In the ever-shifting landscape of personal finance, managing debt can feel like navigating a dense forest without a map. For those with less-than-stellar credit, options may seem limited and paths forward unclear. But what if there was a way to bundle those debts into one manageable payment, reducing stress and potentially saving money? As we dive into August 2024, we’ve scoured the financial terrain to spotlight the 10 best debt consolidation loans specifically designed for those with bad credit. Whether you’re seeking to untangle financial snares or simply aiming to streamline your obligations, this guide offers a beacon of hope and clarity in your journey towards financial freedom.

Table of Contents

- Understanding Debt Consolidation Loans and Bad Credit

- Evaluating Your Options: Criteria for the Best Loans

- Top Lenders Offering Debt Consolidation Loans in August 2024

- Key Features and Benefits: What Sets These Loans Apart

- Concluding Remarks

Understanding Debt Consolidation Loans and Bad Credit

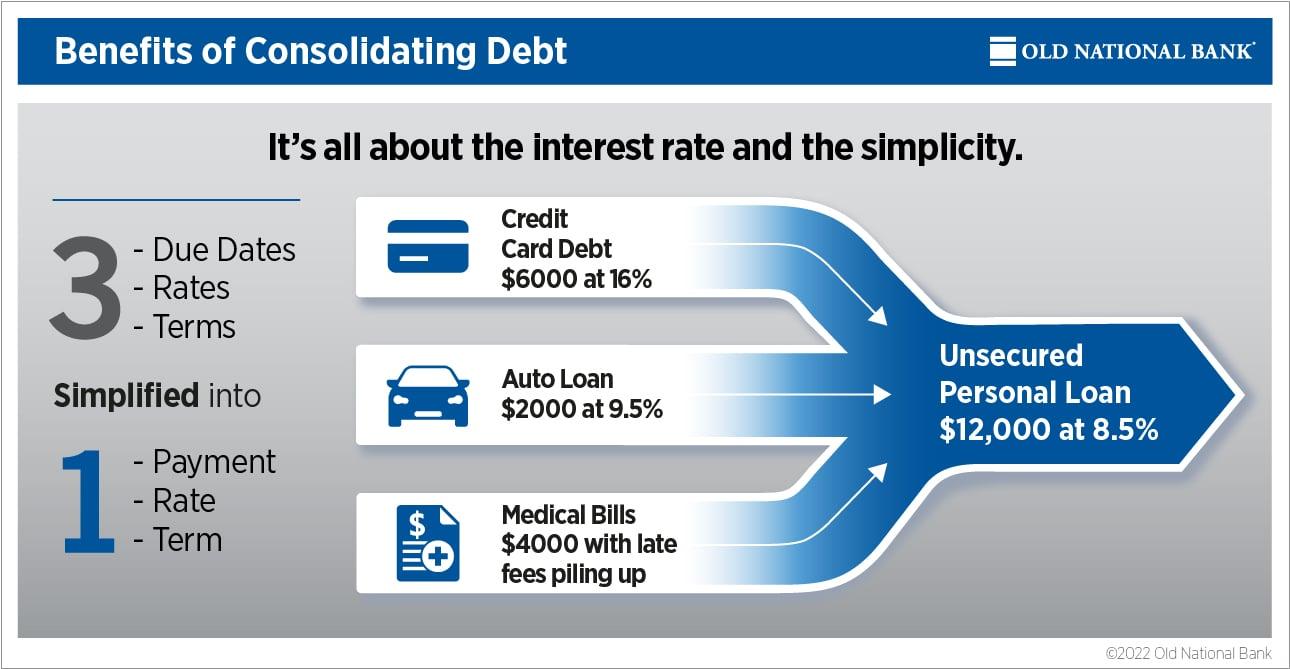

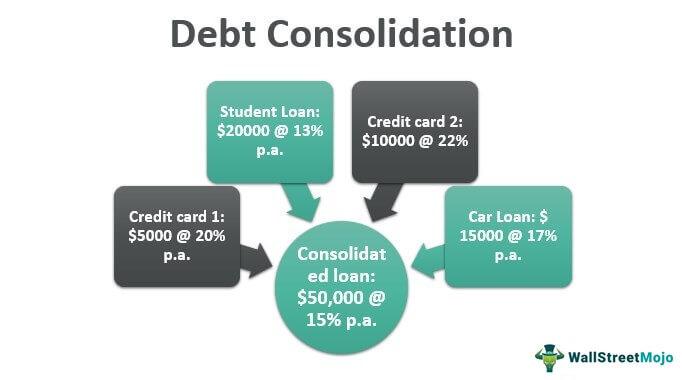

Negotiating financial hurdles can be particularly tough when bad credit is involved. Yet, debt consolidation loans might just offer the lifeline needed to regain control over your finances. Such loans enable you to combine multiple debts into one single loan with a potentially lower interest rate. For those grappling with less-than-stellar credit scores, finding the right loan option can seem daunting.

