Navigating the labyrinth of car loans can be daunting, especially when bad credit casts a long shadow over your financial endeavors. You may feel like you’re trapped in a maze with no clear exit, but don’t lose hope just yet. This journey might be fraught with challenges, but it’s not insurmountable. In this article, we’ll transform the opaque landscape of auto financing into a more transparent and manageable expedition. Whether your credit score has taken a hit from past financial missteps or unexpected life events, there are pathways to securing a car loan. Buckle up as we guide you through insightful strategies and practical tips to accelerate your journey from despair to behind the wheel of your own car.

Table of Contents

- Understanding Your Credit Score and Its Impact on Loan Approval

- Choosing the Right Lender: Banks, Credit Unions, and Online Options

- How to Improve Your Loan Eligibility: Practical Tips and Strategies

- Negotiating Loan Terms to Suit Your Financial Situation

- Q&A

- Final Thoughts

Understanding Your Credit Score and Its Impact on Loan Approval

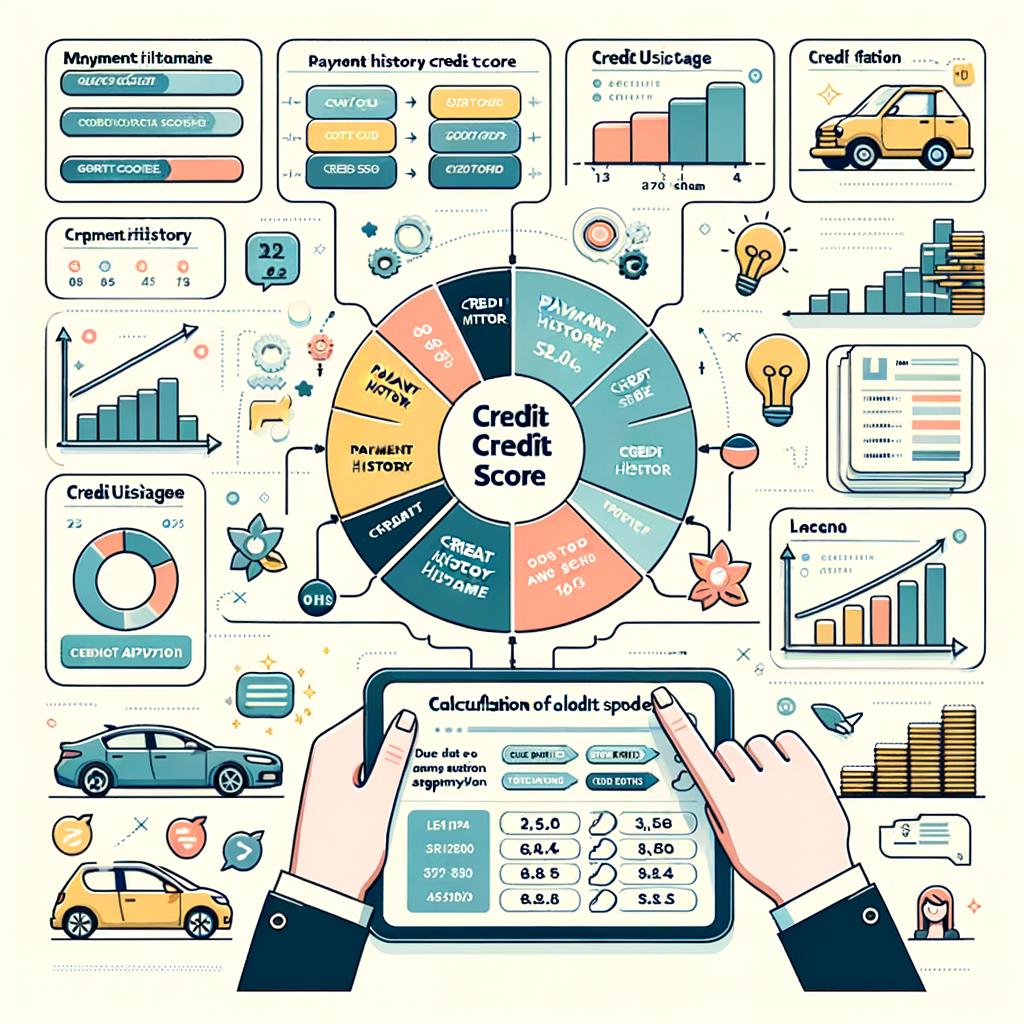

Your credit score is a critical piece of your financial puzzle, often holding the key to unlocking loan approvals and favorable interest rates. But what exactly is a credit score, and how can it influence your ability to secure a car loan, especially if your score isn’t as stellar as you’d like it to be?

