Finding the perfect home equity loan can feel like navigating a labyrinth, with options and terms that seem to twist and turn at every corner. August 2024 brings a fresh landscape of possibilities, making it the prime time to explore the best home equity loans available. Whether you’re planning a major renovation, consolidating debt, or simply looking to tap into the value nestled within your home’s walls, we’ve meticulously sifted through the myriad of choices to present you with the top nine contenders. In this guide, we unravel each option, showcasing rates, terms, and unique features to help you make an informed decision. Dive in as we uncover the 9 Best Home Equity Loans of August 2024!

Table of Contents

- Understanding Home Equity Loans: What You Need to Know

- Top Lenders and Their Unique Offerings

- Comparing Interest Rates and Loan Terms

- Expert Recommendations for Diverse Financial Needs

- To Conclude

Understanding Home Equity Loans: What You Need to Know

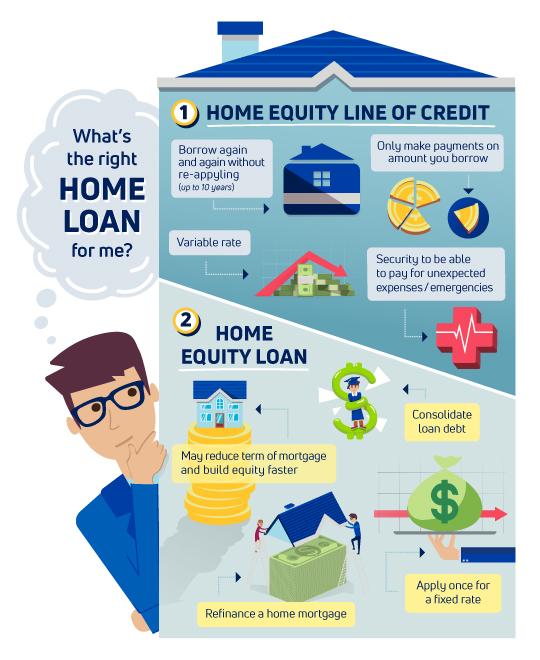

Home equity loans can be an excellent financial option for homeowners seeking to take advantage of the equity built up in their properties. To understand the intricacies and benefits of these loans, it’s important to delve into how they function, what the qualification criteria are, and weigh the pros and cons.

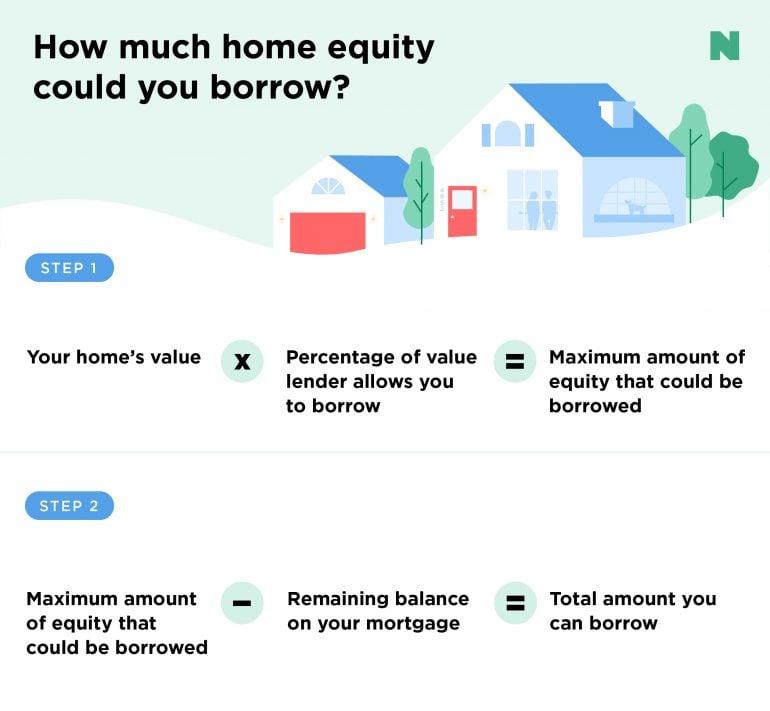

Home equity loans work by allowing you to borrow against the value of your home. Essentially, the loan amount is determined by assessing your home's appraised value, subtracting what you owe on your mortgage, and using the remainder as collateral. The process involves getting an appraisal, completing loan paperwork, and sometimes even paying for origination fees and closing costs.

Benefits of Home Equity Loans:

- Fixed Interest Rates: One of the main advantages is that these loans often come with fixed interest rates, providing predictability in your repayment schedule.