Financial institutions consider applicants with poor credit as high-risk, which typically results in elevated interest rates and stringent terms. Nevertheless, there exist options tailored to facilitate the needs of such borrowers. By choosing wisely, you can reduce your monthly payments and simplify your financial life.

Benefits of Debt Consolidation Loans:

- Streamlines multiple payments into one monthly installment.

- May offer lower interest rates compared to your existing debts.

- Reduces the chances of missed or late payments.

- Can improve your credit score over time if managed effectively.

However, securing a debt consolidation loan with poor credit demands thorough research and understanding of several factors, including interest rates, terms, and associated fees. It’s essential to evaluate each loan option meticulously.

Things to Consider:

- Interest Rates: Fixed vs. variable.

- Loan Terms: Duration and flexibility.

- Fees: Origination fees, prepayment penalties, etc.

- Repayment Plan: Monthly payments and affordability.

For quick reference, here’s a comparative table of the Top 3 Debt Consolidation Loans for Bad Credit in August 2024:

| Loan Provider | APR Range | Loan Term | Key Feature |

|---|---|---|---|

| Lender A | 5.99% - 24.99% | 24-60 months | No prepayment fee |

| Lender B | 6.49% – 29.99% | 36-72 months | Flexible terms |

| Lender C | 7.50% – 32.00% | 12-48 months | Quick approval |

Some lenders also offer personalized customer service to assist during the application process, making it easier to navigate options and choose the best fit. Don’t hesitate to reach out for help if needed.

Remember, opting for a debt consolidation loan signifies a commitment to improving your financial health. Ensure you read the fine print and ask relevant questions to avoid any surprises.

By exploring the best offers available in August 2024, you can find a debt consolidation loan that aligns with your financial situation and goals. Reclaiming financial stability is challenging, but these tailored loan options can pave the way to a more secure future.

Evaluating Your Options: Criteria for the Best Loans

When faced with multiple high-interest debts, choosing the right debt consolidation loan can be a critical step towards financial stability. Here are some essential criteria to consider when evaluating your options for the best loans:

Interest Rates

The interest rate is a major factor that can significantly impact the total cost of your loan. Aim to find a loan with the lowest possible interest rate. Remember, even a small percentage difference can save you a considerable amount over the loan’s term.

Payment Terms

Different loans come with varied repayment schedules. Check for loans offering flexible terms that align with your financial capability. A longer term might mean lower monthly payments but higher overall interest. Conversely, a shorter term can lead to higher monthly payments, but you’ll pay less interest in the long run.

Credit Requirements

Providers vary in their credit score requirements. While some loans are designed specifically for those with bad credit, they might come with higher interest rates. Look for lenders offering affordable rates to borrowers with less than stellar credit scores.

Fees and Penalties

Consolidation loans can come with several fees, such as origination fees, prepayment penalties, or late payment fees. Ensure you read the fine print and understand any associated costs. Some lenders might waive certain fees, which can be a significant saving.

Customer Service

Excellent customer service is essential, especially if you’re dealing with consolidation loans over a longer term. Look for lenders with positive reviews and a reputation for helping customers navigate any issues.

Loan Amount

Make sure the loan amount is sufficient to cover all your outstanding debts. Some lenders might have minimum or maximum loan amounts. It’s important to choose a loan that fits your needs precisely.

Approval Time

In urgent situations, the speed of loan approval and fund disbursement can be critical. Some lenders offer quick approval processes with funds available within a few days.

| Lender | Interest Rate | Loan Term | Fee Structure |

|---|---|---|---|

| Lender A | 6.99% – 24.99% | 12-60 months | No origination fee |

| Lender B | 10.45% – 27.89% | 24-72 months | 1% origination, no prepayment penalty |

Consolidating your debt can be a strategic move towards financial freedom. By carefully considering these criteria, you can select a loan that not only helps manage your debts effectively but also fits seamlessly into your financial plan.

Top Lenders Offering Debt Consolidation Loans in August 2024

Finding the right lender can be a game-changer when you’re grappling with less-than-perfect credit. In August 2024, several top lenders are making waves by offering debt consolidation loans specifically tailored for individuals with bad credit. These lenders are not only providing competitive interest rates but also excellent customer service and flexible repayment terms.

Lender A has positioned itself as a leader in the market, offering borrowers with bad credit debt consolidation loans with APRs starting as low as 5.99%. The application process is straightforward, and pre-qualification checks do not impact your credit score.

