In a world where life’s expenses often outpace our earnings, credit card debt has become an all-too-familiar companion for many. The feeling of being ensnared in a web of multiple high-interest debts can be overwhelming, casting a shadow over future financial freedom. Enter credit card consolidation—a lifeline that promises to untangle this financial mess and chart a clear path toward debt-free living. But how can one harness this tool effectively? Join us as we delve into six key strategies to master credit card consolidation and regain control over your financial destiny.

Table of Contents

- Understanding Credit Card Consolidation: What You Need to Know

- Exploring Different Consolidation Methods: Find the Right Fit for You

- Creating a Realistic Debt Repayment Plan: Step-by-Step Guidelines

- Maximizing Savings with Balance Transfers: Tips and Best Practices

- Future Outlook

Understanding Credit Card Consolidation: What You Need to Know

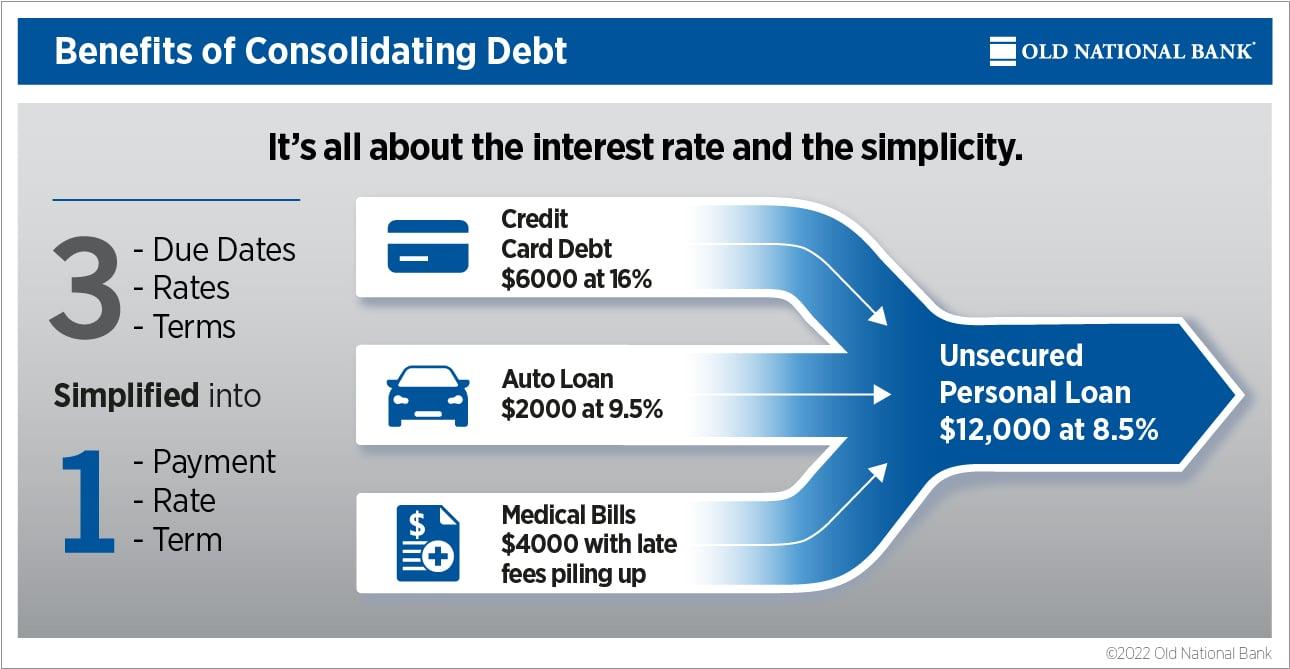

When it comes to credit card consolidation, understanding its intricacies can be the key to unlocking a debt-free future. This approach involves combining multiple credit card balances into a single payment, often with a lower interest rate. By doing so, you can simplify your finances and potentially save money.

Benefits of Credit Card Consolidation

- Lower Interest Rates: Most consolidation options offer lower interest rates compared to credit card rates, which can significantly reduce the total interest you pay over time.

- Single Monthly Payment: Consolidating your debt means you only have one payment to manage each month, making it easier to keep track and avoid missed payments.