- Lump Sum Payout: Borrowers receive the loan amount in a single lump sum, which can be beneficial for large expenses like home renovations or debt consolidation.

- Tax Deductible Interest: In some cases, the interest paid on a home equity loan may be tax-deductible.

Drawbacks to Consider:

- Risk of Foreclosure: Since your home is used as collateral, failing to repay the loan can lead to foreclosure.

- Closing Costs: These can range from 2-5% of the loan amount, adding a substantial cost to borrowing.

- Impact on Credit Score: Borrowing a significant amount may negatively impact your credit score if not managed properly.

Eligibility for a home equity loan generally includes having at least 15-20% equity in your home, a good credit score (typically 620 or higher), and a reliable income source. Lenders will also scrutinize your debt-to-income ratio to ensure you can manage additional debt.

<table class="wp-block-table">

<thead>

<tr>

<th>Loan Features</th>

<th>Details</th>

</tr>

</thead>

<tbody>

<tr>

<td>Loan Term</td>

<td>5-30 years</td>

</tr>

<tr>

<td>Interest Type</td>

<td>Fixed</td>

</tr>

<tr>

<td>Loan Amount</td>

<td>Up to 85% of home’s equity</td>

</tr>

<tr>

<td>Origination Fees</td>

<td>2-5%</td>

</tr>

</tbody>

</table>

If you're considering such a loan, there are a few steps you can take to prepare:

- Appraisal Preparation: Simple home improvements can help boost your home's value.

- Check Your Credit Report: Ensure there are no errors or outstanding debts impacting your score.

- Budgeting: Understand how the loan repayments will fit into your monthly budget.

The loan application process often involves submitting documents such as proof of income, tax returns, mortgage statements, and a list of assets and liabilities. Lenders may also require an appraisal of your property to accurately determine its market value.

Ultimately, home equity loans can serve as a powerful financial tool for homeowners, enabling them to leverage their homes for significant expenses or investments. However, it's crucial to thoroughly understand the terms and risks involved to make an informed decision.

Top Lenders and Their Unique Offerings

When it comes to selecting the best home equity loans, multiple lenders stand out for their unique offerings and customer-oriented services. Here’s a comprehensive look into some of the top lenders and what sets them apart.

Quicken Loans boasts a user-friendly digital platform that ensures a swift application process. Their competitive rates and flexible terms make them a favorite among tech-savvy borrowers. They offer the convenience of an all-online application, allowing users to track their loan status in real-time.

A household name in banking, Wells Fargo offers traditional yet robust home equity loans. Their strong presence in local communities, combined with personalized customer service, is unmatched. With Wells Fargo, borrowers can enjoy a variety of term options and competitive interest rates, making it a versatile choice for many.

Discover is another stellar option, perfect for those looking to consolidate debt. They offer loans with no application or origination fees and feature straightforward fixed rates. Discover’s customer support is highly ranked for its responsiveness and reliability.

If flexibility is high on your list, consider Bank of America. They stand out with their flexible payment terms and low introductory rates. Additionally, existing customers might benefit from rate discounts, making it an appealing choice for loyal patrons.

Third Federal Savings & Loan emphasizes stability and security. Known for their fixed-rate options, they provide peace of mind in knowing your payment amounts won’t change. They’re also praised for their transparency and lack of hidden fees.

- Regions Bank shines with its comprehensive suite of financial products. They offer both fixed and variable rate home equity loans, and their extensive branch network makes in-person consultations convenient.

- PenFed Credit Union is ideal for military members and their families, offering competitive rates and low fees. Their commitment to serving the community can translate to more personalized loan options.

Citibank provides exclusive offers for its valued customers. With attractive rates for existing account holders and streamlined online services, Citibank combines tradition and technology effectively. Their promotional rates are worth checking out for significant savings.

Navy Federal Credit Union stands tall for military communities needing home equity loans. They offer unique loan structures that cater to members’ specific needs, including lower rates and fewer fees than many competitors.

| Lender | Unique Offering |

|---|---|

| Quicken Loans | All-online application process |

| Wells Fargo | Personalized customer service |

| Discover | No application/origination fees |

| Bank of America | Flexible payment terms |

| Third Federal S&L | Transparency and fixed rates |

Comparing Interest Rates and Loan Terms

When selecting a home equity loan, two critical aspects to consider are interest rates and loan terms. These factors can significantly impact the overall cost of your loan and its affordability over time. Here’s an in-depth look at how these elements compare across different lenders and products available in August 2024.