- Minimum Credit Score: 580

- Loan Amounts: $1,000 - $50,000

- Repayment Terms: 3 to 7 years

- Perks: No prepayment penalties

Lender B stands out due to its personalized approach. They take into account various factors beyond just your credit score, such as your employment history and income stability.

- Minimum Credit Score: 560

- Loan Amounts: $2,500 – $40,000

- Repayment Terms: 2 to 6 years

- Perks: Free financial counseling

For those who prefer a completely online experience, Lender C offers a streamlined digital application process. Their competitive rates and user-friendly interface make them a solid choice.

- Minimum Credit Score: 600

- Loan Amounts: $1,000 – $35,000

- Repayment Terms: 3 to 5 years

- Perks: Quick approval and funding

To give you a clearer comparison, here is a table showcasing a few key loan features from these top lenders:

| Lender | Interest Rate | Loan Amounts | Repayment Terms |

|---|---|---|---|

| Lender A | 5.99% – 21.99% | $1,000 – $50,000 | 3 to 7 years |

| Lender B | 6.99% – 24.99% | $2,500 – $40,000 | 2 to 6 years |

| Lender C | 6.49% – 22.99% | $1,000 – $35,000 | 3 to 5 years |

Lender D is known for its exceptional customer service and flexible repayment schedules. They are a fantastic option for those needing personalized solutions to their debt issues.

- Minimum Credit Score: 580

- Loan Amounts: $5,000 – $50,000

- Repayment Terms: 2 to 7 years

- Perks: Personalized repayment plans

Lender E caters specifically to those with poor credit, requiring a minimum score of 550. They boast a hassle-free application method and a quick turnaround for loan disbursal.

- Minimum Credit Score: 550

- Loan Amounts: $1,500 – $30,000

- Repayment Terms: 1 to 5 years

- Perks: Quick disbursal

With such a variety of lenders and loan options available, borrowers with bad credit can find a debt consolidation loan that meets their needs. By considering factors such as interest rates, loan amounts, and repayment terms, individuals can make informed decisions and take steps towards financial stability.

Key Features and Benefits: What Sets These Loans Apart

When exploring debt consolidation loans designed for individuals with bad credit, it’s essential to understand the unique features and benefits that can set certain loans apart from the rest. Below, we delve into key aspects that make these loans distinctive and advantageous.

Competitive Interest Rates

Even with a less-than-stellar credit score, some lenders offer competitive interest rates that can significantly reduce your overall debt burden. These rates are often better than those on credit cards, helping you save money in the long run.

Flexible Repayment Terms

Debt consolidation loans typically come with flexible repayment terms, ranging from a few months to several years. This flexibility allows you to choose a timeline that fits your financial situation, ensuring that monthly payments are manageable.

Simple Application Process

Many lenders offer a streamlined application process, often allowing you to complete the entire procedure online. Quick approval times mean you can consolidate your debts and start your journey toward financial stability without unnecessary delays.

No Prepayment Penalties

Loans with no prepayment penalties give you the freedom to pay off your loan ahead of schedule without incurring additional fees. This feature is particularly beneficial for those who anticipate an improvement in their financial situation and wish to pay off their debt sooner.

Boosting Credit Scores

Consolidating high-interest debts into a single loan can positively impact your credit score. By consistently making on-time payments, you demonstrate reliability to credit bureaus, which can enhance your credit profile over time.

Customer Support and Financial Education

Many lenders provide robust customer support and additional resources aimed at financial education. Access to financial counseling, budgeting tools, and webinars can empower you to manage your finances more effectively.

Transparency and Trust

Lenders that prioritize transparency offer clear terms and conditions without hidden fees. Building trust is key, and knowing exactly what to expect can bring peace of mind as you work to consolidate and manage your debts.

| Lender | Interest Rate | Loan Term | Key Benefit |

|---|---|---|---|

| Finance Guru | 5.99% – 17.99% | 12 – 60 months | No Origination Fees |

| DebtBusters | 6.50% – 19.50% | 24 - 84 months | Free Financial Counseling |

| Wealthease | 7.00% – 20.00% | 12 – 72 months | Low Credit Acceptance |

Concluding Remarks

As we wrap up our exploration of the 10 best debt consolidation loans for bad credit in August 2024, it’s clear that financial recovery is within reach, even for those with less-than-perfect credit. Each option we’ve reviewed offers unique benefits, tailored to meet diverse needs and circumstances. Whether you’re seeking lower interest rates, more manageable payments, or a path to rebuild your credit score, there’s a solution waiting to be found.

Remember, taking the first step towards consolidating your debt is a brave and commendable move. By carefully considering your options and choosing a loan that aligns with your financial goals, you set the stage for a more secure and stress-free future. Keep informed, stay proactive, and let this guide be your companion on the journey to financial freedom.

Here’s to making August 2024 the month you reclaim control over your finances and build a brighter tomorrow.