<p>A credit score is a numerical representation of your creditworthiness, calculated based on your credit history. This number typically ranges from 300 to 850, with higher scores signaling stronger creditworthiness to lenders. Several factors go into calculating your credit score, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Here’s a breakdown:</p>

<ul>

<li><strong>Payment History:</strong> Late or missed payments can drastically lower your score.</li>

<li><strong>Amounts Owed:</strong> High balances relative to your credit limits can be a red flag.</li>

<li><strong>Length of Credit History:</strong> Longer histories tend to boost your score.</li>

<li><strong>New Credit:</strong> Opening several new accounts in a short time can be detrimental.</li>

<li><strong>Types of Credit Used:</strong> A mix of credit types (credit cards, retail accounts, installment loans, etc.) can be beneficial.</li>

</ul>

<p>When applying for a car loan, lenders scrutinize your credit score to assess the risk of lending you money. A higher credit score generally translates to easier loan approval and more favorable terms, such as lower interest rates. Conversely, a lower credit score might mean higher interest rates or even outright loan denial.</p>

<p>But having bad credit doesn’t necessarily mean you’re out of options. Lenders also consider other factors, such as your income, employment stability, and the amount of your down payment. Demonstrating consistency in these areas can enhance your borrowing prospects. Below is a simple comparative table illustrating how these factors can impact your loan approval chances:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Factor</th>

<th>High Credit Score</th>

<th>Low Credit Score</th>

</tr>

</thead>

<tbody>

<tr>

<td>Interest Rate</td>

<td>Lower</td>

<td>Higher</td>

</tr>

<tr>

<td>Down Payment</td>

<td>Lower Required</td>

<td>Higher Required</td>

</tr>

<tr>

<td>Loan Approval Chances</td>

<td>Better</td>

<td>Challenging</td>

</tr>

</tbody>

</table>

<p>So how can you improve your chances of getting a car loan with bad credit? Start by thoroughly reviewing your credit report for errors or discrepancies, and dispute any inaccuracies with the credit bureaus. Additionally, focus on paying down existing debt and avoiding new debt as much as possible.</p>

<p>Consider saving for a larger down payment. A more substantial down payment reduces the lender's risk and can often lead to better loan terms. Also, explore the possibility of a co-signer with strong credit to help strengthen your loan application.</p>

<p>Doing your homework on lenders is crucial. Some specialize in subprime auto loans and might be more willing to work with you despite your credit history. Be sure to compare offers from multiple lenders to find the best terms available to you.</p>

<p>Instead of feeling discouraged by a less-than-perfect credit profile, take proactive steps to improve it and explore all available options. By understanding the role of your credit score and taking steps to mitigate its impact, you can increase your chances of driving away in your new car.</p>

Choosing the Right Lender: Banks, Credit Unions, and Online Options

When you’re dealing with bad credit, finding the right lender to secure a car loan can feel like an uphill battle. The key is to know the strengths and weaknesses of different types of lenders—this will help you make an informed decision tailored to your specific needs.

Banks

Banks are often the first stop for many borrowers. They can offer stability and a wide array of services. However, traditional banks might not be the best option if you have bad credit, as they often have stringent credit score requirements.

- Pros: Established relationships, comprehensive services.

- Cons: Higher credit score requirements, less flexibility.

Credit Unions

Credit unions differ from banks in that they are member-owned. This means they often have more flexibility to work with borrowers who have less-than-perfect credit. If you’re already a member of a credit union, you might find more favorable loan terms here.

- Pros: Lower interest rates, flexible lending criteria.

- Cons: Membership required, limited branches.

Online Lenders

In the digital age, online lenders have become popular for their convenience and competitive rates. They often specialize in serving customers with bad credit. That said, the vast selection can be both a blessing and a curse. You’ll need to wade through varying terms and reviews to find the best fit for you.

- Pros: Easy application process, competitive rates.

- Cons: Variable reliability, sometimes higher fees.

