Navigating the turbulent waters of personal finance can often feel like an insurmountable challenge, especially when grappling with the weight of multiple debts and a bruised credit score. But, as the summer sun of August 2024 casts a hopeful glow, so too does the possibility of finding the right financial lifeline. Enter the realm of debt consolidation loans, a potential beacon of relief for those burdened by bad credit. In this guide, we dive into the sea of options and bring to shore the 10 best debt consolidation loans tailored for those facing credit woes. Whether you’re seeking to streamline your payments or simply find a way to rebuild your financial foundations, we’ve curated a list that promises to illuminate your path to fiscal stability. Buckle up as we embark on this journey to discover how you can transform your debt-laden concerns into a manageable, optimistic future.

Table of Contents

- Top Picks for Debt Consolidation Loans Tailored for Bad Credit

- Understanding Eligibility Requirements for August 2024 Offers

- Comparing Interest Rates and Terms to Find Your Best Fit

- Expert Recommendations for Optimal Debt Management Strategies

- In Retrospect

Top Picks for Debt Consolidation Loans Tailored for Bad Credit

Embarking on a journey to consolidate your debt can be daunting, especially if your credit score is less than ideal. Fortunately, several lenders offer customized solutions that can help you regain control of your finances. Here are our top picks for debt consolidation loans that are tailored to individuals with bad credit, making it easier to streamline multiple payments into one manageable loan.

<p>1. LendingClub - LendingClub stands out for its flexible loan options and transparent terms. Known for their user-friendly platform, they offer loans with competitive interest rates and a quick approval process, even for those with credit scores as low as 600. </p>

<p>2. OneMain Financial - If you're looking for a lender that doesn’t heavily weigh your credit score, OneMain Financial could be your answer. They specialize in offering personal loans to individuals with low credit scores and provide personalized service throughout the loan process.</p>

<p>3. Avant - Avant is another excellent option for those with bad credit, boasting an easy online application and quick funding. Their clear fee structure and flexible payment plans make debt consolidation simpler and more accessible.</p>

<p>4. Upgrade - Upgrade combines low fees with loan amounts up to $50,000, making them an attractive choice. They offer credit health tools and educational resources to support you in managing and improving your financial situation post-consolidation.</p>

<p>Compare Loan Features:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Lender</th>

<th>Min. Credit Score</th>

<th>Loan Amount</th>

<th>APR Range</th>

</tr>

</thead>

<tbody>

<tr>

<td>LendingClub</td>

<td>600</td>

<td>Up to $40,000</td>

<td>6.95% - 35.89%</td>

</tr>

<tr>

<td>OneMain Financial</td>

<td>None</td>

<td>$1,500 - $20,000</td>

<td>18.00% - 35.99%</td>

</tr>

<tr>

<td>Avant</td>

<td>580</td>

<td>$2,000 - $35,000</td>

<td>9.95% - 35.99%</td>

</tr>

<tr>

<td>Upgrade</td>

<td>620</td>

<td>$1,000 - $50,000</td>

<td>7.99% - 35.97%</td>

</tr>

</tbody>

</table>

<ul>

<li><strong>Remember to check for hidden fees</strong> - Some lenders may charge origination fees, prepayment penalties, or late fees. Read the fine print to avoid unexpected costs.</li>

<li><strong>Explore co-signer options</strong> - If your credit is a hurdle, consider using a co-signer with a better credit profile to secure more favorable terms.</li>

</ul>

<p>Choosing the right debt consolidation loan takes research and careful consideration of your financial situation. Be sure to compare these options and leverage their unique features to find the best fit for your needs.</p>

Understanding Eligibility Requirements for August 2024 Offers

Navigating through the eligibility requirements for debt consolidation loans, especially when dealing with bad credit, can feel like deciphering a complex code. Fortunately, the criteria for August 2024 offers are more inclusive and flexible than ever before. Below, we unpack the key considerations to help you better understand what it takes to qualify.