The interest rate on your home equity loan determines how much you’ll pay in interest over the life of the loan. These rates can vary widely among lenders and can be fixed or variable. Fixed rates provide predictability with a constant rate throughout the loan term. Conversely, variable rates may start lower but can fluctuate based on market conditions, potentially rising over time.

- Fixed Rates: Ideal for borrowers who prefer steady, predictable payments.

- Variable Rates: Beneficial for those who expect interest rates to remain stable or decrease.

The loan term is another crucial factor, referring to the length of time over which you’ll repay the loan. Loan terms for home equity loans typically range from 5 to 30 years. Shorter terms usually result in higher monthly payments but lower overall interest costs. Longer terms, while easier on your monthly budget, can cost more in interest over time.

| Lender | Fixed Rate (APR) | Variable Rate (APR) | Minimum Loan Term | Maximum Loan Term |

|---|---|---|---|---|

| Bank A | 5.25% | 4.50% | 5 years | 20 years |

| Lender B | 5.50% | 4.75% | 10 years | 25 years |

| Credit Union C | 5.00% | 4.25% | 7 years | 30 years |

Shorter loan terms equate to higher monthly payments but result in lower interest costs over the loan’s lifetime. For instance, a 10-year loan at a 5.25% fixed rate will be paid off more quickly and cost less in total interest than a 20-year loan at the same rate. However, the monthly payments for the shorter-term loan will be significantly higher.

- Short-Term Loans: Ideal for those who can manage higher monthly payments and want to minimize total interest paid.

- Long-Term Loans: Suitable for those who need lower monthly payments but are willing to pay more in interest over time.

When , it’s important to consider your financial goals and budget. A low interest rate is appealing, but it must align with your ability to make monthly payments without straining your finances. Carefully assess your situation to select the loan term that fits your long-term financial plan.

In addition to the interest rate and loan term, consider any additional fees or costs associated with the loan, such as origination fees, closing costs, and prepayment penalties. These can affect the total cost of your loan and should be factored into your decision-making process.

Ultimately, the best home equity loan for you will strike a balance between a favorable interest rate, a manageable loan term, and terms that fit within your financial strategy. By carefully comparing these elements, you can find a loan that meets your needs and helps you achieve your financial goals.

Expert Recommendations for Diverse Financial Needs

In the quest to find the best home equity loan to suit your distinct financial needs, these expert recommendations are your guiding light. Navigating through diverse options, we’ll ensure you find the perfect match for your financial ambitions, whether it be home improvement, debt consolidation, or unexpected expenses.

1. Flexible Repayment Options: Versatile loan terms allow you to pick repayment plans that fit seamlessly with your budget. Several lenders offer adjustable plans, making it easier to balance other financial commitments.

- Customizable loan periods

- Variable and fixed interest rates

- Potential to reduce monthly payments

2. Competitive Rates: Scouring the market for the lowest APR can make a significant difference on the total cost of your loan. Many top lenders offer competitive rates which directly impact your saving potential over the loan’s lifespan.

| Lender | APR Range | Min. Loan Amount |

|---|---|---|

| LoanMart Solutions | 2.5% – 4.0% | $10,000 |

| EquiHome Loans | 3.1% – 5.2% | $5,000 |

3. Streamlined Application Process: For the busy individual, a user-friendly application process is paramount. Certain lenders excel in providing digital tools and resources to simplify every step, from online applications to instant approvals.

- Intuitive interface

- Real-time loan tracking

- Quick response times

4. Customer Support Excellence: Personalized customer service can vastly improve the lending experience. Seek lenders known for their strong support teams, ready to assist with any questions or concerns.

5. No Hidden Fees: Transparent fee structures help avoid surprise costs. Top lenders detail any origination fees, maintenance costs, or closing costs upfront.

Consider these factors to find a home equity loan that not only fits your current needs but also adapts to any unexpected changes in your financial landscape. Diverse needs require tailored solutions, and these expert recommendations provide the insights you need to make a well-informed decision.

To Conclude

As we turn the page on our exploration of the 9 Best Home Equity Loans of August 2024, it becomes evident that unlocking the hidden potential in your home’s value is more accessible than ever. Whether you’re looking to fund a dream project, consolidate debt, or navigate life’s unpredictable patches, the right home equity loan can be a steadfast ally.

Remember, the finest loan is the one that fits your personal narrative. Dive into the details, weigh the rates, and scrutinize the terms—we’ve merely illuminated your path. Just as your home is a cornerstone of stability and comfort, so too should be your financial decisions. As you move forward, may your choices reflect not just the data we’ve laid out, but the unique rhythms and aspirations of your own life’s journey.

Happy borrowing, and may your home equity empower you to bring your visions to life.