Comparison of Lender Types

| Lender Type | Pros | Cons |

|---|---|---|

| Banks | Stability, comprehensive services | Strict credit requirements |

| Credit Unions | Lower rates, flexible criteria | Membership required |

| Online Lenders | Convenient, competitive rates | Variable reliability |

Making the Decision

Your choice will depend on various factors: your existing relationships, your ability to meet membership requirements, and the specific loan terms offered. Banks might suit those with steady financial histories, while credit unions could offer better alternatives for those who already have membership access. Online lenders will attract those who prioritize convenience and are adept at navigating the digital landscape.

Final Tips

Regardless of the lender you choose, always ensure you understand the full terms of any loan agreement. Look out for hidden fees, prepayment penalties, and varying interest rates. Comparing multiple offers will enable you to secure the best possible deal given your financial situation.

How to Improve Your Loan Eligibility: Practical Tips and Strategies

One of the most effective ways to enhance your eligibility for a car loan, even with bad credit, involves taking clear and actionable steps. Start by checking your credit report and making sure there are no errors that could be bringing your score down. Correct any discrepancies you find immediately; this can sometimes lead to a noticeable increase in your credit score.

Paying off small debts can also be a strategic move. If you have small balances on credit cards or other loans, paying them off can help improve your credit utilization ratio, which is a major factor in your overall credit score. Lowering this ratio tells lenders that you’re responsible with your borrowing limits.

Consider getting a co-signer for your car loan. A co-signer with a stronger credit profile can provide the lender with extra security that the loan will be repaid, potentially allowing you to qualify for a loan that you wouldn’t be eligible for alone. Make sure this person understands the responsibility, as they will be on the hook for payments if you default.

Shopping around can make a big difference. Different lenders have varying criteria. Traditional banks and credit unions might offer better rates for those with poor credit compared to high-interest subprime lenders. Look at multiple lending options to find the best terms possible, and don’t focus solely on interest rates; the overall loan terms matter just as much.

Saving for a larger down payment can improve your loan approval chances. A significant down payment reduces the lender’s risk because it shows you’re invested in the purchase and lowers the amount you need to borrow. Even saving just a few extra dollars each month can add up over time.

Being prepared to provide extra documentation can work in your favor. Lenders may need proof of income, employment history, and stability. Have your pay stubs, tax returns, and any other financial documents ready to present. This demonstrates your ability to repay a loan despite a low credit score.

Lastly, consider multiple offer scenarios. By getting pre-approval from various lenders, you can use those offers to negotiate better terms. Here’s a quick comparison for clarity:

| Lender | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| Credit Union | 5.8% | 60 months | $315 |

| Bank A | 6.5% | 60 months | $325 |

| Subprime Lender | 9.3% | 60 months | $355 |

Compare these details to make an informed decision that fits your budget while minimizing the financial impact of higher interest rates.

By following these tips and strategies, you empower yourself to improve your car loan eligibility, despite a less-than-perfect credit score. Persistence and careful planning are key to achieving favorable loan terms and driving away in the car you need.

Negotiating Loan Terms to Suit Your Financial Situation

When you’re dealing with bad credit, getting approved for a car loan can be a daunting process. However, negotiating loan terms effectively can help you secure a deal that aligns with your financial situation. Here are some strategies to consider:

Understand Your Credit Report and Score

Before diving into negotiations, it’s crucial to understand your credit report and score. Order a free copy of your credit report and review it for accuracy. Look for discrepancies and resolve any errors to potentially boost your credit score. Knowing your credit score gives you an edge during negotiations.

Explore Multiple Lenders

Don’t settle for the first loan offer that comes your way. Instead, shop around and explore multiple lenders, including banks, credit unions, and online lenders. Each lender has different criteria for assessing loan applications, and some may be more willing to work with you than others.

Consider Getting a Co-Signer

If your credit score is particularly low, consider asking a family member or friend with good credit to co-sign the loan. A co-signer can significantly improve your chances of getting approved and might also help you get better loan terms, such as a lower interest rate or reduced monthly payments.

Negotiate the Interest Rate

Interest rates can vary widely, especially for borrowers with bad credit. Don’t hesitate to negotiate the interest rate with your lender. Emphasize any positive changes in your financial situation, such as a recent job promotion or additional sources of income. Even a small reduction in your interest rate can save you a considerable amount of money over the life of the loan.

Adjust Loan Duration

The length of your loan term directly impacts your monthly payments and the total amount of interest you’ll pay. While a longer loan term can lower your monthly payments, it also increases the amount of interest paid over time. Discussing different term lengths with your lender can help you find a balance that works best for you.

