once, use a pre-qualification service. These soft inquiries give you a good idea of your potential rates without impacting your credit score.</p>

<p><strong>Be Transparent with Your Lender:</strong> Clearly communicate your financial situation and future plans with your lender. Transparency can sometimes help in negotiating interest rates and loan terms more favorable to your situation.</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Factor</th>

<th>Optimal Level</th>

<th>Impact on Loan Rate</th>

</tr>

</thead>

<tbody>

<tr>

<td>Credit Score</td>

<td>Above 700</td>

<td>Significantly Lowers</td>

</tr>

<tr>

<td>DTI Ratio</td>

<td>Below 36%</td>

<td>Favorable</td>

</tr>

<tr>

<td>Employment Stability</td>

<td>2+ years</td>

<td>Improves Eligibility</td>

</tr>

</tbody>

</table>

<p>By meticulously managing these aspects, you can greatly enhance your chances of not only being approved for a personal loan but also securing it at the lowest possible rates. Start early, stay consistent, and keep your financial health in check to enjoy the most benefits.</p>

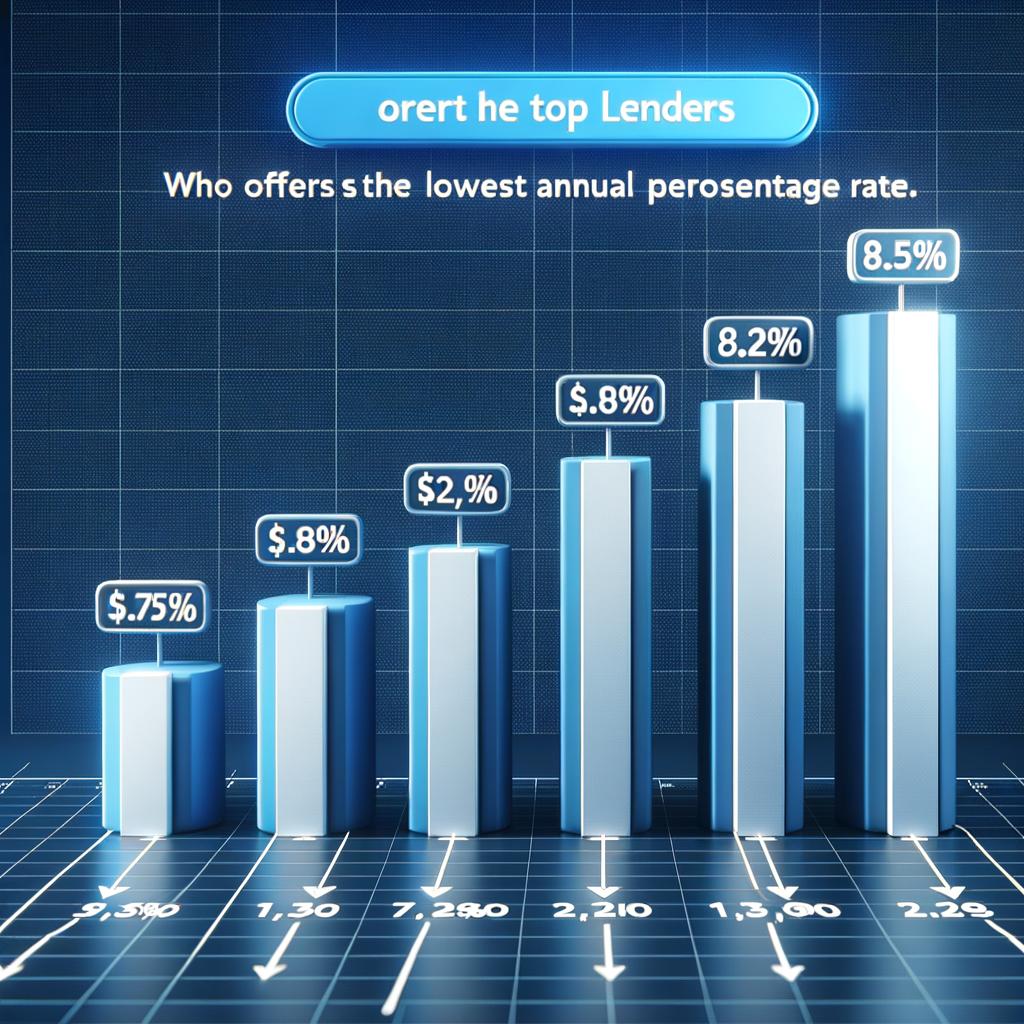

Comparing Top Lenders: Who Offers the Lowest APR

When hunting for the best personal loan in 2024, the Annual Percentage Rate (APR) is one of the most crucial factors to consider. Not all lenders are created equal, and APRs can vary significantly. The following breakdown highlights some of the top lenders, their advertised APRs, and what you need to qualify for their most competitive rates.