<h2>Credit Score</h2>

Lenders usually look at your credit score as the first criterion for eligibility. For August 2024 offers, many loans cater to individuals with FICO scores below 600. However, some exclusive offerings are available for those with slightly higher scores. It’s worth checking:

<ul>

<li>FICO score requirements</li>

<li>Credit history specifics</li>

<li>Allowances for recent improvements</li>

</ul>

<h2>Employment History</h2>

Consistent employment is another factor that lenders take seriously. Typically, a stable employment history spanning at least two years is preferred. Key points include:

<ul>

<li>Verification of current employment</li>

<li>Proof of steady income streams</li>

<li>Length of employment at current job</li>

</ul>

<h2>Debt-to-Income Ratio (DTI)</h2>

Your Debt-to-Income ratio (DTI) is imperative in evaluating your capacity to manage monthly payments. Generally, lenders prefer a DTI below 50%. Here’s a brief example to clarify:

<table class="wp-block-table">

<thead>

<tr>

<th>Monthly Income</th>

<th>Monthly Debt Payments</th>

<th>DTI</th>

</tr>

</thead>

<tbody>

<tr>

<td>$4,000</td>

<td>$1,800</td>

<td>45%</td>

</tr>

<tr>

<td>$5,500</td>

<td>$2,800</td>

<td>50.9%</td>

</tr>

</tbody>

</table>

<h2>Loan Amount and Term</h2>

The amount you wish to borrow and the duration over which you plan to repay it are also pivotal. Lenders generally have set minimum and maximum loan amounts. For August 2024, these may range from:

<ul>

<li>Minimum loan amount: $1,000</li>

<li>Maximum loan amount: $50,000</li>

<li>Repayment term: 12 to 84 months</li>

</ul>

<h2>Collateral Requirements</h2>

Some loans might require collateral, especially if your credit score is on the lower end of the spectrum. Common types of collateral include:

<ul>

<li>Vehicle titles</li>

<li>Home equity</li>

<li>Savings accounts</li>

</ul>

<h2>Co-Signer Option</h2>

If your creditworthiness is a concern, some lenders offer the possibility of including a co-signer. This can significantly enhance your eligibility. Ideal co-signers typically have:

<ul>

<li>High credit scores</li>

<li>Stable income</li>

<li>Low DTI</li>

</ul>

<h2>Documentation</h2>

Lastly, being prepared with the necessary documentation can expedite the application process. Here’s what you might need:

<ul>

<li>Proof of identity (driver’s license, passport)</li>

<li>Proof of income (pay stubs, tax returns)</li>

<li>Bank statements</li>

<li>Details of current debts</li>

</ul>

Comparing Interest Rates and Terms to Find Your Best Fit

Finding the optimal debt consolidation loan can feel like navigating a web of interest rates and loan terms. Each lender has its unique offerings, and understanding how these variables work together is critical for choosing a loan that aligns with your financial goals.

Interest rates can vary significantly between lenders, especially for those with bad credit. Generally, rates will range from 5.99% to 35.99%, depending on your creditworthiness and financial history. A lower interest rate can save you substantial money over the life of the loan, so it’s crucial to compare multiple options.

| Lender | Interest Rate Range | Loan Amount | Term Length |

|---|---|---|---|

| DebtHelper Co. | 7.99% – 29.99% | $1,000 – $50,000 | 24 – 60 months |

| CrediFix Inc. | 5.99% - 26.99% | $2,000 – $75,000 | 36 – 72 months |

| LoanDig | 9.99% – 35.99% | $500 - $25,000 | 12 – 48 months |

Beyond interest rates, loan terms are another critical aspect to consider. Loan terms refer to the duration over which you’ll repay the loan, which can typically range from 12 months to seven years. A shorter term means higher monthly payments but less interest paid over time. Conversely, longer terms result in lower monthly payments but can accrue more interest overall.