Make a Larger Down Payment

A larger down payment can reduce the loan amount, potentially leading to better terms. If possible, save up to make a significant down payment. This could lower your monthly payments, reduce the interest rate, or even strengthen your bargaining position.

Compare Offers Using a Table

Creating a comparison table of different loan offers can help you see which one is the most beneficial. Here’s a simple example:

| Lender | Down Payment | Interest Rate | Monthly Payment | Loan Term |

|---|---|---|---|---|

| Bank A | $2,000 | 10% | $400 | 60 months |

| Credit Union B | $1,500 | 8.5% | $385 | 60 months |

| Online Lender C | $1,800 | 9.5% | $395 | 60 months |

Q&A

Q&A: How To Get A Car Loan With Bad Credit

Q: What does “bad credit” mean when trying to get a car loan?

A: “Bad credit” typically refers to a low credit score or a tarnished credit history often resulting from missed payments, defaults, or high outstanding debt. This can make lenders view you as a higher risk, potentially complicating your efforts to secure a car loan.

Q: Does having bad credit mean I can’t get a car loan at all?

A: Absolutely not! While a lower credit score can present challenges, it doesn’t block you entirely from the realm of auto financing. There are various lenders who specialize in offering loans to those with less-than-perfect credit. It might come with higher interest rates or stricter terms, but it’s possible.

Q: What steps should I take before applying for a car loan with bad credit?

A: Start by checking your credit report to understand your financial standing and ensure all details are accurate. Discrepancies should be disputed and corrected. Create a budget to determine how much you can realistically afford for car payments, and manage your expectations accordingly. Saving for a significant down payment can also improve your loan prospects.

Q: How important is the down payment for securing a car loan with bad credit?

A: A substantial down payment can significantly boost your chances. It reduces the lender’s risk by lowering the loan amount required and demonstrates your commitment and ability to save. Additionally, a higher down payment can help you secure more favorable loan terms.

Q: Should I consider getting a co-signer for my car loan?

A: Yes, if possible. A co-signer with good credit can strengthen your application and may help you secure better interest rates and terms. However, bear in mind that the co-signer is equally responsible for the loan, so it’s vital to maintain consistent payments to protect their credit as well as your own.

Q: Are there specific car dealerships known for working with bad credit?

A: Indeed, some dealerships specialize in financing for individuals with a challenging credit history. These “buy here, pay here” lots often provide in-house financing. While convenient, be especially cautious about the terms and conditions, as interest rates and fees can sometimes be higher than conventional loans.

Q: Can refinancing an existing car loan help if I have bad credit?

A: Refinancing an existing auto loan can be a strategic move if your credit has improved or if interest rates have dropped since you first took out your loan. It might lower your monthly payments or save you money on interest over the loan’s life. Always calculate the total cost to ensure refinancing benefits your financial situation.

Q: What are some common pitfalls to avoid when seeking a car loan with bad credit?

A: Watch out for excessively high-interest rates and hidden fees, common with some lenders targeting those with bad credit. Avoid overestimating your repayment capacity; it’s crucial to have a clear and realistic budget. avoid multiple credit inquiries in a short period, as too many can further damage your credit score.

Q: Are there alternative options to consider if traditional car loans are not feasible?

A: One alternative is leasing a car instead of purchasing it. While this won’t lead to ownership, leasing may offer lower monthly payments and upkeep costs. Another option is to explore peer-to-peer lending or credit unions, which might provide more flexible terms compared to traditional financial institutions.

Q: How can improving my credit score help with future car loans?

A: Improving your credit score can open doors to better loan terms, lower interest rates, and more favorable financing options. Consistently making all payments on time, reducing outstanding debt, and avoiding new credit inquiries will steadily improve your creditworthiness, easing future loan processes and saving money over time.

By taking systematic and informed steps, getting a car loan with bad credit can move from a daunting task to an achievable goal, paving the way to a brighter financial future.

Final Thoughts

As the dashboard lights illuminate the twilight and you navigate the winding roads of financial opportunity, remember that a less-than-perfect credit score doesn’t have to keep you parked indefinitely. From bolstering your application with a sturdy co-signer to exploring the diverse landscape of specialized lenders, the route to securing a car loan with bad credit is more accessible than you might have imagined. By equipping yourself with the right knowledge, driving toward a brighter financial horizon is well within your reach.

So, adjust your rear-view mirror, put the pedal to the metal, and let the journey to financial freedom and your dream car truly begin. After all, every mile traveled starts with a single turn of the key. Safe travels!