- Potential Credit Score Boost: Successfully managing a consolidated debt can improve your credit score by demonstrating consistent, responsible repayment behavior.

Choosing the Right Method

There are several methods to consolidate your credit card debt, and choosing the right one depends on your financial situation and objectives. Consider these popular options:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Balance Transfer | Transfer balances to a card with 0% APR for a promotional period. | Save on interest during the promo period. | High interest rates if not paid off in time. |

| Personal Loan | Take out a loan at a fixed interest rate to repay your cards. | Predictable payments, potentially lower rates. | Requires good credit score for the best rates. |

| Home Equity Loan | Use your home as collateral to secure a low-interest loan. | Very low interest rates. | Risk of losing your home if you default. |

Creating a Repayment Plan

Once you’ve consolidated your debt, it’s essential to create a structured repayment plan. Here are some tips to help you stay on track:

- Set a Budget: Outline your monthly income and expenses to determine how much you can allocate toward debt repayment.

- Automate Payments: Set up automatic payments to ensure you never miss a due date.

- Cut Unnecessary Expenses: Temporarily reduce or eliminate non-essential spending to free up more funds for paying off your debt.

Monitoring Your Progress

Keep track of your progress by regularly reviewing your account statements and credit reports. This helps ensure that errors are corrected promptly and motivates you as you see your debt balances decrease:

- Use budgeting apps to track spending and payments.

- Check your credit score monthly to monitor improvements.

- Celebrate milestones, like paying off a specific amount of debt.

Seek Professional Advice

If you’re unsure about the best consolidation method or struggling to manage your debt, consider seeking advice from a financial advisor or a credit counseling service. These professionals can provide personalized recommendations and help you develop an effective strategy for debt repayment.

Stay Disciplined

staying disciplined and committed to your debt repayment plan is crucial. Avoid taking on new debt while paying off your consolidated balance, and remember that patience and persistence are key. By steadily working towards your goal, you can achieve financial freedom and a brighter financial future.

Exploring Different Consolidation Methods: Find the Right Fit for You

Navigating through various credit card consolidation methods can significantly lighten your financial burden. Choosing the most effective strategy depends on your unique situation, but the goal is universally the same: alleviate debt pressure and streamline payments.