- Short Term Loans: Ideal for those who can manage larger monthly payments and wish to save on interest.

- Long Term Loans: Suitable for borrowers looking for smaller monthly payments to ease their cash flow, at the cost of paying more interest.

Fees are another aspect not to be overlooked. Application fees, origination fees, and late payment fees can add to your overall loan cost. It’s essential to assess whether potential savings from a lower interest rate might be diminished by high associated fees.

Consider the flexibility offered by the lender. Some loans allow for early repayments without any penalties, which can save you money on interest. Other lenders might offer hardship plans should your financial situation change, providing a safety net.

balancing interest rates, term lengths, fees, and lender flexibility can significantly impact finding the right debt consolidation loan for you. It’s not just about the lowest rate but also about the total cost and how comfortably you can meet the payment schedule.

Use calculators and comparison tools to visualize how different rates and terms impact your payments. Seeking expert advice can further clarify which loan conditions are most favorable for your specific circumstances, paving the way to regain financial stability efficiently.

Expert Recommendations for Optimal Debt Management Strategies

Managing debt can be overwhelming, yet experts agree that with the right strategies, it becomes much more manageable. Here are several expert-endorsed tactics to navigate debt, especially when considering debt consolidation loans.

- Understand Your Debt: First and foremost, take stock of your debts. Create a comprehensive list of all your debts, including credit cards, personal loans, and any other outstanding liabilities. Knowing what you owe is the essential first step towards managing it effectively.

- Explore Loan Options: Not all loans are created equal. Investigate various debt consolidation loans designed for those with bad credit. Look into interest rates, fees, and repayment terms to identify the most suitable option for your situation.

- Negotiate Interest Rates: Don’t hesitate to speak with your creditors about lowering your interest rate. Many lenders might be willing to renegotiate, especially given a sincere commitment to repay. A reduced rate can mean significant savings over time.