<h2>Advertised APRs of Top Lenders for 2024</h2>

<table class="wp-block-table">

<thead>

<tr>

<th>Lender</th>

<th>APR Range</th>

<th>Loan Amount</th>

<th>Term Length</th>

</tr>

</thead>

<tbody>

<tr>

<td>Bank A</td>

<td>4.99% - 19.99%</td>

<td>$2,000 - $50,000</td>

<td>2 to 5 years</td>

</tr>

<tr>

<td>Credit Union B</td>

<td>5.45% - 18.75%</td>

<td>$1,000 - $40,000</td>

<td>1 to 7 years</td>

</tr>

<tr>

<td>Online Lender C</td>

<td>3.99% - 22.00%</td>

<td>$5,000 - $35,000</td>

<td>2 to 6 years</td>

</tr>

</tbody>

</table>

<h2>Key Requirements to Qualify for the Lowest APRs</h2>

<ul>

<li><strong>Excellent Credit Score:</strong> Typically, a credit score of 720 or higher is necessary to snag the lowest APRs. However, some lenders might offer competitive rates to those with scores in the upper 600s.</li>

<li><strong>Low Debt-to-Income Ratio:</strong> An ideal debt-to-income ratio is 35% or lower. This assures lenders of your ability to manage and repay the loan.</li>

<li><strong>Stable Employment:</strong> Having a steady job and a reliable income stream reassures lenders of your repayment capability.</li>

</ul>

<h2>Additional Perks and Considerations</h2>

<p>When evaluating lenders, consider additional perks that might come with the loan:</p>

<ul>

<li><strong>No Origination Fees:</strong> Some lenders waive origination fees, which can save you a significant amount of money upfront.</li>

<li><strong>Flexible Repayment Terms:</strong> The ability to choose a loan term that fits your budget is essential.</li>

<li><strong>Loyalty Discounts:</strong> Returning customers or those who use other financial services from the same institution may qualify for lower rates.</li>

</ul>

<h2>Case Study: Bank A vs. Online Lender C</h2>

<p>Consider two prospective borrowers, both seeking a $10,000 loan:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Borrower Profile</th>

<th>Bank A</th>

<th>Online Lender C</th>

</tr>

</thead>

<tbody>

<tr>

<td>Excellent Credit (740+)</td>

<td>4.99% APR - $1,123 total interest</td>

<td>3.99% APR - $824 total interest</td>

</tr>

<tr>

<td>Good Credit (680-739)</td>

<td>7.25% APR - $1,928 total interest</td>

<td>6.25% APR - $1,884 total interest</td>

</tr>

</tbody>

</table>

<h2>Conclusion</h2>

<p>APR is a critical component of any personal loan. By assessing APRs from various lenders and understanding what each lender requires to qualify for their lowest rates, you can make an informed decision that aligns with your financial situation. Remember to factor in potential perks and additional costs, as these can significantly impact the overall cost of your loan.</p>

Q&A

—

Q&A: Understanding the Lowest Personal Loan Rates in 2024 and What You’ll Need to Qualify

Q1: What are personal loans, and why are they important in 2024?

A1: Personal loans are versatile financial products allowing individuals to borrow money for various needs without requiring collateral. In 2024, they remain crucial for managing large expenses such as home renovations, medical costs, or consolidating high-interest debts, thanks to potentially low interest rates.

Q2: What are the projected lowest personal loan rates for 2024?

A2: While exact figures will vary by lender and borrower profile, it’s anticipated that personal loan rates could dip to as low as 5.5% APR for those with excellent credit scores. Market conditions, such as central bank policies and economic stability, also play significant roles in determining these rates.

Q3: How can I qualify for the lowest personal loan rates in 2024?

A3: To secure the lowest rates, you’ll need to demonstrate financial reliability. Key qualifications include:

- Excellent Credit Score: Typically, a score of 720 or higher.

- Low Debt-to-Income Ratio: Indicates manageable existing debt relative to income.

- Stable Employment History: Shows steady income and job security.

- Strong Financial Records: Including savings and a healthy credit history.

Q4: What steps can I take to improve my chances of qualifying for these rates?

A4: Improving your eligibility for the best rates involves:

- Paying Bills On Time: Establishes a positive credit history.

- Reducing Existing Debt: Lowers your debt-to-income ratio.

- Increasing Your Income: Through additional jobs or income streams.

- Limiting Hard Inquiries: Frequent credit applications can negatively impact your score.

Q5: Are there any emerging trends in the personal loan market for 2024?

A5: Yes, a few trends to note:

- Digital Lending Platforms: Growth in online lenders offering competitive rates and quicker approval processes.

- AI-Based Assessments: Increased use of AI to evaluate creditworthiness beyond traditional metrics.

- Green Loans: Specialized personal loans aimed at financing environmentally friendly projects, often at favorable rates.

Q6: What should I watch out for when comparing personal loan offers?

A6: When evaluating personal loan options, consider:

- APR: The total cost of borrowing annually.

- Fees: Hidden costs like origination fees, prepayment penalties, and late fees.

- Loan Terms: The repayment period and flexibility.

- Customer Reviews: Experiences of other borrowers can highlight potential red flags or advantages.

Q7: How does an economic downturn affect personal loan rates?

A7: In an economic downturn, central banks might lower interest rates to stimulate borrowing. This can lead to lower personal loan rates. However, lenders may also tighten eligibility criteria, making it harder for those with less-than-perfect credit to qualify for the best rates.

Q8: Can personal loans impact my credit score?

A8: Yes, taking out a personal loan can affect your credit score both positively and negatively. Timely repayments can boost your score by demonstrating responsible borrowing behavior. Conversely, missed payments or defaults can significantly harm your credit score.

By understanding the landscape of personal loans in 2024 and preparing adequately, you can secure favorable rates, manage your finances effectively, and avoid potential pitfalls.

In Conclusion

As we venture into 2024, securing the lowest possible personal loan rates can be the financial bridge to realizing your aspirations. Whether you’re planning to consolidate debt, finance a major purchase, or simply invest in your future, understanding the qualifying criteria and leveraging today’s competitive rates can set you on the path to achieving your goals with confidence.

Remember, the key to unlocking those advantageous terms lies in a robust credit profile, diligent financial habits, and a keen awareness of the ever-evolving market landscape. May your journey toward financial empowerment in 2024 be paved with informed decisions and prudent choices.

Here’s to a prosperous year ahead, where your financial dreams find their wings and soar!