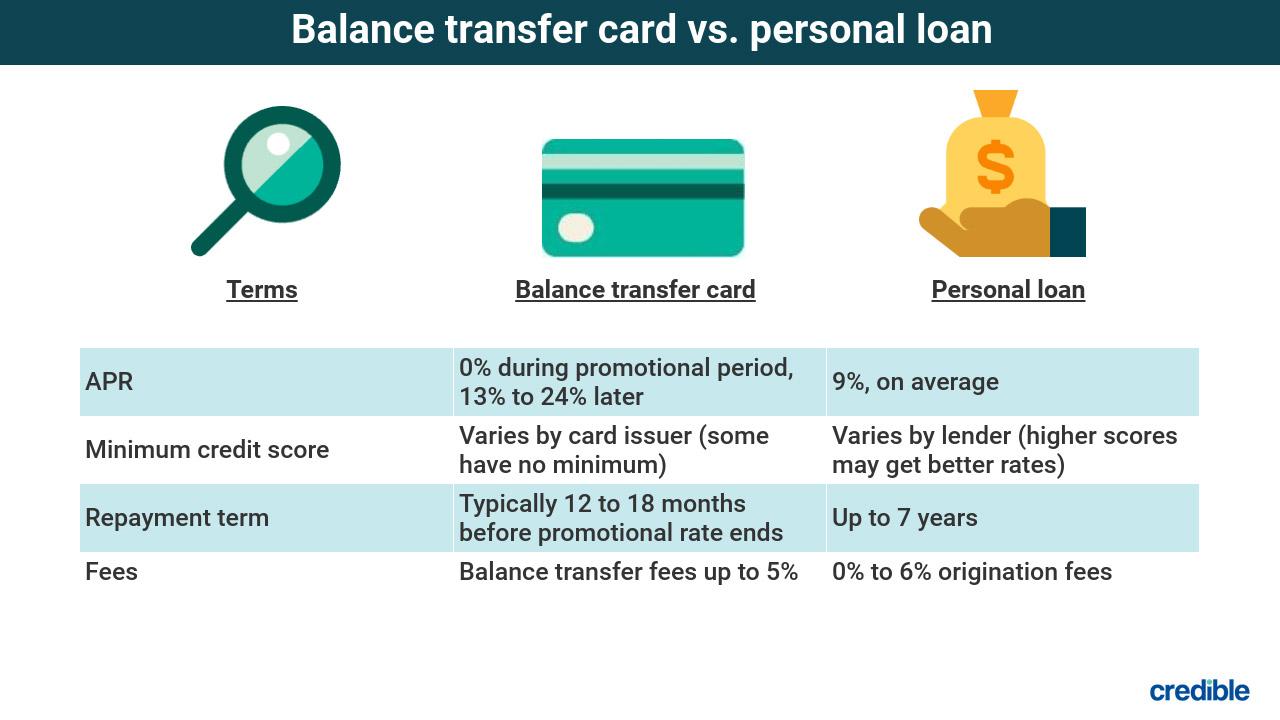

If you’re considering a balance transfer, this option allows you to move your existing high-interest debt to a new credit card with a lower interest rate. Many cards offer a 0% introductory rate for a set period, making it an appealing choice. However, be mindful of balance transfer fees and the expiration of the promo rate.

Another promising method is seeking a personal loan for consolidating debt. Personal loans typically come with fixed interest rates and set repayment terms, which simplify planning and budgeting. Ensure to compare rates and terms from various lenders to find the most favorable deal. Here’s a quick comparison:

| Option | Interest Rate | Term Length |

|---|---|---|

| Bank A | 8% | 5 years |

| Bank B | 10% | 3 years |

Leveraging a home equity line of credit (HELOC) taps into your home’s equity. This method offers typically lower interest rates compared to credit cards. However, it’s crucial to note that your home becomes collateral, so missing payments can put it at risk.

For those preferring a structured path, enrolling in a debt management plan (DMP) through a credit counseling agency could be beneficial. DMPs usually negotiate lower interest rates with your creditors, consolidating multiple debts into one monthly payment. This approach requires discipline and adherence to the counseling plan.

Debt settlement is another approach, where you negotiate with your creditors to pay a lump sum lesser than what you owe. While this can significantly reduce your balance, it can adversely affect your credit score and may incur fees from settlement companies.

A final method is utilizing a cash-out mortgage refinance. By refinancing your mortgage to a higher amount, you can use the additional cash to pay off high-interest debt. This option can provide lower interest rates, but it extends your mortgage term and increases your home loan debt.

Each method comes with its own set of advantages and potential pitfalls. Understanding your financial situation and goals will help determine which consolidation method aligns best with your needs. Compare the options, weigh the benefits and risks, and choose the path that leads you towards a debt-free future.

Creating a Realistic Debt Repayment Plan: Step-by-Step Guidelines

One of the first steps in managing credit card debt is to create a concrete and realistic debt repayment plan. Without a plan, it’s easy to become overwhelmed and lose track of progress, making it harder to ever achieve financial freedom. Follow these step-by-step guidelines to regain control of your finances and embark on the journey to a debt-free life.

Evaluate Your Current Financial Situation

Start by taking a complete inventory of your finances. List out all your debts, from credit cards to any personal loans, and include details like interest rates, minimum monthly payments, and the total amount owed. An honest assessment will help you understand the extent of your debt and lay the groundwork for developing a repayment strategy.

Set Clear Financial Goals

Establishing clear, measurable goals is crucial. Do you want to be debt-free in two years, or are you looking to reduce your debt by 50% within one year? Having specific targets not only motivates you but also provides a framework for determining the best methods to achieve them.

Create a Monthly Budget

Track your monthly income and expenses meticulously. Identify areas where you can cut back—whether it’s dining out, subscription services, or other discretionary spending. Allocate as much of your remaining income as possible to debt repayment. Stick to your budget and periodically review it to ensure you’re on track.

Consider the Debt Snowball or Avalanche Methods

- Debt Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger debts. As each smaller debt is paid off, you gain momentum and confidence.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first. This method minimizes the total interest you’ll pay over the life of your debt, saving you money in the long run.