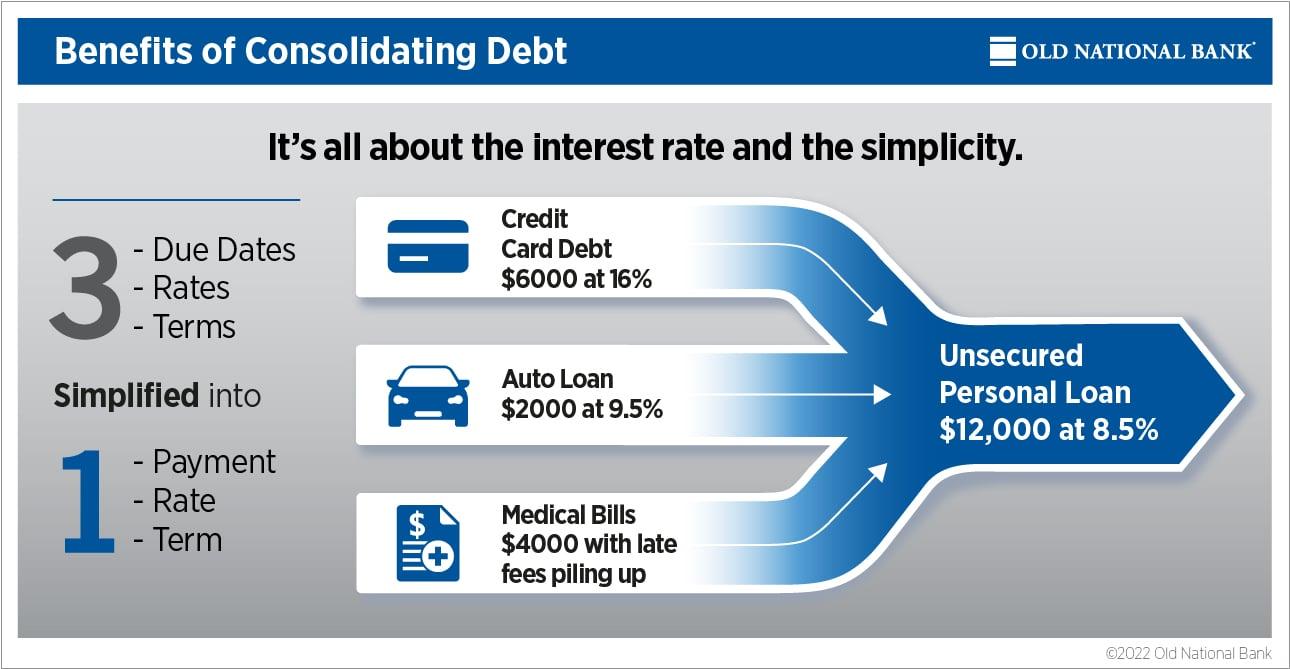

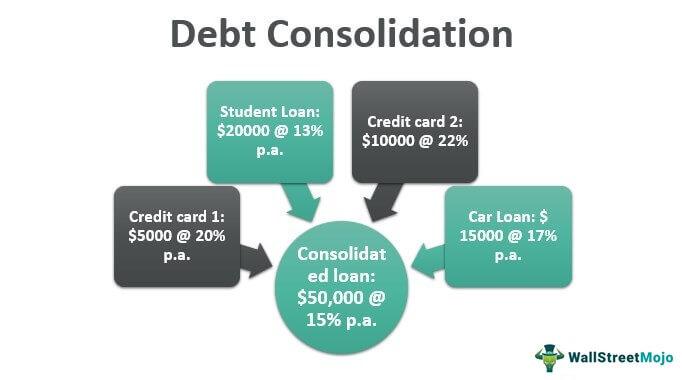

Debt consolidation loans for bad credit can be particularly beneficial. These loans combine multiple high-interest debts into a single, more manageable monthly payment. When carefully chosen, a consolidation loan can substantially reduce your financial stress. Here’s a quick comparison of three popular options:

| Loan Provider | Interest Rate | Loan Term | Special Features |

|---|---|---|---|

| Provider A | 5.99% - 24.99% | 2-5 years | No prepayment penalty |

| Provider B | 6.49% – 25.99% | 1-4 years | Free financial counseling |

| Provider C | 5.45% – 26.74% | 3-6 years | Flexible payment options |

Set a Realistic Budget: A budget tailored to your income and expenses will keep your spending in check. Factor in the consolidated loan payment and ensure you’re not overspending in other areas. A solid budget serves as a roadmap to financial stability.

Avoid New Debts: Once you’ve consolidated your debts, make a firm commitment to avoid accruing new ones. This can be challenging, but it’s essential to ensure that you don’t fall into the same debt traps again.

Monitor Your Credit: Keep a close watch on your credit report. Check for any discrepancies or errors that could harm your credit score. Regular monitoring helps you spot potential issues early, allowing for corrective actions before they escalate.

Seek Professional Help: If managing your debt feels too overwhelming, consider consulting a financial advisor or a debt counselor. These professionals can offer personalized guidance and support, helping you navigate your journey to a debt-free future.

In Retrospect

As we navigate the ever-shifting landscape of personal finance, finding the right financial solutions becomes not just a necessity, but a journey toward a more secure future. Our exploration of the “10 Best Debt Consolidation Loans for Bad Credit in August 2024” aims to not only inform but to empower those who might find themselves at a crossroads. Each loan option, with its unique set of features and benefits, opens a door to better financial health and stability.

the best choice is one that aligns with your individual needs, financial goals, and circumstances. We hope this guide has illuminated the paths available to you, offering clarity and confidence as you take the next steps toward managing and consolidating your debt.

Remember, every small step taken today lays the foundation for financial freedom tomorrow. Stay informed, stay proactive, and most importantly, stay optimistic about the possibilities that lie ahead.