Negotiate Lower Interest Rates

Contact your credit card issuers and request a lower interest rate. Explain your situation and demonstrate your commitment to repaying the debt. Even a small reduction in interest rates can significantly speed up your repayment timeline and reduce the total amount you’ll pay.

Consolidate Your Debts

Debt consolidation can be a powerful tool. This involves combining multiple debts into a single loan with a lower interest rate. Here’s a quick comparison of common consolidation options:

| Method | Pros | Cons |

|---|---|---|

| Personal Loan | Fixed interest rates, potential for lower monthly payments | May require good credit score |

| Balance Transfer | Introductory 0% APR for a set period | High fees if not paid within promo period |

| Home Equity Loan | Low interest rates | Risk of losing your home if you default |

Regularly Review and Adjust Your Plan

Your financial situation may change, and your repayment plan should be flexible enough to accommodate these changes. Regularly review your plan and make adjustments as necessary, whether it’s allocating more funds to repayment, revisiting negotiation with your creditors, or adopting a different repayment strategy.

By following these detailed steps, you can craft a realistic and effective debt repayment plan that aligns with your financial goals and allows you to regain control over your monetary future.

Maximizing Savings with Balance Transfers: Tips and Best Practices

Making the most out of balance transfers involves strategic planning and disciplined financial habits. When done right, a balance transfer can significantly cut down interest payments and help you consolidate debt efficiently.

Choose the Right Card

Start by finding a balance transfer credit card with an introductory 0% APR period. This grace period usually lasts between 12 to 18 months and can provide breathing room to pay down your debt without accumulating extra interest. Ensure that the card’s transfer fees don’t outweigh the interest savings.

Plan Your Payments

Merely transferring balances won’t solve your debt issues unless you create a solid repayment plan. Calculate the monthly payments required to clear your balance within the promotional period. This clear timeline instills discipline and prevents accruing any interest once the introductory period ends.

Understand Fees and Terms

Carefully scrutinize the card’s fine print. Look for balance transfer fees, which are typically 3% to 5% of the amount transferred. Some cards may offer no transfer fees, but they often come with shorter introductory periods. Also, pay attention to penalties, such as late fees, which could prematurely end your 0% APR offer.

Avoid New Purchases

Even if a card offers 0% APR on purchases, using it for new buys can complicate your repayment strategy. Focus solely on clearing the transferred amount. Keeping new charges off the card helps maintain a lower credit utilization ratio, positively impacting your credit score.

Consider Multiple Transfers

Sometimes, one balance transfer isn’t enough to clear all your debt, especially if it’s substantial. You might need to strategize with multiple balance transfers across several cards. However, this requires vigilant tracking to avoid missing payments and incurring penalties.

Monitor Your Progress

Regularly check your credit card statements and online account to track your progress. Ensure payments are applied correctly and monthly goals are being met. Adjust your budget as necessary to stay on track and avoid financial hiccups.

Balance Transfer Checklist

– Find a card with 0% introductory APR

– Calculate required monthly payments

– Watch for transfer fees and penalties

– Avoid using the card for new purchases

- Contemplate multiple transfers if needed

– Consistently monitor your financial progress

| Card | Introductory APR | Transfer Fee | Duration |

|---|---|---|---|

| Card A | 0% for 18 months | 3% | 18 months |

| Card B | 0% for 15 months | No fee | 15 months |

| Card C | 0% for 12 months | 5% | 12 months |

Future Outlook

In the labyrinth of personal finance, credit card debt can often feel like an insurmountable beast. However, armed with the right strategies, even the most daunting financial obstacles can be conquered. The six key ways to consolidate credit card debt we’ve explored offer a roadmap to not just paying off what you owe, but also to regaining control over your financial destiny.

As you embark on this path, remember that every small step counts. Each payment, each budget adjustment, and each moment of financial clarity brings you closer to a life unburdened by high-interest debt. Think of it as a journey towards financial freedom, where every milestone celebrated is a testament to your determination and resilience.

Now, it’s your turn to take charge. Apply these strategies, stay committed, and watch as those towering debts shrink into manageable pieces. After all, the power to transform your financial future lies in your hands. Keep going, stay focused, and soon you’ll see the horizon of debt-free living blissfully within reach. Here’s to a future where your finances are as bright and promising as you’ve always dreamed.